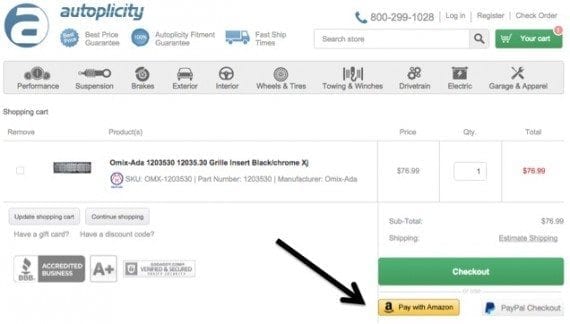

Autoplicity.com is a retailer of auto parts and accessories in suburban Chicago. Roughly 25 percent of its orders are processed via Amazon Payments, whereby customers click the “Pay with Amazon” button in their shopping cars.

Fewer than 10 percent of Amazon’s 304 million customers reportedly used Amazon Payments on third-party sites in 2014 and 2015. This, potentially, could be an opportunity for ecommerce merchants that offer Amazon Payments at checkout if that percentage grows to, say, 20 percent or 30 percent.

Merchants that offer “Pay with Amazon” may lower cart abandonment rates among Amazon customers, in addition to providing a layer of payment fraud protection, especially for international orders. The main downsides to merchants are customer service (i.e., customers have to interact with Amazon if there is a decline) and administrative hoops to set up the service.

Amazon: Huge Customer Base

PayPal reported over 184 million active customer accounts — those that have received or sent a payment in the past 12 months — in the first quarter of 2016. Amazon has the potential to eclipse PayPal if more of its customers use Payments.

Amazon’s global brand value makes it attractive to many consumers and merchants. Reader’s Digest recognized Amazon, in 2015, as the “Most Trusted Online Shopping Site.”

Interbrand, a brand consultancy owned by Omnicom Group, a global advertising agency, includes Amazon in the world’s top 100 brands. Within that group, Amazon’s estimated brand value, at $37 billion in 2015, ranks tenth. A number of pure-play payment providers were also in Interbrand’s top 100, including American Express ($18.9 billion brand value), Visa ($6.8 billion), MasterCard ($5.5 billion) and PayPal ($4.2 billion). Whether the Amazon’s size will translate to success in payments remains to be seen.

To attract the attention of merchants, Amazon is offering incentives. The Amazon Payments Growth Guarantee states: “If after 30 days of launching Login and Pay with Amazon you have not seen an increase in sales, we’ll refund your fees on up to $100,000 in transactions,” subject to a few conditions.

Does this strong brand and powerful incentive translate into value for ecommerce firms? Let’s consider the experience of ecommerce companies that use the service.

Benefits of Amazon Payments

What happens when a new prospect lands on an ecommerce website for the first time? If she found the website by searching for a specific product, she may be unfamiliar with the site. In that situation, credibility and low sales conversions are in play.

“The biggest strength for Amazon payments is the brand. When you get access to millions of customers who trust the name, conversion is bound to go up — no questions asked,” explains Eddie Lichstein, co-founder of Autoplicity.com, a retailer of automotive parts and accessories. Approximately 25 percent of Autoplicity’s orders are processed through Amazon. “If I could just do Amazon and PayPal for payments, I would because it would simplify the number and complexity of statements to manage and both companies make dealing with fraud issues easier,” Lichstein added.

Consumer trust in Amazon may lead to higher ticket price sales. “We have seen a large number of our higher price items go through Amazon payments, such as items over £400 (roughly $580),” commented Scott Lucas, ecommerce manager at First Class Watches, a retailer in Kenilworth, U.K. Lucas said that Amazon payments was used by about 15 percent of the company’s orders in the past 30 days.

Amazon’s technological strength is another attraction for some merchants. Lichstein explained, “Amazon has a large team of data scientists who protect us against fraud. This means that we never have to worry about being defrauded [from Amazon Payments transactions]. In addition, you can get more orders through the door and not have to turn down good business in fear of it being fraudulent.”

“Due the vetting required for credit cards, we were unable to accept a significant portion of potential international orders. While bank wire transfers are an option, few clients were interested. With Amazon Payments guaranteeing the transaction, there is now a safe, secure alternative for international clients to pay with a credit card, thus boosting sales,” commented Peter Grant, general manager at AuthenticWatches.com, a retailer in California. As of May 2016, AuthenticWatches.com payment options were Amazon, PayPal, credit cards, bank wire transfers, and personal checks. The company started using Amazon Payments in July 2014.

Disadvantages of Amazon Payments

What happens when something goes wrong with an Amazon Payments order? There is potential for confusion by customers and the corresponding harm to a merchant’s brand.

“Amazon is a bit stringent in its verification procedure, as we do receive a few ‘Amazon Decline’ transactions, leaving the client confused,” explained AuthenticWatches.com’s Peter Grant. “Many times, the client has ample credit available, leaving me to believe that Amazon may be declining the transaction for security purposes. In most cases, however, the client can contact Amazon, resolve the payment issue, and the order is reactivated.”

This risk may be addressed by explaining the process in advance to customers that pay using Amazon.

Getting started with Amazon Payments does involve significant paperwork. “In 2014, we had set up with an earlier Amazon payment product. In 2016, we started to use Login and Pay with Amazon. Unfortunately, we had to go through a long paperwork process with them, even though we already had a relationship,” explained Scott Lucas of First Class Watches. Completing this paperwork may be a reasonable price to pay given Amazon’s other benefits, yet it may frustrate some merchants.

The ease of integrating Amazon Payments into an ecommerce platform varies. Merchants using custom or dated platforms may require some development work to adopt the product. “We are using osCommerce and there was no module available to integrate Amazon Payments. As a result, we had to do some development for the integration,” explained Scott Lucas.

“Customers do not have to leave our website to complete a payment because of the integration we used for nopCommerce [an ecommerce platform],”explained Eddie Lichstein of Autoplicity. “I believe similar integration options are available with other ecommerce platforms.”

Pricing and Geography

Numerous payments providers have similar pricing models to Amazon Payments, which is 2.9 percent + $0.30 per order. Pricing may not be the only consideration, however. Geography may be a factor.

Amazon Payments “is currently available to sellers in the United States, the United Kingdom, Germany, and Luxembourg.” Authorize.Net, the payment gateway, works with businesses based in the U.S., Canada, Europe, and Australia. Stripe, the merchant account provider founded in 2010, currently serves nine countries with five more listed in “beta” status.