Paying with a smartphone is easier than ever. Innovative mobile payment apps are providing consumers with new ways to exchange money with peers, purchase products, use alternative currencies, manage expenditures, earn rewards, and more.

Here is a list of innovative mobile payment apps. There are digital wallets, mobile commerce apps, cryptocurrency apps, and peer-to-peer payment platforms.

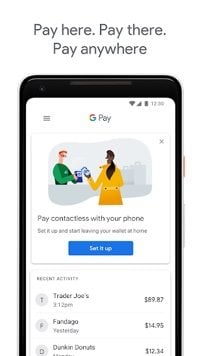

Google Pay

Google Pay is a fast and simple way to pay online and in physical stores. With Google Pay, check out in hundreds of apps without having to enter your payment information. Google Pay Send, a peer-to-peer feature included inside Google Pay, has replaced the Google Wallet service. With Google Pay Send, pay anyone with an email address or phone number. When you pay in stores, Google Pay shares an encrypted number (instead of your card details) with the merchant.

—

Cash App

From Square, Cash App is an easy way to exchange, send, request, and receive money. Every time you receive a payment, either keep the funds in your balance to withdraw or to spend with your Cash Card, or initiate a deposit to your linked bank account. Sending money costs nothing. With Cash Boost, pick a place or category and get instant cash back every time you use your Cash Card. Buy and sell Bitcoin from the app in seconds. Cash isn’t currently available outside of the U.S.

—

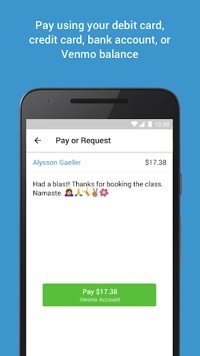

Venmo

A service of PayPal, Venmo is a simple, fun app for sending money quickly between friends and shopping at your favorite online stores. Pay friends and family with a Venmo account using money you have in Venmo, or link your bank account or debit card quickly. Add notes to your payments using your favorite emojis, and like or comment on friends’ stories. Easily track your finances. It’s free to send money using your Venmo balance, bank account, debit card, or prepaid card. A 3 percent fee applies to credit cards.

—

Facebook Messenger

Facebook Messenger has expanded well beyond the original messaging app. Send or receive money in Messenger after you add a bank-issued debit card or PayPal account to your account and install the latest version of Messenger. Once you add your payment information, you can create a PIN to provide extra security the next time you send money. To request money from someone in Messenger, open a chat and click the dollar icon.

—

Jaxx

Jaxx is a cryptocurrency wallet available for download on eight platforms. Use Jaxx to hold, control, and trade a variety of blockchain-based cryptocurrencies, including Bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic, Litecoin, Dash, and Zcash. It has free customer support.

—

Zelle

Zelle is a new way to send money to almost any U.S. bank account within minutes. With just an email address or mobile phone number, you can quickly and safely send and receive money with more people, regardless of where they bank. Access the Zelle app to send and receive money, or use Zelle through your bank or credit union. Money sent with Zelle is typically available to an enrolled recipient within minutes.

—

LevelUp

LevelUp gives you the power to order in advance your coffee, lunch, afternoon snack, breakfast, and dinner with a single tap and have it ready when you get there. Most orders are ready in 7 to 15 minutes. LevelUp lets you know when it’s going to be ready and where to grab it in-store. When you arrive, no need to wait in line. Your food is paid for and ready for you. Just grab your items from the pickup area.

—

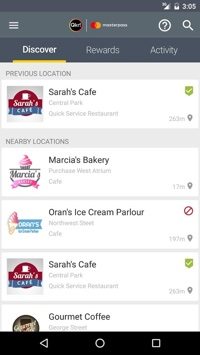

Qkr

Use Qkr with Masterpass to order and pay for food and drinks, split the bill, or make school payments. The Qkr with Masterpass app is free, easy to use, and available in thousands of locations. Discover Qkr with Masterpass merchants in nearby locations. Split bills, add to your order from within the app, and pre-order and pay for food and drinks and collect from the dedicated Qkr collection point. Qkr uses Masterpass, Mastercard’s secure digital wallet solution that accepts Mastercard, Visa, American Express, and Discover Cards.

—

Skrill

Use the Skrill app to send money to friends and relatives, pay and play online, or make quick and easy international payments to merchants. Store your credit and debit cards and bank details securely. Spend funds instantly while keeping your financial details private. Send or receive money in 40 currencies across 200 countries. Each month, enjoy new merchant offers, deals, and bonuses.

—

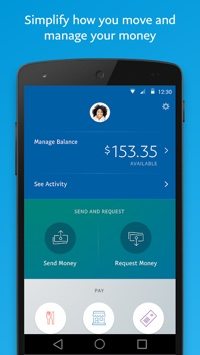

PayPal

Send money to anyone with a PayPal account across the globe. All you need is recipients’ email address or mobile phone number. They can quickly use the money online or withdraw it with a few taps. Manage how you send, spend, and receive at a glance in the mobile wallet.

—

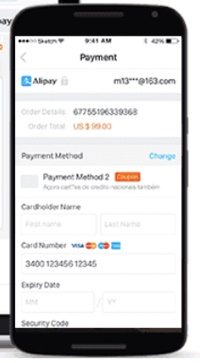

Alipay

Developed by Alibaba and its co-founder Jack Ma, Alipay is the world largest mobile payment platform with over 100 million daily transactions and over 520 million active users. Its digital wallet, Alipay Wallet, includes a mobile app that allows consumers to conduct transactions directly from their mobile devices. It is available in 70 markets and has been adopted by over 80,000 retail stores worldwide.

—

Apple Pay Cash

Store Apple Pay Cash and your credit and debit card details in the Wallet app along with boarding passes, tickets, rewards cards, and more. Apple Pay works with most credit and debit cards from nearly all U.S. banks. When you receive money it’s added to your Apple Pay Cash card that lives in the Wallet app. Start using the cash right away to make purchases using Apple Pay in physical stores, in apps, and on the web. You can also transfer your Apple Pay Cash balance to your bank account.

—