2016 was a tough year for initial public offerings of venture-capital-backed ecommerce companies. However, it was a year of notable acquisitions of ecommerce companies by large retail chains and consumer product providers. Getting acquired has always been a primary exit strategy for ecommerce companies that have received funding from outside investors.

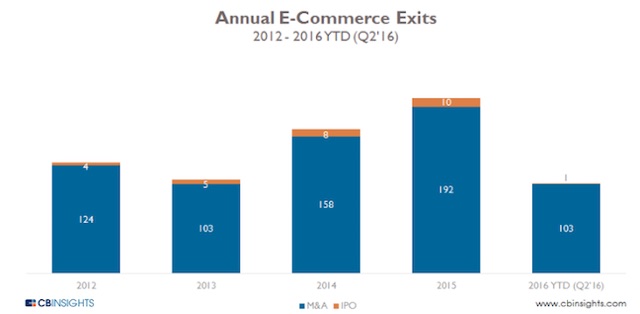

In 2015, ecommerce exits from companies that received venture capital funding reached their highest point ever with 192 acquisition deals and 10 IPOs, according to research firm CB Insights. However, acquisitions in 2016 will likely exceed 2015, as CB Insights reported 103 acquisitions through Q2 2016, for an annual run rate of 206.

Initial public offerings for venture-capital-backed ecommerce companies slowed in 2016, according to CB Insights, with just one IPO through Q2 2016. However, acquisitions in 2016 likely will reach their highest. Prior year acquisitions and IPOs of venture-capital-backed ecommerce companies were, respectively, 192 and 10 for 2015; 158 and 8 for 2014; 103 and 5 for 2013, and 124 and 4 for 2012.

The most notable acquisition this year involved Walmart buying Jet.com in August tor $3.3 billion in cash and stock. See “In Acquiring Jet, Wal-Mart Seeks Younger, Higher-income Consumers.” The other big acquisition involved Dutch consumer products giant Unilever purchasing Dollar Shave Club for $1 billion in July 2016. Dollar Shave Club’s acquisition is the fourth largest ecommerce acquisition since 2009, according to CB Insights. The five-year-old start-up sells razors and other personal products for men. The company raised $160 million in venture capital and has more than 3 million subscribers.

Sell Directly to Consumers?

The four largest consumer-package-goods companies are, in order: Nestle´, Proctor & Gamble, PepsiCo, and Unilever. None have been very interested in ecommerce. The Dollar Shave Club acquisition and the increasing number of CPG brands being sold by Amazon.com, Jet.com, and Boxed.com could change that. The big CPG companies, which are experiencing less than two percent annual revenue growth, may be able to increase sales by selling directly to consumers online.

Products that are relatively inexpensive and need to be replenished frequently such as toothpaste and razor blades, are perfect for online ordering and subscription services. Some CPG companies may simply establish their own websites, but acquiring an existing online business with millions of loyal customers may be a smarter approach.

Access to Ecommerce Expertise

Successful brick-and-mortar retailers want brands that have proven themselves on the Internet. For example, upscale retailer Nordstrom bought Trunk Club in 2014, and in 2011 acquired flash sale site Hautelook. Both sites offer luxury clothing and Trunk Club offers personal online shoppers for its customers. This is a good fit with Nordstrom’s personalized in-store shopping experience.

Several large brick-and-mortar stores have had difficulty gaining traction online even with practically unlimited resources and sophisticated distribution networks. Acquisitions give them immediate access to online expertise and a customer base.

Walmart.com, for instance, struggled to pull in consumers. Purchasing Jet.com gave Walmart more potential SKUs as well as younger, more affluent consumers who feel comfortable buying online. As for expertise, Jet C.E.O. Marc Lore will run Walmart.com as well as Jet, and has agreed to remain at the helm for at least five years. Jet, which wanted to compete with Amazon, was running short of funds for expansion and Walmart’s coffers can certainly help Jet grow.

Fire Sale Acquisitions

Some ecommerce companies put themselves up for sale — sometimes at bargain prices — because growth has stalled and they cannot attract more venture capital funding. One example is luxury flash sale merchant Gilt Groupe, which had received $284 million in VC funding but was acquired by Hudson Bay Company for only $250 million. At one time Gilt had a valuation of $1 billion.

One Kings Lane, a purveyor of high-end home décor, was once valued at over $900 million, but sold to Bed Bath & Beyond in June for just $11.8 million. In November, Bed Bath & Beyond bought another online company, Personalizationmall.com, which sells personalized items such as mugs, doormats, and Christmas stockings. Bed Bath & Beyond paid $190 million for the company. Bed Bath & Beyond has been experiencing declining profits and is looking for ways to gain more online customers to generate greater revenue.

What to Expect in 2017

It’s likely that more ecommerce companies will exit via acquisition in 2017 because the venture capital community is looking to other industries for investments. Also, brick-and-mortar companies that want to scale their omnichannel sales can do so more quickly by buying a successful ecommerce company, even if that company has stopped growing.

Globally, ecommerce acquisitions will pick up in Southeast Asia and India. Alibaba is reportedly looking at buying large Indian online retailers as well as smaller Chinese companies. In April, Alibaba paid $1 billion to acquire Lazada, a Thailand-based ecommerce retailer.

The IPO market for ecommerce will likely continue to be tough, especially for U.S. companies.