This is the third installment in a series where I help you understand your credit and debit card fees. In last month’s article, “Understanding Credit Card Fees, Part 2: Merchant Account Fees and Charges,” I discussed the various monthly and annual fees charged by merchant account providers. I explained what the fees are, if they are legitimate, and why the merchant account providers charge them. In this installment, I identify two important interchange rates you may see on your monthly merchant statement.

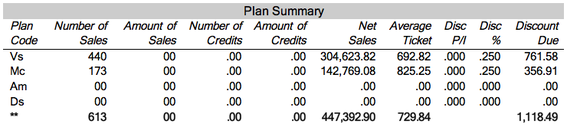

Below are two sections of a typical statement for merchants on an “interchange plus” pricing schedule. The first is the “Fees” section and the second is the “Plan Summary” section of the merchant statement. Merchants on this pricing plan see the actual sales volume for each card type used. Merchants on a tiered pricing plan pay similar fees, but they are harder to monitor than on “interchange plus” pricing.

Merchant Account Statement – "Fees" section.

Looking at the “Fees” section above, on the first line, 7 transactions for a total of $1443.01 in sales were made by customers using their MasterCard Enhanced cards (one of many MasterCard cards issued by banks). “Merit 1” is MasterCard’s terminology for a card-not-present/ecommerce sale. (Visa and Discover use the term “CNP, “Card –Not-Present”, or “eCommerce”.) The interchange rate — the portion that goes to the bank that issued the customer’s card — was 2.04 percent + 10 cents, which totaled $30.14. MasterCard charges a “NABU” fee (third line from top) of 1.85 cents per transaction. (Visa and Discover have similar fees. The Visa fee will be stated as an “APF fee” and Discover’s terminology is “Data Usage” fee). In addition, MasterCard charges a “Dues and Assessment fee” — see eighth line from top, which at the time of this statement was 0.095 percent. MasterCard has since increased this to 0.11 percent. (Visa also charges a 0.11 percent “dues and assessment fee” and Discover charges a 0.10 percent fee).

Merchant Account Statement – "Plan Summary" section.

The merchant account provider’s mark-up is 10 cents (third line from bottom in “Fees” section) + 0.25 percent (see “Plan Summary” section, second column from right – “Disc %”). So the merchant ended up paying (2.04 percent + 10 cents) + 1.85 + 0.095 percent + 10 cents + 0.25 percent = 2.385 percent + 21.85 cents for each sale where the customer used a MasterCard Enhanced card.

As you can see below, each card has a different interchange rate. For example, the MasterCard “Merit 1” — meaning this was a basic MasterCard processed as a card-not present/ecommerce — card is 1.89 percent + 10 cents and MasterCard World card is 2.05 percent + 10 cents.

As a merchant, you cannot control which card your customer uses. However, you may be able to control two fees that are not “card types” but instead possible procedural or system issues. These fees are “EIRF” and “Standard.”

EIRF (Electronic Interchange Reimbursement Fee)

Note the “Visa EIRF” fee fourth line from the bottom of the first table, above. “EIRF” is a Visa-only interchange rate.

EIRF means the merchant did not meet all the requirements when processing the transaction(s). Therefore, the merchant is forced to pay a higher EIRF rate for the transaction(s). Both Visa debit cards and credit cards can be charged an EIRF interchange fee. I have not yet seen the post-Durbin Amendment EIRF rate for debit cards. However, the credit card EIRF interchange rate for ecommerce merchants is 2.30 percent + 10 cents. This is 0.50 percent higher than the 1.80 percent + 10 cents interchange rate for a basic Visa credit card.

The important thing to understand if you see “EIRF” on your statement is that you may have an issue with your order entry procedures or system. The most common reason why ecommerce merchants are charged the “EIRF’ rate is because they did not obtain the address verification information — ZIP code/address registered for the credit card used — correctly at the time of sale. It is not uncommon for ecommerce merchants to have a few EIRF charges each month because some cardholders used a ZIP code or address not registered to the cards in use. However, you should contact your merchant account provider if more than 5 percent of your credit card volume is EIRF. Review your set up and order entry procedures with your provider to determine what is needed to eliminate excess EIRF fees.

You will not see the “EIRF” term if you are on a tiered — qualify, mid-qualify, non-qualify — pricing schedule. I do not believe any ecommerce merchant should be on tiered pricing. This is not just because the merchant probably pays too much, but because the tiered pricing schedule masks important information such as “EIRF” downgrades. EIRF transactions are bundled into the non-qualifying rate level for tiered pricing and it is not uncommon for merchants to be surcharged 2 to 4 percent at that level instead of just the interchange difference. I recommend merchants on a tiered pricing schedule review all non-qualifying transactions with their merchant account provider every third statement to determine the reasons for the non-qualifying rate and determine if any of them can be eliminated or reduced.

Standard

Note in the first table above, fifth line from the bottom, “Visa Bus Std” at an interchange rate of 2.95 percent + 10 cents. Unlike “EIRF,” “Standard” applies to both Visa and MasterCard transactions and is not just one interchange rate but can be applied to a number of card types. There can be “World Standard,” “World Elite Standard,” “Signature Preferred Standard,” “Business Standard,” and others. The “Standard” interchange is more punitive than EIRF and is generally in the 3 percent range, but varies by the card type.

Standard, like EIRF, means the merchant did not meet all the requirements when processing the transaction(s). Generally, the transactions were not settled within two days of the sale. However, for business cards it can also mean that all the information needed to obtain the lower business card level II rate was not obtained. Merchant should review standard charges with their merchant account provider to determine if any changes can be eliminated or reduced.

As with EIRF transactions, Standard transactions are bundled into the “non-qualifying” level for merchants on a tiered pricing schedule. Here again, merchants should review the specific reasons transactions are downgraded to the non-qualifying level with their merchant account provider.

Summary

Ecommerce merchants should understand the following points.

- Many interchange rates. Each card type has its own interchange rate and merchants cannot dictate which card their customers use.

- “Interchange-plus” more transparent. Merchants on “interchange plus” pricing can see exactly what cost goes to the issuing bank, the card associations, and the merchant account provider.

- Eliminate or reduce fees. The merchant may be able to eliminate or reduce some EIRF and Standard fees.

- Tiered-pricing less transparent. Merchants on tiered pricing cannot see the critical details but should review non-qualifying charges with their merchant account provider quarterly.