Non-fungible tokens are a hot topic. Some claim that NFTs are the future of artwork and that the next Vincent van Gogh will be a computer programmer. Many see NFTs as viable, profitable investments tailored for younger, digitally savvy buyers. Detractors wonder if NFTs are a short-term novelty.

In this post, I’ll describe NFTs and how they are created, purchased, and sold.

Non-fungible Tokens

An NFT is two things. First, it’s a unique digital asset created and traded via blockchain technology. Second, it’s proof of authenticity. Thus an NFT is a digital property and evidence that it’s not fake or counterfeit.

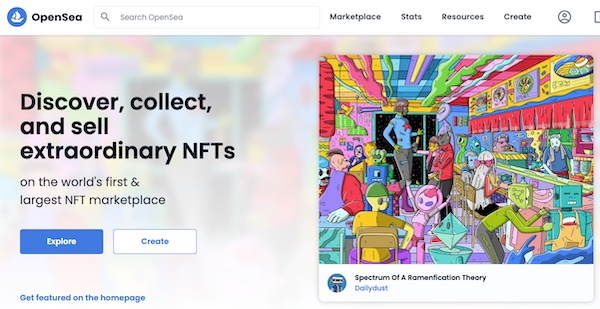

Specialized trading platforms such as OpenSea facilitate the buying and selling of NFTs.

An NFT can be most anything digital, such as art, images, videos, music, memes, and tweets. The process of creating NFTs is “minting,” similar in concept to metal coins that are minted (stamped) to confirm their legitimacy. Minting an NFT produces a one-of-a-kind token on the blockchain and an electronic certificate of authenticity.

Digital assets such as GIF images and MP4 videos are easy to copy and distribute. Buyers need to know the seller is the legal owner and the asset is original. Blockchain technology validates both by storing a record of who created the NFT and each subsequent transaction. These records cannot be forged because they reside in a digital ledger on thousands of computers across the internet. A hacker may falsify one record on one computer but not on all the worldwide computers that host the blockchain.

“Fungibility” in economics means a good is interchangeable. Examples include commodities, currency, and common stocks. Thus a non-fungible good is not interchangeable. It’s unique — one of a kind.

Creators and traders of NFTs profit from supply and demand. Creators limit the supply of NFTs while attempting to increase demand via social media, traditional media, and trading platforms, such OpenSea, Rarible, CryptoPunks, NBA Top Shot, and CryptoKitties.

Example Transactions

- “Beeple,” a computer graphics artist, sold a digital collage called “Everydays: The First 5000 Days” for $69 million in March 2021.

- A randomly generated pixelated image of an animated face, called “CryptoPunk #7523,” sold for $11.8 million in June 2021.

- Sir Tim Berners-Lee created and sold an image of his original computer source code for the World Wide Web for $5.43 million in June 2021.

- An NFT representation of the first tweet created by Twitter’s founder and CEO Jack Dorsey was sold for $2.9 million in March 2021.

NFTs, Cryptocurrency

As I write this, the only way to purchase an NFT is with a cryptocurrency. Both use blockchain technology. One can acquire crypto with cash or credit cards and then use it to purchase NFTs. But, in the end, buyers of NFTs must use a cryptocurrency.

Most NFT traders are crypto investors. Requiring cryptocurrency for NFT purchases is wise for those investors as it increases widespread adoption, increasing demand and value.

Time will tell if NFTs are sustainable, viable investments, or a fad. In the meantime, my advice is caveat emptor — buyer beware.