This article is “Part 4” in a series where I help you understand your debit and credit card fees. In last month’s installment — “Understanding Credit Card Fees, Part 3: Punitive Interchange Rates” — I explained how to decode your merchant statement to distinguish the actual interchange fees from the merchant account provider’s mark ups. I also explained how to identify, reduce, or eliminate two costly interchange fees. In this installment, I will focus on the “per-item” fees that may be costly or unnecessary.

Understand all the Costs

Merchants can become fixated with the percentage they are paying for card processing, whether it is a base rate of 2.35 percent or 0.30 percent above interchange rates. However, merchants need to also be aware of all the per-item fees being charged, just as they need to be aware of all the monthly and annual fees being charged. This I explained in last month’s “Part 3” installment.

Per-item fees are particularly important for ecommerce merchants with lower average tickets. Remember, a 30-cent authorization fee is the equivalent of 2.0 percent on the sale of a $15 book. Per-item fees are also important if you are obtaining a pre-authorization followed by the authorization at the time of the sale. Doing so may allow your merchant account provider to charge you twice for a single sale and 60 cents (2 x 30 cents) is 0.5 percent on a $120 sale.

Merchant account providers generally charge a per-item fee — sometimes stated as an “authorization fee” or “transaction fee” on the statement — because there is a real and fixed cost to physically route the transaction and process it. This fixed cost has been dramatically reduced over the last decade because most transactions generally run over the Internet versus dial-up lines as they did in the 1990s. Computer power is less expensive and servers are used more often in transaction processing.

Fees from the ’90s

Nonetheless, many merchant account providers still charge a 25-35 cent per-item fee just like they did in the 1990s because they know merchants do not understand the actual cost to route a transaction. Also, inflating the per-item fee may enable them to reduce their percentage to make their cost appear lower, especially if the merchant is only fixated on the percentage charged.

Other merchant account providers cleverly have 2 or 3 per-item fees instead of just one authorization or transaction fee, to make their quoted rates look more appealing.

Many merchant account providers also charge a higher per-item fee for processing Discover and American Express cards even though it does not cost anymore to route those transactions.

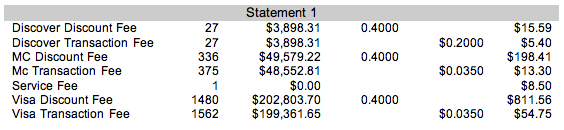

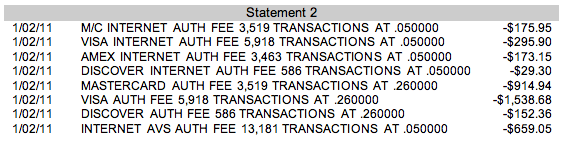

Below are sections from a couple of merchant statements. Try to identify any “red flags” that the merchant account provider or salesperson is taking advantage of the merchant. In both statements, the merchant account provider is actually processing the Visa, MasterCard, and Discover transactions. In statement 1, the merchant is on an “interchange plus” pricing schedule and in statement 2 the merchant is on “tiered” pricing. See “Notable Views: Credit Card Veteran on ‘Onerous’ Processing Rates,” where I explained the “interchange plus,” “tiered” and “hybrid” pricing models.

Charging More for Discover

In “Statement 1,” the merchant account provider is charging the merchant interchange + 0.40 percent to process Visa, MasterCard, and Discover transactions — see the fourth column from the left. However, the merchant account provider is charging 20 cents per Discover transaction versus 3.5 cents for Visa and MasterCard. There is no reason why the merchant account provider should charge this much more for Discover, other than they can and they know merchants simply do not understand. I cannot tell you the number of merchants who have told me that they do not take Discover because it costs more to process a Discover card than a Visa or MasterCard card. If it does, it is not Discover that is charging the extra amount and it should be a warning on how your merchant account provider views your business relationship.

Merchant Account Statement – Example 1

“Statement 2” is from a very recent client. Note on lines 5-7 that this merchant account provider was charging a 26-cent transaction fee for all Visa, MasterCard, and Discover transactions. However, also note the merchant was being charged a 5-cent “Auth Fee” (lines 1-4) and a 5-cent “Internet AVS Fee” (last line). These fees added over $1,300 to the monthly processing cost.

The merchant was really paying closer to 36 cents per sale in per-item fees to the merchant account provider. Whether the “Auth fee” or “AVS fee” is warranted is not the point here. The point is to make sure you add up all of your per-item fees when comparing merchant account providers. In this case, I asked other merchant account providers to bid for the merchant’s processing service. The merchant wisely chose another provider. The merchant’s overall rate was dropped by more than 2 percent and the per-item fees were dropped from 36 cents to less than 8 cents. Remember, these fees are negotiable.

The other per-item fee that is critical for all ecommerce merchants to understand is the “gateway” per-item fee. Many payment gateway agreements will typically offer the first 200-500 transactions per month without a per-item fee. Thereafter, the gateway per-item fee can range from 5 to 25 cents. Clearly, the closer you can get to 5 cents the closer you are getting to merchant account provider’s real costs. When evaluating providers, make sure you know which gateway they will use and how much they will charge you for set up, monthly fees, and per-item fees. These, too, are negotiable.

Merchant Account Statement – Example 2

Summary

Ecommerce merchants should understand the following points regarding “per item” fees.

- Look beyond the percentage being offered by the merchant account provider and understand all of the fees it charges to determine if your overall rate is fair.

- Merchants should never have to pay their merchant account provider more to process a Discover sale over a Visa or MasterCard sale.

- Add up all of the per-item fees being charged by your merchant account provider, not just the “transaction fee” listed on the merchant agreement.

- Understand all of the gateway fees when choosing a merchant account provider.