Most every ecommerce site accepts credit-card payments. But the type of cards that merchants accept can affect cart-abandonment rates, and many consumers expect payment options other than the four basic credit cards. Merchants that accommodate these new methods can increase sales.

The purpose of this article is to describe the rapidly changing online-payments landscape.

Credit Cards

Accepting credit cards is the very basic requirement of an ecommerce site. Though, not every site supports all the widely used credit card brands.

Visa, MasterCard and American Express are accepted almost everywhere but few retailers support Discover, JCB and Diners. Most people are not aware that the Discover and JCB networks are connected. If your site supports Discover, then you can add the JCB logo and support it — or vice versa. China UnionPay used to be only accepted in China but now it is accepted in over 100 countries. If your site has customers from China — or is in the tourism business — then supporting China UnionPay will likely increase your revenue.

Apart from accepting these branded credit cards, large retailers also accept private-label cards and co-branded cards. Private-label cards are branded for a specific retailer and can only be used within that retailer’s network of stores. Co-branded cards are issued in collaboration with a large credit card network like MasterCard and the retailer. These cards can be used anywhere the co-branded network like MasterCard is accepted. Usually, these cards are associated with a rewards program for the consumers. Best Buy is a good example of a retailer that supports both types of cards and offers rewards as part of the Reward Zone program.

Best Buy supports a wide range of credit cards.

Some retailers, like Dell, allow customers to split the payment across multiple credit cards. This option works well if your site offers big-ticket items that might exceed a credit card’s limit. CDW, the electronics retailer, even allows customers to phone in their payment information as part of the checkout process.

Some retailers allow consumers to phone in their payment information. This screenshot is from CDW’s shopping cart.

PayPal and Google Checkout

PayPal has also become a basic payment for an ecommerce site. Almost every large retailer supports it. Since PayPal launched its guest checkout functionality a couple of years back, consumers can check out using PayPal without creating an account on the retailer’s site. This has been a game changer and has resulted in significant growth in checkouts using PayPal.

Google Checkout has been around for the last few years but does not have the same level of adoption as PayPal. Google Checkout has recently transitioned to Google Wallet; it may capture a bigger market share.

Pay Using your Bank Account

Some large online retailers offer consumers the option to pay using a check or a money order, where the money comes directly from the consumer’s bank account. eCheck and Western Union are two vendors that support this payment option. The money takes a few days to clear as it follows the normal check clearing process. Some consumers who are afraid to enter their credit card numbers online prefer this option — though it delays the shipment of the purchased goods until the payment is cleared.

Several retailers are now also allowing their customers to pay using their bank’s bill pay service. eBillme is one of the vendors that helps enable this payment option by sending an email that serves as the bill for the online order. The consumer can then pay the bill using the bank’s bill pay service. Since consumers are already used to that bill pay service, this method is growing quickly.

Instant Financing

“Instant financing” payment methods are gaining wider adoption. Bill Me Later — owned by PayPal — is one example. You can offer “Bill Me Later” as a standalone payment option or it now integrates with the PayPal checkout flow. You can have the customer start the checkout process using PayPal and then select “Bill Me Later” as the payment option on the PayPal site.

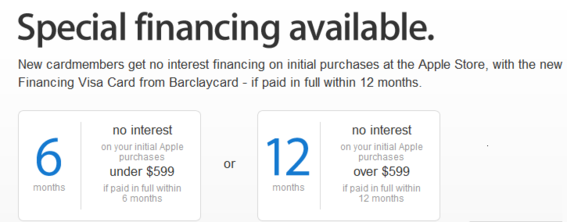

Other retailers, like Apple, are offering customers to apply for credit cards as part of the checkout process to offer instant financing. Apple has partnered with Barclaycard to offer instant financing to their customers.

Retailers often use instant financing as an incentive to sign up for credit cards. This example is from Apple.com.

Other retailers are offering an installment plan on their sites to pay for the purchases, such as “3 easy payments of $39.99 each.” In some cases, the retailer carries the burden of financing the purchase. In others, it is working with a separate finance organization to extend the loan. Dell, for example, offers instant financing to its customers.

Dell offers financing to “Preferred Account” customers.

Mobile Payments

More people have mobile phones than credit cards. So it is no wonder that paying using a mobile phone is growing quickly. Several vendors — such as ISIS, Intuit, and Square — now support a variety of different ways for mobile payments. Retailers are adopting various strategies to enable mobile payments using these vendors, as clear leaders and standards have not been established. Much innovation is occurring at physical, brick-and-mortar retailers to enable mobile wallets and near field communication (NFC) payments, which are contactless payments enabled using a chip on your mobile device and new, specialized hardware at the retailer’s location. Visa PayWave and MasterCard PayPass both support NFC payments. There are some vendors — such as Boku, Mopay, Payfone, SurfPin, Zong — that have offerings to allow online payments with just the mobile phone number. As a retailer, you need to review and identify the offering and the vendor that works best for your commerce environment. Mobile commerce is not a trend that should be ignored.

Subscription Payments

You can offer subscription payment methods that bill the customer a fixed amount every week or every month. Shoedazzle and Birchbox, for example, use this subscription model. Some of the vendors that provide the subscription platforms are Aria Systems, Billing Circle, Recurly, Spreedly, Zuora, and SubscriptionBridge.

Other Emerging Payment Methods

There are several other newer payment methods that are currently being offered or reviewed by large retailers. Dwolla is a U.S.-based private payment network that is gaining in popularity; merchants who use it pay a flat 25-cent fee for every transaction over $10. There are a number of international payment company — such as Klarna, PayEx, ClickandBuy, AfterPay, Konbini, Boleto Bancario — that are being used by large global retail sites. If your site does business internationally, then supporting some of these payment methods will better meet consumers’ needs.