Before launching an affiliate program, merchants should establish their default commission structures. This is the base commission rate that will apply to all of your standard affiliates. You will still be able to customize terms for individual affiliates, but your base commission rate dictates how affiliates that do not have negotiated terms are paid.

When formulating a commission structure, the first step is to consider all stakeholders involved in the transaction. Even though affiliate marketing is entirely performance-based — and nary a nickel gets paid unless a transaction occurs — there are several different parties taking a cut of that sale. The affiliate gets a percentage. The affiliate network gets a percentage. And, your affiliate manager might take a percentage. What initially seemed as a no-risk marketing channel could be one of your most expensive.

But that doesn’t need to be the case. Affiliate marketing is one of the most cost efficient marketing channels, provided that margins are properly managed. Here are four points to consider when determining your ideal commission structure.

4 Keys to Setting Affiliate Commissions

1. New vs. existing customers. New customers traditionally have higher lifetime value than existing ones. This is because every new customer grows your customer base. And once you own the customers, you pay less to convert them on future purchases. Customers who have purchased from you already know your product, value your service, and presumably trust you. It costs more to acquire a new customer because you have to build that credibility and trust.

Since new customers are valuable, it makes sense to offer incentives to your affiliate partners to generate fresh traffic and new customers. You may already have new customer marketing incentives in place — perhaps a first purchase discount or another special offer. The same reason you offer those incentives is why you should pay affiliates more for generating new customers. No matter where the incentive is paid — i.e., to the customer or to the affiliate — the result is the same. You’re paying a bit extra to acquire that new customer because you know your ultimate payback is in the customer’s lifetime value.

Affiliates can also help your company tap into new audiences and reposition inventory so that it is relevant to them. For example, perhaps your site is entirely in English, with no exposure to the Hispanic market. One of your affiliates may translate your copy into Spanish and target that market, thus bringing new customers to you. Such a tactic — translating text — would be expensive and time consuming. So increased commissions for those new customers would help offset the affiliate’s initial investment.

2. Product categories with varying margins. If you have many products, your margins on each one will likely vary. Electronics might have a tight margin, while home decor may have more leeway. If you are looking to establish a flat commission structure — i.e., a set revenue-share percentage, no matter what item the affiliate sells — then evaluate what your product mix is. What percentage of your sales are low margin? What percentage are high margin? From here, develop a blended commission rate that will be profitable for both you and your affiliate.

You can also establish commission tiers based on specific product categories. For example, you could pay 2 percent revenue share on electronics, and 10 percent on home decor, since the former carries a lower profit margin than the latter. A challenge of working with this dual structure is the technical integration. You will need to create a product feed for the affiliate network, and for each affiliate transaction that occurs you will have to submit item-level data to distinguish, say, electronics from home decor. Neither task is particularly challenging, but it does require some work.

This commission structure from Groupon.com accounts for product categories as well as new and existing customers. Enlarge This Image

Enlarge This Image

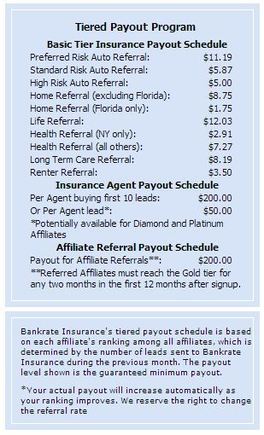

3. Paying for leads. Some merchants benefit by paying affiliates on a lead basis. For example, an insurance company might pay affiliates a fixed bounty for each potential customer who signs up for an estimate. Alternately, a car dealership might pay affiliates for each customer that requests information on a specific car, and perhaps an additional bonus if the customer schedules a test drive.

A challenge with a lead-based commission structure is fraud prevention. If the form is easy to complete and the payout high enough, a dishonest affiliate can determine ways to auto-fill that form and collect commission on bogus leads. To prevent this, you would need a dedicated affiliate manager to police the quality of inbound leads. Warning signs include multiple leads originating from the same IP address, or patterns in data entry such as spelling variations on a single name — such as “Jonathan Smith,” “Jon Smith,” and “J. E. Smith.” When you detect fraud, boot the affiliate from the program immediately, and inform the network. And don’t forget to reverse any recorded leads associated with the bad affiliate.

InsureMe.com’s commission structure is tiered by product, and also by affiliate performance in the previous month. Enlarge This Image

Enlarge This Image

4. Sales incentives. Structure your commission rates so that you have additional margin to offer sales incentives. For example, perhaps you are launching a new product line and you want affiliates to focus their marketing efforts on it. If you have room in your commission structure, you can offer a temporary increase — or perhaps sales bonuses — for hitting established revenue targets. I addressed sales incentives here previously, in “Affiliate Marketing: 3 Incentives to Drive Sales.”