I’ve previously suggested that online merchants and brand manufacturers sell their products on marketplaces to expand their reach and increase their revenues. Marketplaces attract more visitors than a smaller online merchant could possibly attract.

In this article, I’ll explore each of the major marketplaces, to better understand the benefits for merchants and brands. Here’s a quick snapshot of the major marketplaces. Unique visitor (UV) traffic estimates are from Compete.com for September 2013. This list is ranked by traffic, not by fit for most merchants.

7 Online Marketplaces

- Amazon. 129 million UV. The big gorilla. A first-party seller that added third-party sellers with great success. Wide variety of products in all categories. Allows you to set up a store and products within strict rules. The customer is Amazon’s, not yours and that is strictly enforced. Offers Fulfillment by Amazon, which opens up Prime Rewards program and free shipping to third-party products. Amazon offers several monthly plans for merchant stores and charges commissions upwards to 25 percent, depending on the category.

- eBay. 84 million UV. No first-party sales. All transactions brokered by eBay and fulfilled by third-party merchants. Options for “Buy It Now” or for traditional auctions. Fees structure is complex: subscription rates, insertion fees, and final value fees vary by plan. Easy-to-establish seller account. Wide variety of products and categories.

- Walmart.com. 57 million UV. Yes, Walmart also has a third-party marketplace. But it is currently limited to less than a dozen authorized online retailers, including eBags, Tool King, and Wayfair. Hence, Walmart.com is not an open marketplace.

- BestBuy.com. 22 million UV. A relative newcomer to marketplaces, BestBuy.com requires authorization and does not offer many details on its program to the public. However, it does offer many products — mostly electronics — not available in stores.

- Sears.com. 21 million UV. In many ways, Sears copied Amazon. It is a first-party seller with marketplace stores. It has many products and categories, and many marketplace sellers. Sears charges a monthly fee for a merchant store; commission rates range from 7 to 20 percent. It also offers rewards to its customers as a competitive advantage over Amazon. The customer belongs to Sears, not the marketplace seller, with rules in place to prevent follow-up marketing. Sears also offers Fulfillment by Sears services.

- Newegg. 3.4 million UV. A tech geek paradise where you can also buy a snowboard while you pick up a new hard drive. An approval process is required. Commission rates run from 8 to 14 percent. Many sellers report good success here, perhaps because the competition in niche products is much lower than other larger marketplaces.

- Rakuten.com. 1.5 million UV. Formerly Buy.com, now owned by Rakuten, Japan’s largest ecommerce company. It allows merchants to customize their stores and product pages, and to conduct follow-up marketing to customers. Rakuten offers customer reward points of 1 percent of purchases. Store plans start at $33 per month, with commissions from 8 to 15 percent, plus a $.99 per item fee that is waived under certain plans and conditions. Sellers can make products available to the Japanese market with no additional charge. Some products also may be sold on BestBuy.com.

In my view, Amazon, eBay, Sears.com, Rakuten, and Newegg are the viable alternatives for smaller ecommerce merchants. Rakuten’s value proposition, especially, appears to target smaller merchants and brands.

Rakuten.com

According to Rakuten’s chief U.S. operating officer, Bernard Luthi, the company’s goal is to provide the best tools to help merchants build their own brands and identity within the Rakuten marketplace.

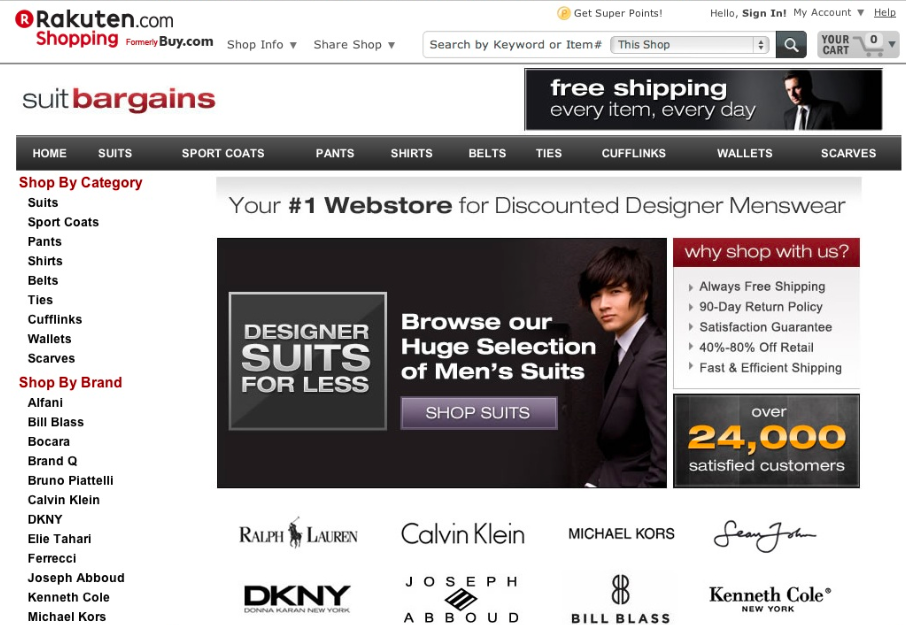

Rakuten “suit bargains.”

The roots of that were in the original Rakuten online marketplace in Japan, according to Luthi. Most Japanese merchants are local. The Rakuten platform allows them to build a presence throughout Japan rather than just their local communities. These merchants email their customers, design their own stores and products, and even have their own blog — all within the Rakuten platform. Rakuten encourages direct communication with prospects and customers throughout the buying cycle.

In the U.S., Rakuten is transitioning from the Buy.com platform, which was designed for delivering the best price on a given item. The platform currently is cluttered with legacy third-party ads. Rakuten is improving seller visibility and branding on the platform. It is also offering a 1-percent rewards program that allows customers to pay for their future order with points.

I like the idea that merchants can build and embellish their brands within Rakuten’s marketplace. This can be done within eBay, too, but the look and feel is dictated by eBay. The other marketplaces all control product and store content closely.

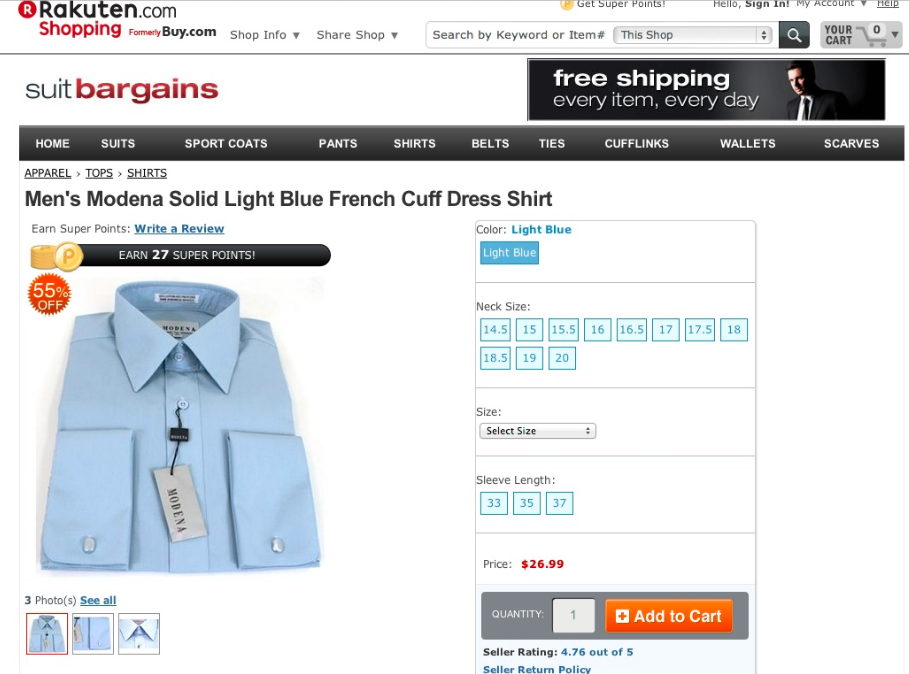

Rakuten “suit bargains” product detail.

Rakuten also offers tools that allow participating merchants to promote products and stores within the marketplace search results, home page, and category pages. Other marketplaces do not freely allow this.

If you sell niche products, you could likely be successful in any marketplace. With niche items, you can better control margins, leverage the larger volume of traffic, and, with Amazon and Sears, use the fulfillment services. However, none of them encourage you to build your own brand and communicate with your customers. Most prohibit that practice altogether.

I appreciate the Rakuten vision that merchants should control their own brand and merchandising. The thought of being able to leverage your customer list for a direct promotional emailing from the marketplace itself is appealing, recognizing that feature is not yet available in the U.S.

The main drawback to Rakuten relative to the other marketplaces is overall traffic. It is less than 1 percent of Amazon, for example. But, Rakuten’s 1.5 million unique visitors is much more than most merchants receive directly.

The other drawback is Rakuten’s $.99 fee per item. That makes it tough to sell lower-priced items there.

General Marketplace Tips

Read the details on any marketplace before selling products there. Understand what you must do and what you cannot do. Review the data feed requirements. Research pricing policies and the price points you will need to target to achieve sales. Understand the inventory requirements.

Review the tools that are available for order management and fulfillment. Many of the marketplaces listed in this article integrate with third party order management systems.

Don’t expect to be immediately successful in any marketplace. Most will introduce your products into their merchandising feeds slowly. The more unique your product, the more likely you are to be found sooner rather than later.