There’s no shortage of alternative payment choices: eBay’s PayPal, Google’s Wallet, Visa V.me, and MasterCard MasterPass, to name a few. There is also a proliferation of alternate contenders, as mobile shopping threatens to disrupt traditional methods of payments.

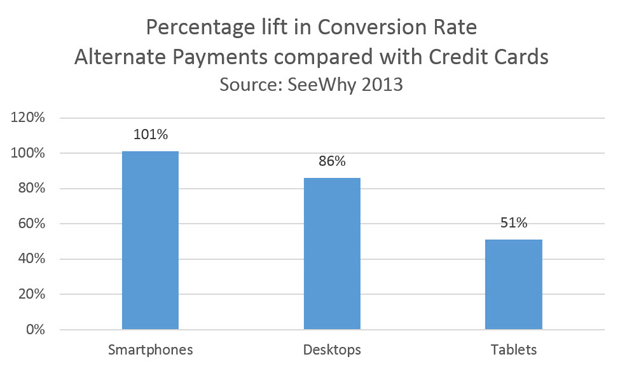

Alternative payment companies each claim that their payment method increases conversions. My company, SeeWhy, performed an independent analysis and confirmed these claims.

This SeeWhy analysis of conversion increases from alternative payment types shows increases from users of smartphones, desktops, and tablets, of 101 percent, 86 percent, and 51 percent, respectively.

In this study I’ve analyzed credit card conversions and compared them with multiple alternative payment methods across more than 1,000 ecommerce sites. The data shows significant increases in conversion compared with credit cards, peaking at a 101 percent increase on smartphones.

But this is not the whole story. While these increases are impressive, they only applied to around 15 percent of traffic, so the impact on your site’s overall conversion rate will be much less. Depending on the characteristics of your site you will probably see somewhere in the region of 5 to 10 percent improvement in your site’s overall conversion rate, which is still significant enough not to be ignored. As mobile commerce grows, then alternative payments will become ever more important.

However, before embarking on an alternative payment implementation, there are three important considerations you need to take into account.

1. Which Payment Method?

Since there are multiple choices, the obvious route is to adopt PayPal. PayPal claims over 30 million U.S. mobile customers, and over a 100 million active accounts — which is a larger base than any of its competitors. SeeWhy found that 34 percent of U.S. consumers shopping online had PayPal accounts as of July 2013.

However, PayPal also carries some baggage. Having grown up as a payment method of choice for eBay, its reputation is not always considered positive. Some consumers are wary about PayPal, having had negative experiences in the past, probably with smaller merchants on eBay. In fact, according to SeeWhy’s analysis, two thirds of PayPal account holders state that their preferred payment method is a credit card.

Merchants selling luxury items might want to consider alternatives before implementing PayPal because of its reputation issues. Google Wallet is an alternative that is growing fast in part because of the growth of Android smartphones where a Google Wallet account is required to use the Play store, the Android equivalent of the app store. Google Wallet can also be linked to Google+ social sign on, so if you are considering implementing social sign on as well this might be a route to consider.

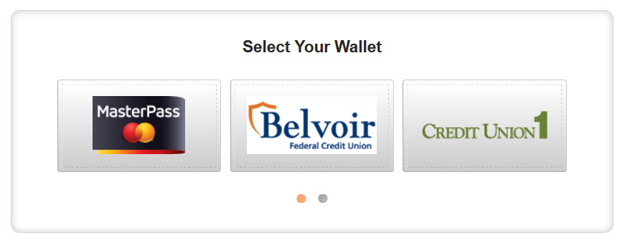

Both Visa’s V.me and MasterCard’s MasterPass both hold significant potential but the companies are only just beginning to roll out their service. It’s also worth noting that both Visa and MasterCard are rolling out their services through the acquiring banks. This will cause a proliferation of payment choices, leading to complexity and confusion for the shopper. You can see this already with MasterPass where having selected the “Buy with MasterPass” option, you are then presented with an array of different MasterPass wallets to choose from. Currently there are only six options, but what happens when there are hundreds?

MasterPass wallet options.

2. How Many Alternative Payment Methods?

Choosing only one alternative payment method might be tough, so why not implement several, and cover the market more thoroughly? This may be a valid approach, but think carefully before choosing this option.

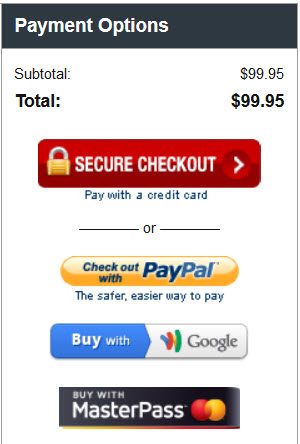

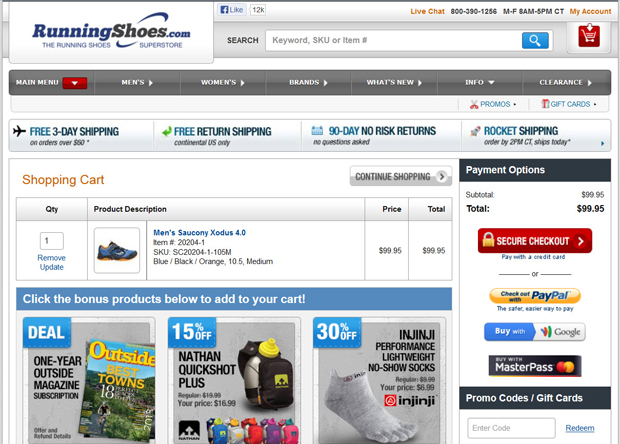

For example, RunningShoes.com has implemented PayPal, Google Wallet, and MasterPass as alternative payment options.

The problem is that offering payment choices can create four different competing calls-to-action, as you can see in the screen shot. Whenever consumers are faced with too much choice, indecision tends to follow.

More alternative payment options can mean more competing calls-to-action.

This is also problematic when you consider the whole page. There are lots of visual distractions to the primary call to action, which in this case is the red “Secure Checkout” button.

Competing calls-to-action can detract from the checkout call-to-action.

Before embarking on implementing multiple calls-to-action, consider how you are going to solve this issue. One route you could consider is to suppress the alternate payment methods for returning customers if the customer always pays by credit card, for example. Or if the customer always purchases by PayPal, show the PayPal button most prominently, and hide the others under a “Show alternate methods of payment” link.

3. How to Implement

Not all sites will see significant increases in conversion when implementing alternate payment methods. The main reason for this is that implementations can be done badly. One of the primary benefits of these payment methods is that they enable visitors to bypass the billing, shipping, and card entry steps on an ecommerce site. This is especially important for mobile sites, where entering these details using fingers and small screens defeats all but the most determined.

However, many sites implement these payment methods as an alternative only to entering the credit card number. You can see this here on Barnes and Noble ‘s site, where you are forced to enter shipping and billing information before being presented with the PayPal button. This may be a simpler implementation to do than providing an alternate checkout path, but it is frankly a waste of time, and surprisingly prevalent in PayPal implementations.

Some sites require entering shipping and billing information before the PayPal option.

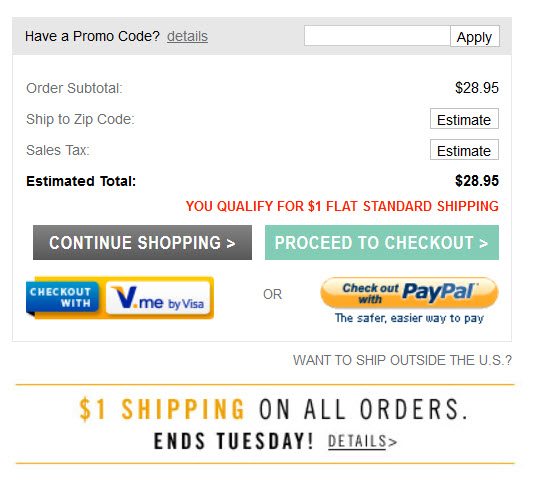

The correct method is to implement the alternative payment method as a button at the start of the checkout process, probably on the cart summary page. You can see a good example here of this at PacSun.com, an apparel site, but note the competing calls-to-action problem here as well.

Checkout payment alternatives at PacSun.com.

PacSun deals with this slightly differently on mobile devices by not offering V.me. as a payment alternative. This avoids having a four choice vertical list of competing calls-to-action.

Alternative payments can undoubtedly result in higher conversions. However, to be effective they need to be implemented correctly to provide an alternative checkout flow, not simply a payment alternative to credit cards. This takes more effort to implement, but it is worth it. Implementing one payment method properly is a better route than superficially implementing multiple payment methods. This is especially true for mobile sales where the goal is to eliminate data entry as much as possible and alternate payments can do this very effectively. As mobile commerce becomes more important, so will alternative payments, for all merchants.