One of the first questions retailers ask when launching an affiliate marketing channel is “what should my commission structure be?” My advice is to research what competitors and retailers in related niches are paying.

If you sell apparel, for example, look not just at commission rates for competing apparel sites, but also for retailers of cosmetics, accessories, and shoes. This will give you a better idea of what to offer.

There are two ways, typically, to find affiliate commission rates. The first is to visit the affiliate program page on a retailer’s website. That page is frequently linked in the site’s footer. Oftentimes, standard commission rates will be listed on this page.

The second way is to create an affiliate account on the various affiliate networks. This would enable you to log in and search the directories. The challenge with this approach is actually getting an affiliate account. If you have a blog, you can use it, to apply.

Variations to Affiliate Commissions

Once you have established a basic commission structure, consider adding attribution options — i.e., how to decide if a commission is due, or not, and when to pay it. Here are some variations to consider.

1. Transactions that occur within a minute of an affiliate referral. One of the most common attribution challenges from retailers involves coupon directories. Say that a consumer sees a Facebook ad for a retail site. She clicks on that ad, visits the site, adds items to the cart, and proceeds to checkout. During the checkout process, she sees a field to enter a promotional code. This prompts her to search for one to use with her purchase. She locates a code on an affiliate coupon directory and clicks the affiliate link there to complete her now discounted purchase.

This behavior presents several challenges for the retailer. First, even though the transaction was originally driven by the Facebook ad, it is now likely attributed to the affiliate coupon directory. Second, the retailer is now paying an affiliate commission on a transaction that should have been associated with the Facebook ad.

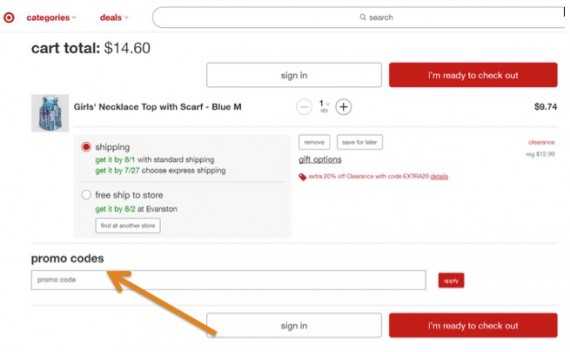

Target uses a promo code field in its checkout process.

The retailer can minimize its exposure to this attribution by using the right affiliate network. With ShareASale, for instance, the retailer can set a time constraint. For example, if a consumer clicks an affiliate link and completes the transaction within one minute, the retailer can be pretty certain the consumer engaged in the behavior described above. She started to check out, saw the promo field, and paused her checkout process to find a coupon code. Having found one, she came back and completed her purchase. The time between clicking the coupon affiliate link and completing her purchase was less than a minute. For transactions that follow this pattern, the retailer can set ShareASale to pay a lower commission rate.

ShareASale takes it a step further. If the consumer was initially referred by another affiliate, rather than a Facebook ad, for example, ShareASale can credit the initial referring affiliate for the transaction. Alternatively, with ShareASale affiliate managers can split the commission between the original referring affiliate and the one that entered the clickstream within a minute of transaction.

This approach doesn’t solve the issue of attribution, but it does help manage advertising budgets. (As an aside, the digital marketing industry is developing more and better attribution models. I’m confident that we will see a complete solution soon.)

2. Transactions that occur during a specific time. There may be occasions when you want to further entice affiliates to drive traffic to your site. Perhaps you’re running an end-of-year sale or another limited-time promotion. Many networks allow you to set a temporary commission rate that will override your default rate, either for all affiliates, or for subsets of affiliates. For example, AvantLink enables affiliate managers to offer a temporary commission structure for select affiliates for a certain time. Afterwards, the rates automatically revert back to the default structure.

AvantLink also offers many options to slice and dice affiliates. You can apply temporary commission rates to all affiliates, individual affiliates, affiliates that have a specific custom tag, and more. You can even apply temporary rates to affiliates that meet a certain activity, such as those that have never sent any traffic, or those that use, say, a custom link or product link generators.

3. Activation commissions. One of best incentives for your affiliates is to create an activation commission. When affiliates join your program, offer them an increased commission rate. You could offer a double commission for the first 30 days, for example. By getting affiliates actively promoting you early on, you can establish a healthy relationship that will, hopefully, continue.

Many affiliate networks enable managers to set custom commission rules — the network is not limited to a base commission structure. However, even if a network doesn’t offer an automated way to do this, you can still implement custom rules manually, by calculating the incremental difference and posting it as an affiliate bonus.

Finally, if you implement an advanced commission structure, don’t just let it run. Tell your affiliates about it. Let them know you’re going the extra mile to ensure their commissions are fairly and properly paid.