Ecommerce companies have been getting recent attention for their initial public offerings (IPOs). Alibaba Group Holding, China’s ecommerce giant, plans to go public in what could be the biggest tech IPO in history. And it’s not alone.

Here is a list of recent IPOs from ecommerce companies. There are digital coupon companies, a global ecommerce platform, a student marketplace, a car-buying platform, a travel company, and huge ecommerce stores. Several of the companies are based in China. Ticker symbols are listed in parenthesis next to company names.

Alibaba Group Holding

Alibaba powers roughly 80 percent of all online commerce in China. In 2013, the company had gross merchandise volume of $248 billion for its Chinese retail businesses. The upcoming IPO is expected to raise more than $15 billion. Alibaba has estimated its fair value at $50 per share. Estimates of Alibaba’s market value have soared in recent months to more than $200 billion. Alibaba’s IPO is expected for the beginning of August.

—

Borderfree (BRDR)

Borderfree is a cross-border ecommerce service. Its platform enables U.S. retailers to transact with consumers in more than 100 countries. Borderfree also provides logistics solutions to several large retailers, such as Macy’s and Aeropostale. The company went public on March 21, offering 5 million shares at $16, giving the company a market valuation of more than $600 million. Currently, shares are trading at the offering price.

—

Chegg (CHGG)

Chegg.

Chegg operates an online learning platform, which includes a textbook marketplace and search engine for internships, scholarships, and resources. Chegg debuted last November on the NYSE. The IPO was priced at $12.50 per share, raising $187.5 million in total at a valuation of close to $1.1 billion. Currently, shares are trading approximately 50 percent below the offering price.

—

Coupons.com (COUP)

Coupons.com is a leader in digital coupons. It operates a promotion platform that connects brands and retailers with consumers through web, mobile, and social channels. On March 6, the IPO was priced at $16, raising $168 million. It finished its first day of trading up 88 percent. Currently, shares are trading nearly 70 percent above the offering price.

—

GrubHub (GRUB)

GrubHub is an online and mobile food ordering platform to connect hungry consumers with local takeout restaurants. On April 3, the company offered 7.4 million shares at $26, raising $192 million. It finished its first day of trading up 31 percent. Currently, shares are trading nearly 40 percent above the offering price.

—

JD.com (JD)

JD.com is a largest online direct sales company in China in terms of transaction volume in 2013, with a market share in China of 46.5 percent. On May 21st, it offered 93 million shares at $19, raising $1.78 billion. The IPO valued the company at $25.7 billion, higher than Twitter’s at its IPO last fall. Currently, JD.com shares are trading nearly 50 percent above the offering price.

—

Jumei (JMEI)

Jumei is China’s largest online beauty products retailer. On May 15, 11.1 million shares were offered at $22. The company raised $245 million, in addition to a $150 million equity investment from General Atlantic in a concurrent private placement. Currently, shares are trading approximately 25 percent above the offering price.

—

LightInTheBox (LITB)

LightInTheBox is an online retailing company that sells China-made goods, including apparel, electronics, home and garden products, and other general merchandise. On June 6th, it offered 8.3 million shares at $9.50. Currently, shares are trading approximately 45 percent below the offering price.

—

NW18 HSN Holdings (HS)

NW18 HSN Holdings is the digital retail arm of Indian media group Network18. On April 2, the company filed with the U.S. Securities and Exchange Commission to raise up to $75 million in an IPO. The company operates the ecommerce website and home shopping television channel of the HomeShop18 platform. The company plans to list under the symbol HS.

—

RetailMeNot (SALE)

RetailMeNot operates a digital coupon marketplace, connecting consumers with retailers and brands. The company estimates that $3.5 billion in paid retailer sales were attributable to consumer traffic from its marketplace. Last July, the company offered 9.1 million shares at $21. Currently, shares are trading approximately 30 percent above the offering price.

—

TrueCar (TRUE)

TrueCar is an online platform to transform the car-buying experience. It enables uses to obtain market-based pricing data on new and used cars, and to connect with its network of TrueCar Certified Dealers. On May 16, the company offered 7.775 million shares at $9, raising nearly $70 million. Currently, shares are trading 50 percent above the offering price.

—

Tuniu (TOUR)

Tuniu is an online leisure travel company that offers organized and self-guided tours in China. On May 8, the company offered 8 million shares at $9, raising $72 million. Currently, shares are trading approximately 90 percent above the offering price.

—

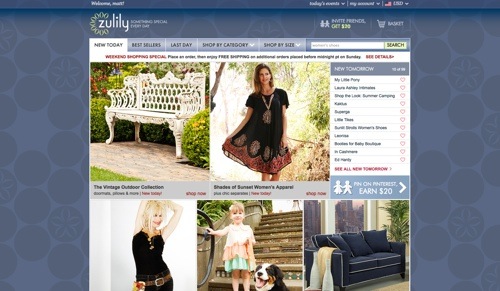

Zulily (ZU)

Zulily is an online retailer that specializes in curated flash sales on boutique brands for the whole family. Last November, Zulily offered 11.5 million shares at $22, raising $253 million. Shares had a 71 percent first-day gain. Currently, shares are trading nearly 80 percent above the offering price.