The much-anticipated Alibaba IPO closed last Friday with shares initially priced at $68. Once trading got under way, the price of a share rose to $93. Demand was so strong the offering price was revised upwards ten times. What helped Alibaba come out so strongly is the fact that it is a profitable company, unlike many of the tech companies that have become public over the past few years. In the fiscal year ending March 31, 2014 Alibaba had net income from operation of $4.1 billion.

Alibaba’s IPO attracted $21.8 billion, surpassing the $17.8 billion raised by credit card marketer Visa in its 2008 IPO and Facebook’s $16 billion in 2012. On Friday the company was valued at $225 billion, surpassing Facebook at $200 billion, and technology giants IBM at $193 billion and Oracle at $185 billion.

Lack of Independent Directors?

Most investors ignored the warnings of some financial analysts who believe there are serious risks tied to Alibaba, mostly over the paucity of independent directors. Instead, decision-making will be concentrated in the hands of a partnership of 28 individuals. That group will have the right to name a majority of the company’s directors. While analysts criticized Alibaba for this, the company has not adopted the dual share class structure that Google and Facebook embraced, which gives insiders Class B shares that entitles them to 10 votes per share versus the Class A one vote per share. (See “How Does Facebook Make Money,” a previous article, for more.) The leadership of Facebook and Google, in other words, maintain the same stranglehold on decision-making as the management of Alibaba.

While Alibaba chose to list on the New York Stock Exchange rather than the Hong Kong Exchange, it has limited operations in the U.S. market. One of the reasons for the choice is that the Hong Kong Exchange demands that all shareholders get only one vote per share.

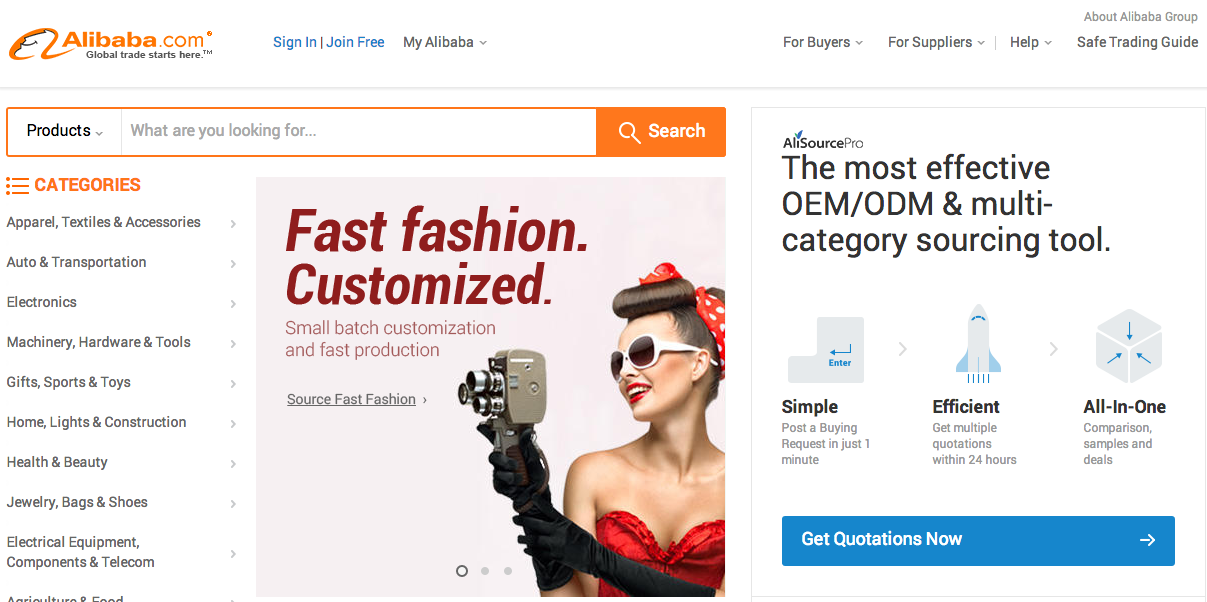

The company’s main focus going forward likely will be providing a marketplace for foreign ecommerce merchants and brands to sell to the rapidly expanding Chinese online market. It is, however, taking cautious first steps in entering the American market, going up against eBay as a first step. Earlier this year, Alibaba invested in a Silicon Valley start-up named 11 Main that went live in June. 11 Main is a more upscale version of eBay that is trying to attract a younger, more affluent customer. It also offers ecommerce merchants more favorable terms than eBay, charging a 3.5 percent commission versus eBay’s 10 percent. 11 Main solicits merchants by invitation only, focusing on specialty shops, boutiques and one-of-a-kind items.

Scot Wingo, CEO of ChannelAdvisor, an ecommerce solutions provider, points out that Alibaba opened a business development office in Silicon Valley in 2013 and is looking for more technology companies to invest in.

Alibaba had already taken on eBay in China, when it introduced Taobao in 2003. eBay operated in China with a Chinese partner, EachNet. By offering its services for free, Alibaba forced eBay out of the Chinese market in two years.

Challenge to Amazon?

Alibaba is the only ecommerce player that could challenge Amazon for supremacy in the third-party marketplace arena. Many merchants who sell products via Amazon are unhappy with some of the changes and increased fees that Amazon has imposed over the past few years and would welcome a competing marketplace. However, many analysts believe that because the growth potential in China is still enormous, the company will focus on that market for the foreseeable future. Interestingly, Alibaba’s percentage of international (outside of China) sales has actually dropped over the past few years because growth in China has been so explosive. Alibaba has 80 percent of the ecommerce market in China.

Alibaba already sells to consumers around the world via AliExpress, which lets manufacturers sell directly to consumers. It now contributes ten percent to company revenues but is growing rapidly. As I noted in a previous article, Alibaba is purchasing stakes in ecommerce companies such as ShopRunner as well as mobile technology companies, to improve the shopping experience in China.

Jack Ma, Alibaba’s founder and CEO, is committed to “helping the little guy,” according to Wingo. Alibaba is “merchant friendly and offer lots of tools for small merchants.”

While it may take awhile for Alibaba to expand in the U.S., it will play a leading role in cross border commerce. Chinese merchants are eager to sell their goods globally and Chinese consumers want better quality western goods. Alibaba’s sheer size and rapid growth will make it one of the most watched companies for years to come.