Inflation is on the rise. Hordes of retailers are raising prices and frustrating shoppers without exploring alternatives.

Before increasing prices, a company should consider its business model, product mix, market position, and overall productivity.

In the end, a price increase might be necessary. But if it can find new opportunities, a business could buck the inflationary trend and even gain profit.

Inflation

Prices for everything appear to be on the rise in the U.S. Last week, the U.S. Bureau of Labor Statistics released its Producer Price Index for February 2022, reporting wholesale prices had moved up 0.8% for the month. For the past year, wholesale prices have shot up 10%.

Materials, finished goods, and even labor costs are rising, and businesses are starting to react.

The National Federation of Independent Business, a free-market advocacy group, reported that 79% of American retailers surveyed last month had increased prices. Price hikes are not surprising but could be unnecessary.

Oded Koenigsberg, deputy dean and a professor of marketing at London Business School, described the dilemma succinctly in a Harvard Business Review article.

“The classic response to inflation is to select one of three unattractive options. Managers can upset their customers by raising prices, upset their investors by cutting margins, or upset practically everyone by cutting corners to cut costs,” Koenigsberg wrote.

Alternatives

What if merchants didn’t have to boost prices to remain profitable?

Koenigsberg is one of many who believe the problem of inflation may represent an opportunity for businesses to improve.

Adjust the business model. Not all ecommerce or retail business models are equal in the face of rising inflation. The current market might be a great time to extend or update how a given business earns a profit.

For example, direct-to-consumer brand Italic supplements ecommerce sales with membership revenue. It uses the same factories as the spendy brands to manufacture apparel and home goods but sells them for less. And it offers a $60 per year membership for exclusive access and support.

Another example is FloorFound, a recommerce business. The company collects oversized returns such as furniture from other retailers. It then inspects those items and resells them, helping the original retailer reduce costs and recover revenue.

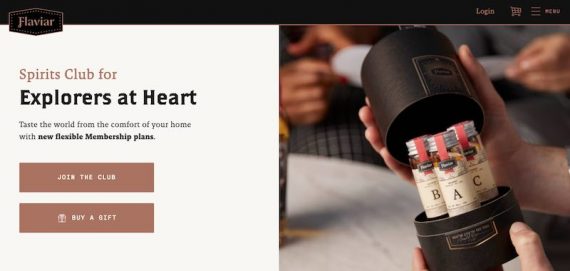

Flaviar is a liquor discovery subscription. It shares spirits via themed “tasting boxes” and provides subscribers access to allocated inventory and co-created whiskeys, gins, and vodkas.

For that matter, consider Shopify. The company started when a couple of guys tried to create an ecommerce snowboarding shop and now makes around $3 billion in annual revenue.

Flaviar sells subscriptions to “tasting boxes” of whiskeys, gins, and vodkas.

Update the product offering. Ask if your business is selling the right products for the current, inflation-infected market and consider updates that do not raise consumer prices.

Merchants might cut underperforming SKUs, add private label products, bundle items to add value, or reduce quantities to keep prices stable — think an 8-ounce package instead of a 10 ounce.

Modify market position. Here the aim might be to shift from one market to another.

Consider a small DTC start-up brand as an example. Fiber Sports started by making an injection-molded armor for hockey stakes but pivoted to industrial footwear to find a much larger market.

Increase productivity. Boosting productivity can be an alternative to raising prices and does not necessarily mean cutting corners.

An increase in productivity could result from automation, marketing optimization, hiring remote workers, or using a third-party fulfillment service to position products nearer to customers.

Prices May Still Rise

Despite its best efforts, a company may still have to raise prices due to inflation. But here, too, could be an opportunity.

Consider combining the price increase with one of the strategies above.

For example, Koenigsberg, the marketing professor, noted some businesses that had competed on price could have undervalued products. Those companies could raise the price and the prestige of the product, selling at something near full value.