Keywords and topics are central to contextual relevance, a primary ranking factor for search engines. In the wake of the changes to Google’s Keyword Planner, the natural search industry’s go-to research tool, many are left wondering where to turn for their keyword and topical research.

Those who haven’t already been using multiple tools to deepen and extend their keyword research are now left with a couple of choices: start spending on an AdWords campaign to activate your account or change the data source.

Changes to the Google Keyword Planner

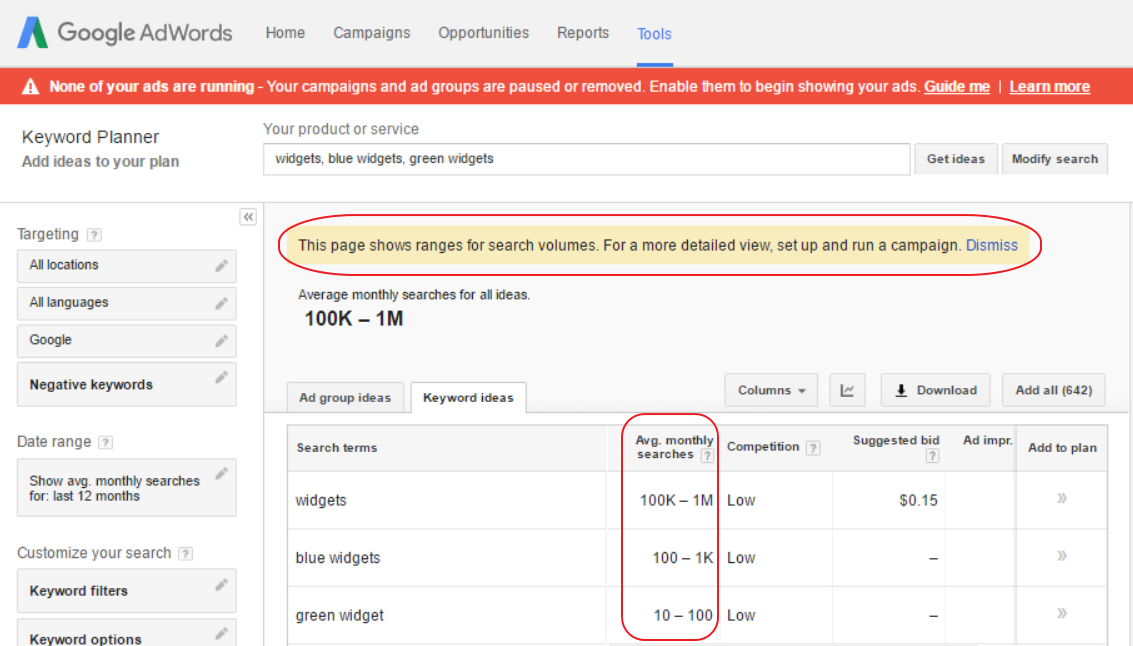

For years Google has offered its AdWords Keyword Planner as a free resource. Many practitioners of search engine optimization used it for their data needs even though they didn’t advertise on AdWords. Recently, however, Google decided to provide the detailed data within the tool only for AdWords customers with active accounts. Users that don’t meet the unannounced minimum spend requirements instead see ranges instead of specific numbers.

Google’s Keyword Planner now shows ranges instead of detailed keyword data for accounts that don’t meet minimum spend requirements. Click image to enlarge.

In addition, Keyword Planner now has limits to the amount of detailed data that can be accessed. After this unspecified limit has been reached, the detailed data will revert to data ranges, as shown above.

The most frequently asked questions around this change are as follows.

- Who is affected? Google instead answers the question of who is not affected. “Most advertisers with active campaigns will not be affected by this change,” according to Google’s representative in the AdWords forums, Cassie Hartt. Users who have not been running ad campaigns in AdWords will now have to start buying ads in order to see detailed data.

- Will access be reinstated for users with inactive accounts? “This will not be changed,” Hartt says. “If you do not have an active campaign, you will no longer be able to access search volume data from the Keyword Planner Tool.”

- Is this another “technical issue,” like the one back in June? In June 2016, Google’s Keyword Planner briefly showed similar ranges to all users, active and inactive, raising cries of protest from every quarter. This was called a temporary technical issue and detailed data was reinstated for all users within a couple of days. However, 13 days later this “technical issue” was made permanent, removing Keyword Planner data for inactive users. Apparently the technical glitch was only that it was prematurely released and that it was released for active users as well as inactive users.

- What are the minimum spend requirements to use the tool? “I don’t have any specific spend requirements or data limit amounts that I can share, and there are no changes planned at this time,” according to Hartt. On the AdWords’ forums, some have reported success with a monthly spend of $50, though others have had issues seeing data with spends lower than $300 a month. The success rate of gaining access to the tool may depend on meeting the minimum recommended bids for the ad groups on which you’re bidding.

- How soon can users start seeing detailed keyword data after activating an ad buy? If you meet the unspecified minimum ad spend, your access to detailed data within the Keyword Planner should be activated within 24 hours.

- Why is Google making access to the tool difficult and more expensive? Complaints in the AdWords forums point to desire to make more money and to put more power into the hands of big brands with big advertising budgets.

There is another logical reason, however. It costs money to provide data and to host and compute that data. In addition to individuals accessing the tool for their own research needs, many third party keyword research tools scrape data from Google’s tool to provide their own data sets. Those tools demand a lot of data from the system rapidly. Instead of shutting down the scrapers, Google has shut down access to the detailed data for everyone who doesn’t pay for it.

Keyword Research Options

The first option is seemingly simple: Run an ad campaign in AdWords. You’ll have to experiment with the bids to find a minimum amount, and it may not be something that small businesses can afford, ongoing. In theory you could activate a campaign, wait 24 hours, and then use the tool to access the keyword data. When you’re finished you could switch the campaign to inactive. I haven’t seen any mentions of a requirement around length of activation for an ad campaign, so this might work for users who want the data for short-term use for a specific project.

The second option is to find another source of keyword data. There are other keyword research tools, but many of the most popular also relied on scraping data from the Keyword Planner. Those tools will no longer be viable sources of data.

Bing also offers its advertising customers a keyword research tool, the aptly named Bing Keyword Research Tool. You do need an account to log into Bing’s Webmaster Tools, within which the keyword tool lives.

Bing’s tool is aimed at SEO professionals using its webmaster tools, versus being a tool with which to specifically sell advertising. Keep in mind, however, that the dataset is different than you’re used to seeing. Bing’s tool contains only Bing searches. It defaults to a three-month time period. The data you get from Bing’s tool will look very different from Google’s past data — don’t expect to be able to compare them apples to apples.

Wordstream also offers a free keyword tool. While it doesn’t disclose searches per month to free users — you need a paid account for that — it does have a visual indicator showing search frequency. You can use this to judge the relative value of keywords against each other.

Other free tools scrape the Google Suggest box at the top of the search results page. A lot of them also scrape suggestions from Yahoo, Bing, YouTube, and Amazon. UberSuggest is the most well known of these suggestion scrapers, and a good place to start. Suggestion tools do not typically have any numeric data associated with them, however. Their role is to produce a lot of keyword ideas, which you could take to another keyword tool and input for data around search volume.

The few options I’ve listed here are free tools that have a good reputation for data integrity and that disclose their data sources. If you are aware of another free tool that meets these criteria, please let us know by putting it in the comments, below.