Amazon launched Fulfillment by Amazon ten years ago as a mechanism to help sellers scale their fulfillment and customer service operations. Yet, the single most important feature had nothing to do with operational effectiveness, but rather with the ability of the seller to win the Buy Box on Amazon.

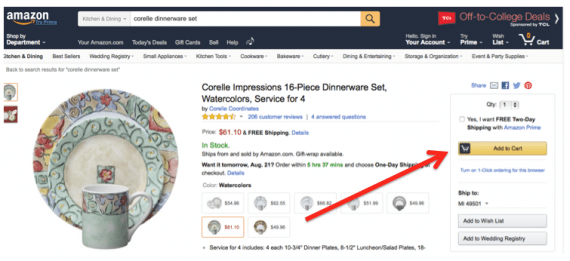

Given that the seller’s ability to have its product show up as the “Add to Cart” seller is based on the Buy Box algorithm, it’s critical to understand that the use of FBA ahead of a seller’s own fulfillment services will significantly improve the seller’s ability to be that Buy-Box-winning seller.

A seller’s ability to have its product show up as the “Add to Cart” option is based on the Buy Box algorithm, which is heavily influenced by the use of FBA, or not.

A seller’s ability to win the Buy Box is based on a number of variables, including:

- Performance metrics — including cancellation rate, late shipment rate, on time delivery rate, and order defect rate, which incorporates negative feedback rate.

- Whether the seller has earned “Featured merchant status” — a seller is eligible to win the Buy Box based in part on the amount of time the seller has been an active on Amazon.

- The seller’s total landed price — i.e., product price plus shipping cost.

When a seller puts its products into FBA, all sorts of benefits are immediately realized as Amazon has the FBA inventory in its own fulfillment centers.

- FBA orders very rarely get cancelled due to lack of inventory.

- FBA orders are shipped out and delivered on time — or else are the responsibility of Amazon, not the seller.

- Negative feedback on FBA orders typically falls, given that customers complain a lot about late and cancelled orders — issues that are now gone with FBA.

Further, Amazon is almost certainly going to make a seller’s FBA products eligible to win the Buy Box, even if the seller hasn’t yet earned featured merchant status on Amazon; non-FBA products from that seller won’t get featured merchant status until the seller earns featured merchant status.

Finally, FBA products are immediately eligible for Prime shipping and Super Saver shipping, two programs that have successfully driven higher sales than non-FBA products.

Comparing FBA v. Non-FBA Sellers

So let’s compare the relative competitiveness of a seller’s FBA product versus the non-FBA product of a seller that has already earned featured merchant status on Amazon. There are different types of competitive use cases worth mentioning.

- The seller has no competitors on its listing, such as a private-label or exclusive sourcing scenario. Since the seller is not fighting with other sellers for the Buy Box on that product, the seller is likely to win the Buy Box all of the time.

But let’s think more broadly about competition. Shoppers typically consider many products before making their purchase. Because at least some other similar listings are likely to have FBA offers, customers are likely to be drawn towards the FBA products ahead of non-FBA products, because Amazon will feature FBA products in product search results. Amazon also makes it easy for shoppers to select the option to show only product search results that are eligible for Prime or Super Saver shipping, thereby hiding all non-FBA seller offers from being explored by customers.

- The seller faces competition on a strict minimum advertised price — MAP — product. If products have strict MAP, sellers that respect MAP pricing don’t have the ability to price down their offers, meaning they have to look for Buy Box advantage elsewhere. FBA will provide that advantage faster than any other mechanism. What often happens on MAP products is all sellers end up in FBA, and the Buy Box revolves across the sellers.

- Seller with other FBA competitors. In this scenario, the pie is split across sellers, and those using FBA get an advantage, as long as no other sellers decided to counter the FBA effect with a big price reduction that overrides the FBA effect on the Buy Box. If competing sellers have similar performance metrics and prices, FBA becomes necessary, essentially, for the individual seller to have any share of the pie.

- Seller with other competitors, with no one using FBA. When Amazon Retail does not have a listing on the same product, and there are no FBA offers, I have repeatedly seen the first seller putting product into FBA generate increase in its unit sales of over 70 percent, usually at the expense of the other sellers. But some of the unit sales increases will also happen because customer conversion typically improves when products are available for Prime or Super Saver shipping.

It is worth mentioning that in situations where all sellers are using drop shippers on a listing (and thereby not using FBA), it takes only one seller to start holding FBA inventory on that product to create a big advantage for itself.

Non-FBA Examples

When can a seller get away with not using FBA? There are just three situations.

- Strong, highly pursued brands. If a product is from a brand heavily desired by consumers, and available only through non-FBA options, shoppers will still seek out non-FBA offers. One good example of this is an Under Armour product, which is nearly exclusively offered by Under Armour, acting as a third-party seller using its own fulfillment services. We also see products with unusual chemical contents, such as beauty and pet products, being offered this way.

- Oversized products. Because a product must be sent to Amazon’s fulfillment centers in order to be available for FBA, the seller incurs a shipping cost to the fulfillment center, all before the product is then sent to an Amazon customer buying the FBA product. This double shipping cost can be too much to make an oversized product price competitive. Hence, with no sellers choosing to incur these double shipping costs, we see a lot of oversized products (especially of the heavy weight variety) offered only through non-FBA options.

- A seller with much lower prices. If a seller has the ability to offer products at a much lower price when those items are offered by others through FBA, the seller may be able to overcome the FBA effect and still win the Buy Box. Unfortunately, long-term lower price advantages rarely last on Amazon, as we see a lot of irrational pricing just so sellers can win the Buy Box, not realizing they are losing money. Second, a lower-priced, non-FBA seller’s offer can get suppressed from view is the customer clicks the option in search to see only Prime or Super Saver offers.

While these situations reinforce the need for FBA, if you are going to use FBA, be sure that you do not comingle your inventory with other FBA sellers. You want the “stickered” version of FBA to avoid being accused of selling problematic inventory that is actually another seller’s inventory comingled with your own.

The Verdict?

In short, yes, the need for FBA is becoming greater for sellers each day on Amazon. While some product exceptions do exist, the power of FBA to help a seller win the Buy Box is so significant that it is hard to see how a seller can maintain and grow its sales revenues without incorporating FBA into its long-term Amazon strategy.