As B-to-B online revenues approach $1 trillion per year, there are still many wholesale distributors who are hesitant to aggressively sell their products online.

I frequently ask executives in the distribution industry if Amazon is impacting their businesses. This is typically a good question to spark the conversation. In many cases, their answers are not appropriate for this venue, as they view Amazon as the enemy that bleeds money and therefore is a poorly run business. In other cases, the answer is that the executives don’t sell the same products as Amazon. Sometimes, I hear that Amazon cannot compete with the service provided by the executives’ organizations.

The bottom line is that if you run a wholesale business, you should monitor AmazonSupply.com very closely. Amazon rarely speaks about its plans, but its actions speak boldly about its intentions in the business-to-business marketplace.

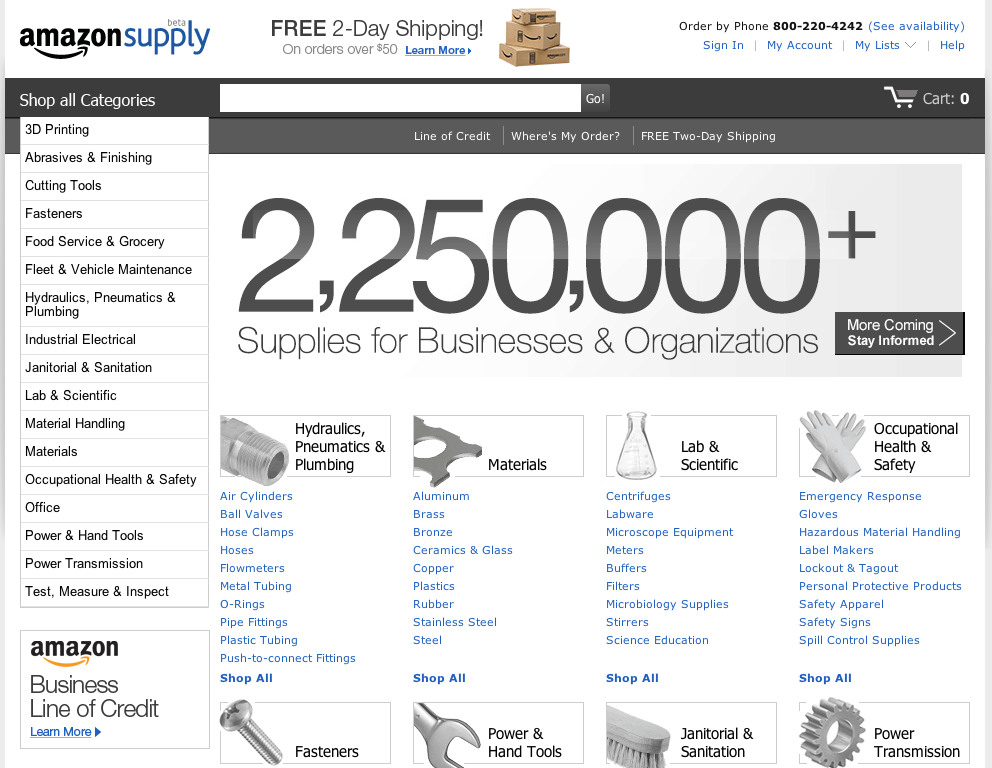

AmazonSupply’s home page says it all. “2,250,000+ Supplies for Businesses & Organizations.” “Free 2-Day Shipping!” “Amazon Business Line of Credit.” “Order by phone.” Categories on the home page include hydraulics, power transmission parts, maintenance supplies, tools fasteners, toilet paper, and thousands of other categories.

Products on AmazonSupply are available in wholesale packaging sizes. Prices are generally 40 to 50 percent lower than the manufacturers list price. Product content is rich.

AmazonSupply home page.

Most B-to-B executives who say that Amazonsupply.com does not compete with their companies are not really paying attention. The executives may sell different brands, but it is increasingly likely that Amazon has competitive or alternative products in the majority of product categories that are purchased by other businesses.

Beta, Really?

Notice that this is still a “beta” site. There is very little “beta” about it. Unlike its parent site, AmazonSupply.com is very tight and clean. There is no clutter from ads or marketplace sellers. If there is a weakness, it may be the search function, which will return, for example, more than 66,000 products with a search on “drills.” However, there are many categories that narrow the search quickly.

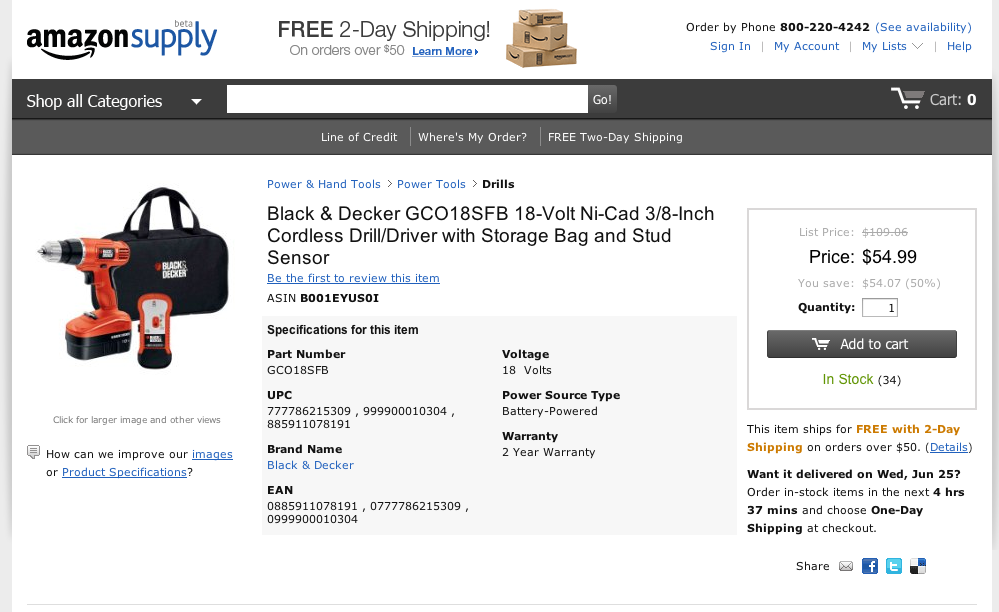

Once you reach a product detail page, the look is basic. Many items have an Amazon description as well as the manufacturer’s description. There are fewer customer reviews than on Amazon.com, but that is likely because business buyers are less inclined to write reviews.

This Black & Decker drill on AmazonSupply was priced, at time of publication, at $54.99, a competitive offer with the option of free Prime shipping.

A quick search on Google for this Black & Decker power drill pictured above shows that AmazonSupply.com has a highly competitive price with the option for free, Prime shipping.

Many B-to-B distributors operate stores or offer free delivery, which gives them an advantage in cities and regional markets. But with Amazon experimenting with same-day delivery for groceries and other items — see “4 Ways Same-day Delivery will Transform Retailers” — one can only assume that AmazonSupply will attempt to use those new delivery fleets to fulfill all order types.

The argument that AmazonSupply.com does not offer similar products is diminishing quickly as it rapidly adds new products. In January 2013, AmazonSupply offered 600,000 products. In January 2014, it offered 1,250,000. In the last six months, it added more than 1,000,000 products to reach 2,250,000. That’s a lot of manufacturers jumping on AmazonSupply’s bandwagon. It’s also a big investment in staffing by Amazon to support that level of buying and merchandising.

Amazon has the most sophisticated pricing systems in the world. It knows how much demand there is and exactly what the market price needs to be to achieve its goals — market share or profits.

If I still owned a distribution business, I would continually invest in my ecommerce operations to stay ahead of AmazonSupply by providing incredible content, superior customer service, and some type of rewards program to maintain customer loyalty. The old way of doing business with direct sales representatives, phone orders, and a round of golf every now and then is not going to cut it against the Amazon machine.