With Mexico’s reputation for unrelenting poverty and crime, it’s difficult to think of the country as a good place to do business. Yet, with a population of 122.3 million and a middle class of 47.9 million — 39.2 percent of the population — according to El Instituto Nacional de Estadística y Geografía (National Institute of Statistics and Geography), Mexico could be a hospitable market, especially for an ecommerce business that does not have to be physically present.

The Stats

The third largest Latin American ecommerce market after Brazil and Argentina, Mexico is expected to see increased sales of 150 percent between 2013 and 2018, from $2.2 billion to $5.5 billion, according to a Forrester Research study, “Latin America Online Retail Forecast 2013 to 2018.” The report predicts that the number of Mexican online buyers will increase 114 percent — from 8.4 million in 2013 to 18.0 million in 2018.

The report predicts that the number of Mexican online buyers will increase 114 percent — from 8.4 million in 2013 to 18.0 million in 2018.

Research firm eMarketer had a more optimistic assessment, pegging the value of online products or services sold outside the travel category at $3 billion in 2013. However eMarketer sees sales reaching only $5.1 billion in Mexico in 2017. Travel — in the form of bus and airplane tickets — rather than physical goods, comprise the majority of Internet sales currently, about 36 percent, according to eMarketer. Intangibles are usually the first items consumers feel comfortable purchasing in burgeoning ecommerce markets.

Young consumers usually drive ecommerce in developing countries and Mexico’s population has an average age of 28. However, in 2012, only 47 million Mexican citizens were Internet users according to Asociación Mexicana de Internet A.C. (Mexican Association of the Internet).

Wealthier Mexicans have a taste for luxury goods and total sales of designer clothing and footwear reached $685 million in 2012, according to research firm Euromonitor. Luxury accessories garnered $294.3 million in sales. While much of the purchasing takes place in brick-and-mortar stores in large cities, online shopping is gaining an audience. The three largest cities in Mexico — Mexico City, Guadalajara, Monterrey — account for more than half of online sales.

Mobile penetration in Mexico is high at 86.7 percent and the preferred mobile operating system is Android with 62 percent market share. Mexican smartphone users purchase three times more than users with other devices on average, according to communications solution provider Ericsson.

Opportunities for U.S. Ecommerce Merchants

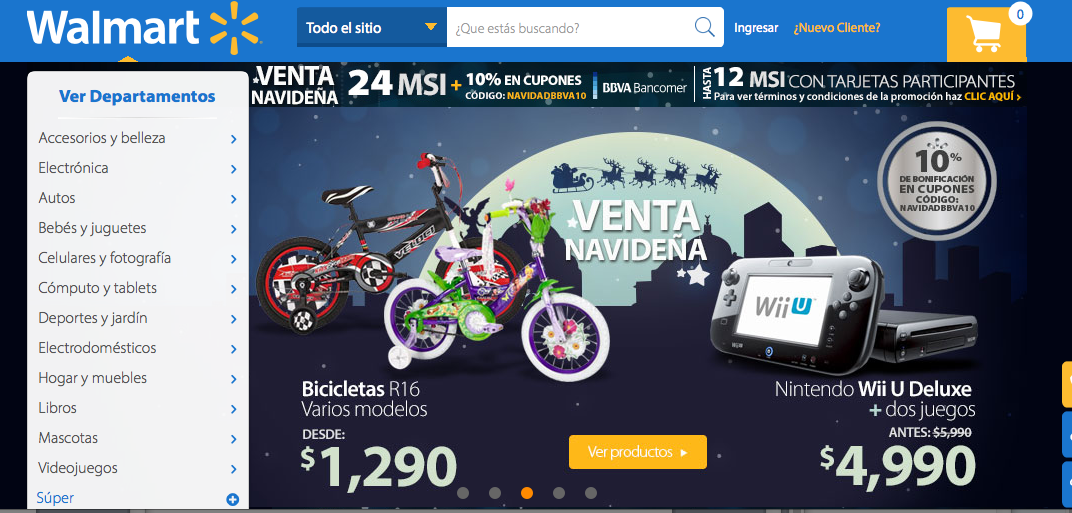

Unlike China and India — see “Ecommerce in India Takes Off; Potential for U.S. Sellers” — Mexico has few homegrown online shopping sites. Large American retail chains that have a brick-and-mortar presence have seen an opportunity to leverage their visibility. Walmart was the first to go online, offering a localized ecommerce option early in 2013. Home Depot and then Lowe’s followed with their own localized sites later in the year.

Walmart offers same-day delivery to its Mexican customers, a strategy that has allowed the company to dominate ecommerce in Mexico. Ninety-two percent of Mexican online physical goods purchases are from either Walmart or its local subsidiary, Superama, according to International Business Times. In contrast to the United States, where its customers are mostly working class, in Mexico Walmart appeals mostly to a wealthier demographic, households with incomes greater than $3,000 a month. Walmart also benefited from the fact that while Amazon has a presence in Mexico, it sells only Kindles and ebooks, not groceries. Additionally, local supermarkets do not offer online sales.

Local Mexican sites focus on small niche markets. For instance, Growlers is a site for ordering domestic and imported beers that are delivered to the customer’s door. Petsy.mx sells pet food and pet care products.

Challenges to Mexican Ecommerce

- A large percentage of Mexico’s population does not have bank accounts.

- Mexico has very low credit card penetration. Debit cards are much more popular but do not accommodate foreign money transfers.

- An inconsistent distribution network discourages some people from shopping online although the big cites have fewer problems.

- A localized Spanish website is necessary.

- A primitive financial system and the lack of modern technology in the payment industry in Mexico poses an impediment for merchants. Basic features like reconciliation and chargeback notifications have not been fully developed, according to allpago, a payment gateway provider. Not all credit cards can process foreign currencies. The Mexican government is constantly monitoring the payment system to identify money-laundering schemes.

Cash Economy

The most popular payment methods are cash and cash on delivery, followed by credit cards. Cash payments are done through convenience stores. The buyer chooses the convenience store payment method online, fills out the checkout page, and prints a voucher containing a barcode. The customer goes to the store, presents the voucher, and pays with cash. Oxxo is a convenience store chain with over 11,000 stores across the country and it is the cash payment leader. PayPal is just starting to gain momentum in the Mexican market.

Recommendations for Entering Mexican Ecommerce Market

- If you establish a localized site but will be shipping products from the United States, consider partnering with a cross-border logistics provider. Some, like Estafeta, offer warehousing services.

- Many niche consumer markets such as the one Petsy.mx, the pet care retailer, is targeting, are underserved in Mexico. If your products match such a need, jump in now and get first-mover advantage.

- If your market is more broad-based, you may wish to wait a year or so before getting into the market. The Mexican government is trying to make the payment structure friendlier to online merchants and logistics are being improved as well.