With 2011 winding down, we recently asked an ecommerce merchant to recap his company’s accomplishments for the year. The merchant is Chad Weinman, founder and CEO of Cat5 Commerce, which operates 10 separate online stores — including RunningShoes.com and TacticalGear.com — from its base in Missouri.

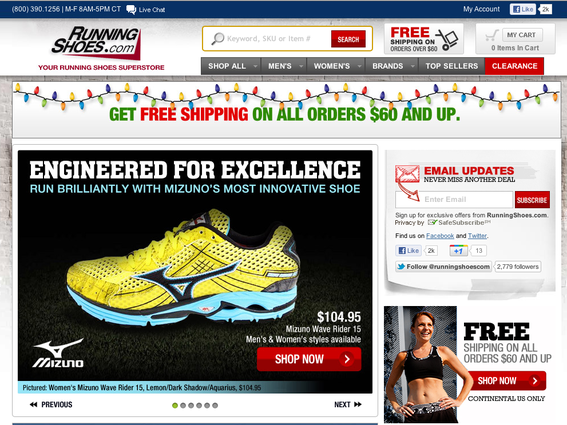

Weinman is an ecommerce pioneer, having founded the company in 2004 with a single store. Fast forward to 2011 and Cat5 Commerce records roughly $12 million in sales — a 50 percent increase over 2010 — all from a customized, single-administration shopping cart platform. His acquisition earlier in 2011 of the domain “RunningShoes.com” set an apparent record for its $700,000 price, which we discussed with him then, in “Domain Name ‘RunningShoes.com’ Sells for $700,000.”

Practical eCommerce: You operate 10 separate ecommerce stores. How was 2011 for Cat5 Commerce?

Chad Weinman: “2011 was a positive year for us overall. Certainly from a growth perspective, we achieved a lot of the goals that we had set at the beginning of the year. The economy was not as strong as it could be over the past few years. So I think that we’ve certainly endured those effects, but generally, as far as our expectations were concerned, we have met our objectives. “

PEC: Did you have an increase in same-store sales from 2010 to 2011?

Weinman: “Yes. We did enjoy an increase in same-store sales by-in-large. Our company is focused on growth and revenue beyond anything else. Profitability is really a secondary factor for us at this point. We have an eye on the future and we have a larger business in mind as we kind of develop our processes and build out our infrastructure. We’re always doing it with a higher revenue business in the back of our minds; that’s really something we’re focused on. Six of our ten stores are concentrated in one market: military and public safety; those stores trade customers between themselves and cannibalize each other’s sales, depending on what kind of marketing efforts we’re doing. So, same-store sales can vary, but generally that market and that category is definitely up for us through the course of the year.”

PEC: To help our readers understand the size of your company, what was 2011 gross revenue versus 2010?

Weinman: “In 2010 we were doing around $8 million in sales, and in 2011 the number is going to be closer to $12 million. I’m referring to ‘pre-return’ numbers — footwear retailers experience heavy returns. But the period between 2010 and 2011 has probably been one of our more substantial in terms of growth so far. So we’re pretty proud of that.”

PEC: That is tremendous growth. Congratulations.

Weinman: “Thank you. When you’re smaller I think it’s easier to hit those kinds of double digit growth figures as you try and participate in new markets and identify opportunities in them. It would probably be unrealistic for us to expect to sustain 50 percent growth year over year, every year. But generally we’ve been kind of chugging along since we started; so far so good.”

PEC: You launched the company in 2004. Is that correct?

Weinman: “Yes, 2004, in the spring, we launched our original store, which is BDU.com. Since then we’ve focused on that market dramatically for a number of years before we got into any new markets, which we have done just this past year.”

PEC: That original market being military and law enforcement, for the most part.

Weinman: “Yes, military law enforcement, public safety — which is a pretty broad market — and even between military and law enforcement, those are certainly different buyers and different professions, and even though there’s a lot of crossover with suppliers, brands, equipment, and clothing, we market to those niches independently. We treat them as separate verticals.

“We launched two flagship superstores this year with the purpose of segmenting those two markets, where previously our original store, BDU.com, was designed to appeal to both. I guess we felt like we were alienating one or the other. While from a business perspective we grouped them together from an end user perspective — military law enforcement and public safety are definitely different customers for us.”

PEC: Cat5 Commerce operates ten stores. How does it manage the back end in terms of the platform, order fulfillment, accounting systems, that sort of thing?

Weinman: “We have developed a proprietary ecommerce platform that allows us to manage all ten stores from one central point of administration. So, for example, if we load a pair of pants in a particular brand into the database, we only do that one time, and then we can make that pair of pants available on any of the properties that we operate.

“From an efficiency perspective, certainly that’s ideal, and it allows us to take the same brands and the same suppliers and market them in different ways depending on what stores we have the products ending up on. Outside of that proprietary platform that’s on the front end, on the back end we use common and conventional order management tools that are third-party off-the-shelf tools. We use Stone Edge Order Manager to do back-end order fulfillment, order management, and warehouse management. We use QuickBooks for accounting and financial record keeping.”

PEC: How many employees do you have?

Weinman: “I think we’re just over 30 at last count. This has been a year of hiring for us. We were nowhere near that just 12 months ago, so the office is definitely a little more crowded lately.”

PEC: Is the holiday season important for the public safety and military-law-enforcement markets?

Weinman: “It certainly is. The end of September is definitely a big time for us because it’s the fiscal government’s year end, where lots of agencies have to make purchases to retain those budgets for the following year. Outside of that, generally speaking, the holidays — November, December — are definitely a big growth period for us. It’s a big influx of revenue. And certainly the stores like Running Shoes and Hiking Boots do well in those periods. But even the military law enforcement stores do as well. I think just generally fourth quarter is where most retailers see the majority of their revenue.”

PEC: Let’s discuss marketing issues. How do attract consumers to your sites?

Weinman: “There are some primary traffic drivers for us, which are search engine optimization, and pay-per-click and display ads. So I guess you can kind of wrap a lot of those up under search engine marketing.

“Display ads — I would include Facebook and retargeting efforts in that category — can certainly represent a percentage of our traffic, certainly return traffic, repeat visitors and loyal customers, that we’ve been serving since 2004. We do email marketing, which is a big component of our sales. It’s something that we’ve invested a lot into and that we think is probably one of the better return-on-investments in the business.

“We also use social media — Facebook and Twitter — to kind of engage with the communities that we participate in and be a part of the conversation in trying to capitalize on trends and current events.

“We don’t do really all that much traditional print media advertising or cataloging. We’ve done some of that in the past, but I think we gravitate to digital marketing initiatives, because they’re easier to track and are more aligned with who we are as a retailer.”

PEC: What about comparison shopping sites?

Weinman: “We do marketplaces — eBay, Amazon — but shopping engines we’ve played with in the past and have had limited success with them. It seemed like the management of it was not worth the traffic that we were receiving. But certainly Google’s shopping engine, which is free, we participate in. That’s a no-brainer for any online retailer to get involved with. And then affiliate marketing we’ve avoided since day one. It’s never really been part of our model.”

PEC: What is the best way for ecommerce merchants to use social media? Is it to actually sell products on those platforms?

Weinman: “Honestly, we’re trying to figure that out — a lot of other retailers are as well. I’m not sure that there’s a clear path or a precise value that you can put on social media efforts as far as how they translate directly to revenue. We’re experimenting with it. We try different mixes of content that is less sales oriented to content that is more sales oriented, to try and engage how our followers react to it. If nothing else, it’s an outlet for customers to communicate with us, maybe they’re more comfortable communicating with Facebook or Twitter, so we give them that option.

“Certainly from an SEO perspective, there’s a lot of schools of thought that suggest that Google, Yahoo! and Bing use social signals to determine rankings. So how popular you are on Facebook or how many times you’re mentioned or what kind of engagement you’re getting on social platforms can affect where you’re showing up in rankings So from that perspective, it’s easy for us to justify investing in social. But I think it allows us to participate in the industry and just kind of make sure that we’re keeping aware of trends and what customers are looking for.”

PEC: Another segment of your business is RunningShoes.com. When we last spoke, you had just acquired that domain name for $700,000. How has that acquisition worked out?

Weinman: “In general we’re as optimistic about it as we have ever been. The purchase price for the domain was pretty high. We’ve had a lot of conversations about that and we’ve talked with a lot of third-parties that were interested in that transaction and whether or not we can justify the expense. When we bought it, it ranked number one for the term ‘running shoes,’ which is a massive keyword for our industry. There’s a lot of value there. Since Google’s Panda update, the ranking has dropped. It’s still in the top ten, but it’s closer towards the middle of the pack on that first page. It’s to be expected that you’re not going to lock down top positions indefinitely without a lot of effort and momentum.

“The transition period for us to get acclimated with that new industry — to get everything migrated over, to forge relationships with the partners and the suppliers that are in that industry — took time. We paid the price in terms of revenue and rankings in making that transition. But things have settled down since then and we have a really firm business plan and a path. We’ve learned a lot about the industry. It’s going well. It’s teaching us a lot about online retail in the sense that military law enforcement was much less competitive than running shoes and hiking boots are.

“We also operate HikingBoots.com. So, when you’re going up against competitors like Sports Authority and REI — well-financed businesses and successful companies — they raise the stakes. We’ve had to elevate our game accordingly to compete at that level. It’s made us a stronger company and all of our sites have benefited from that challenge.”

PEC: Knowing what you know now, would you do that $700,000 transaction again?

Weinman: “Yes, absolutely. I feel like the economy sort of presented us with a very unique opportunity to acquire that domain. And without it we would not have been in a position to get into athletic footwear, which is a very competitive and a very controlled market. The major keystone suppliers do not like to open pure play online retailers, unless they have a really compelling reason to do so. So, without that premium domain name and without a history of business that came along with that domain name, and without the ranking that came along with that domain name, I don’t know that we would have been able to enter this market. We got really lucky.

“To re-create what we did and to say ‘I want to get into hiking boots’ or ‘running shores’ as an online retailer would be incredibly difficult, just because of the people that you have to convince to give you a chance. So that gave us that edge, and I’m not sure that we could re-create it without having made that transaction.”

PEC: Let’s discuss 2012. What do you hope to accomplish with Cat5 Commerce during the next year?

Weinman: “For 2012, we are committed to building out the existing ten properties that we are operating, and focusing on making those stores as strong as they can be. Previously we were pursuing the model of opening a lot of new stores and getting involved in a lot of new markets. But that model was based on a search engine, Google that was easier to rank for, to achieve results in. Google has really made it much more difficult to penetrate rankings without having kind of an established history and a recognizable brand.

“Trying to build a recognizable brand and trying to have an established history is a lot of work. It takes time, in some cases there’s just really nothing you can do but be patient. And so, as a result of that, we don’t feel like continuously opening new stores is the direction we want to keep going in. We instead are looking to build the brands that we already have and just to make them as successful as we can. Fortunately, we feel like each of the ten brands that we operate has a tremendous amount of potential — some more than others — and that there’s enough work to be done there to take us to revenue levels that we would ultimately be comfortable with five years from now.”

PEC: Anything else on your mind about 2011 or going into 2012?

Weinman: “Focusing on one brand or a handful of brands and making them as successful as you can as an entrepreneur is the right path forward to build customer loyalty, to build brand recognition and brand equity, to invest in your specific niche. Doing it better than anybody else is really the best way to go. Make sure that you have a value proposition and some kind of edge that gives people a reason to gravitate toward your business — versus one of your competitors.

“Mark Zuckerberg, the Facebook founder, recently was interviewed on 60 Minutes. He said that no division of any company could compete with a capable entrepreneur. I subscribe to that wholeheartedly. Somebody who’s passionate and focused and driven to accomplish something in a very specific area is going to be able to do that — and be nimble enough and flexible enough to outmaneuver a much larger company. That’s something that we take to heart. It’s a motto that any small business can live by.”