Thinking about taking your company public? After you get through all the paperwork you will have to decide at which stock exchange you want to list your company. Each publicly traded company may trade shares on only one domestic stock exchange. Substantive differences exist among the exchanges and the following discussion should help you make a decision.

The primary function of a stock exchange is to provide liquidity; it is a mechanism to buy and sell shares. Stocks become available on an exchange after a company completes its initial public offering (IPO). In an IPO, a company sells shares to an initial set of public shareholders who represent the primary market. After the IPO “floats” shares into the hands of public shareholders, these shares can be sold and purchased on a stock exchange, the secondary market.

The larger the exchange, the greater the secondary activity, so one criterion to consider is the size. Exchanges have their own standards and many companies cannot meet them. Less selective niche exchanges provide for those companies that cannot meet stricter requirements.

American Stock Exchange (Amex)

Like other companies, stock exchanges can be bought, sold, and merged. The American Stock Exchange (Amex), once the third largest in the U.S., was bought by NYSE Euronext in 2008 and re-branded as the NYSE Amex Equities. It is a subsidiary of the New York Stock Exchange.

London Stock Exchange (LSE)

The LSE was established over 300 years ago. It lists about 2,900 companies from 70 countries. Many large U.S. companies listed on American exchanges also list on the LSE.

The LSE is much smaller than American exchanges with an average daily trading volume of about 250,000 shares.

The New York Stock Exchange (NYSE)

The New York Stock Exchange.

Established in 1792, this is the oldest and most prestigious stock exchange in the U.S. Unlike many other exchanges, it maintains a trading floor. In 2007 it merged with Euronext. About 2,800 companies are listed on the NYSE. Including Amex and Euronext, it has 8,000 listings. The NYSE has strict standards. To be listed a company must have more than 2,200 shareholders and an average daily trading volume of at least 100,000 shares. Generally, the company must have a total capitalization of at least $750 million or pre-tax earnings of more than $10 million.

NASDAQ

The NASDAQ Stock Market.

Also based in New York City, the NASDAQ — originally an acronym for National Association of Securities Dealers Automated Quotations) — was established in 1971. Unlike the NYSE, the NASDAQ is not a physical exchange. Rather it is totally electronic, nothing more than a network of computers. It now has more than 3,200 listed companies, and has surpassed the NYSE in terms of daily traded shares. Generally, a company must have issued around 1,000,000 shares of stock valued at $10 million or more to join the NASDAQ.

The NASDAQ is recognized as the most technologically sophisticated stock exchange in the world and therefore has been the listing choice of most technology firms. Microsoft chose the NASDAQ when it went public in 1986 and the exchange now hosts many media, communication, financial institutions, and biotechnology companies. Google and Apple trade on NASDAQ and Facebook has announced its intention to do the same when it goes public. However, the NYSE did secure Pandora and LinkedIn, two fast growing technology firms.

While NASDAQ has always been publicly traded, the NYSE was a private not-for-profit entity until 2006. Both exchanges are now businesses seeking to earn a profit for their shareholders and they both trade their own shares.

Differences Between the NYSE and NASDAQ

Even if your company qualifies to list on the NYSE, the costs can be prohibitive. A company can expect to pay an entry fee up to $250,000, while on the NASDAQ the fee is between $50,000 and $75,000. Yearly listing fees also exist. The NYSE calculates them on the number of shares of a listed security but they are capped at $500,000. The NASDAQ annual fees are approximately $27,500. Therefore, companies with less initial capital gravitate to the NASDAQ.

The floor of the NYSE operates on a system of controlled chaos, with crowds of people shouting out bids at the same time. In contrast, the NASDAQ’s computer network is an extremely efficient trading model. NASDAQ stocks are considered to be more risky and volatile but can achieve a good deal of growth quickly. The companies on NYSE are older, more stable firms. Its listings include many of the blue chip firms and industrials that have been around for over 60 years.

Securities on the two exchanges are bought and sold via very different techniques. The NASDAQ is a dealer’s market. Buyers and sellers are not negotiating with one another directly but through a dealer who is a “market maker.” This is a broker-dealer firm that accepts the risk of holding a certain number of shares of a particular stock in order to facilitate trading. Market makers compete for customer orders by displaying buy and sell quotations for a guaranteed number of shares. Once an order is received, the market maker immediately sells from its own inventory. There are more than 500 member firms that act as NASDAQ market makers.

In contrast, the NYSE is an auction market. According to Investopedia — an online educational resource for investors — an auction market is, “A market in which buyers enter competitive bids and sellers enter competitive offers at the same time. The price at which a stock is traded represents the highest price that a buyer is willing to pay and the lowest price that a seller is willing to sell at. Matching bids and offers are then paired together and the orders are executed.” The NYSE has specialists who match buyers and sellers. Whereas a market maker creates a market for a security, a specialist only facilitates trades.

Over-the Counter (OTC)

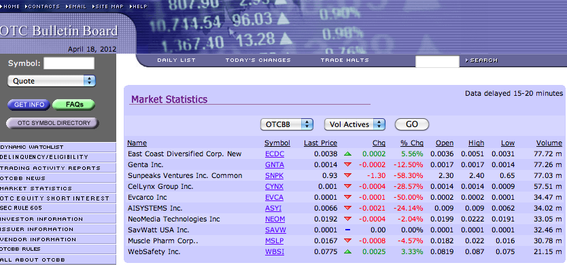

The Over-the-Counter Bulletin Board.

OTC firms cater to smaller public companies. Those companies that are “de-listed” from the major exchanges for failing to meet the requirements for several consecutive quarters usually go to one of the two OTC exchanges.

Over-the-Counter Bulletin Board is an electronic community of market makers. Companies that are delisted from the NASDAQ often go here because there are no minimum annual sales or assets required.

Companies with fewer than 300 shareholders can list on Pink Sheets, which is a daily listing of bid and ask prices of over-the-counter stocks. Companies who appear on Pink Sheets are not required to register with the SEC or to submit quarterly financial statements.

The Takeaway

Ecommerce companies with fast growth and the expectation of more than 300 shareholders would most likely feel most comfortable on the NASDAQ exchange. Companies with fewer than 300 shareholders, and those that don’t meet the requirements of NYSE or NASDAQ, can find a home on the OTC exchanges.