Lower-priced private-label brands have long been a mainstay of large U.S. grocery chains and even more popular over the past two years owing to large increases in food prices.

As a result, U.S. grocery store brand sales in 2022 rose 11.3%, almost double the growth of national brands, according to the Private Label Manufacturer’s Association.

Private-label goods are also popular in Europe, especially for groceries. In Western Europe, private labels have a penetration rate of 40%, with Central and Eastern Europe coming in at 30%, according to Statista. Shoppers in the U.K. are particularly avid private-label purchasers.

But consumers’ acceptance of store-brand groceries does not translate to other retail products. Quality, or the perception of quality, matters for those items.

Following are stories of retailer success and failure.

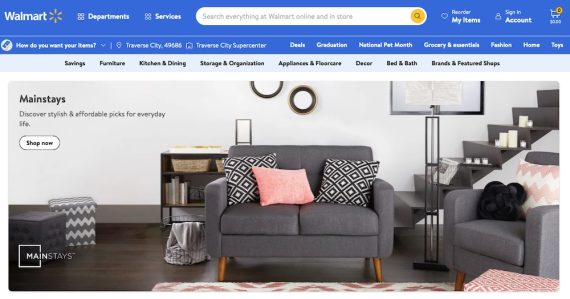

Walmart

The retail behemoth has been selling private label brands, mostly in its grocery line, for over 30 years. Great Value (household essentials) and Equate (health and personal care) are two of its most popular. It also sells a robust selection of apparel, toys, and other items.

All told, Walmart has roughly 300 private label brands across 20 categories and 29,000 products, including:

- Mainstays. Bedding, kitchen utensils, home furnishings.

- Time and Tru. Women’s clothing, shoes, accessories.

- Wonder Nation. Infants, toddlers, older kids.

- Home Trends. Furniture, appliances, home décor.

- EverStart. Batteries and accessories from Johnson Controls and sold only at Walmart.

Amazon

Estimates vary widely on the number of Amazon’s private-label products. In response to questions from a Congressional committee in 2019, Amazon revealed it offered 158,000 private-label products.

Earlier this month, EcomCrew, a podcast and blog, estimated Amazon had 88 in-house brands. Amazon Basics account for about 58% of all Amazon private label sales worldwide, according to Statista.

Among the top brands are:

- Amazon Basics. Batteries, kitchen, office, pet, bedding, storage, travel, music, audio.

- Amazon Essentials. Clothing.

- Amazon Basic Care. Health and personal care.

- Amazon Collection. Jewelry.

- Amazon Elements. Supplements.

- Amazon Aware. Carbon-neutral products.

- Solimo by Amazon. Food, health, baby, beauty, supplements, household items.

Many Amazon marketplace sellers have accused the company of competing with them by using their sales data to find the most popular products and then manufacturing them. Amazon has denied these claims and stated that private labels make up less than 3% of overall sales.

However, in 2020, the European Commission accused Amazon of using its clout and data to compete with merchants using its platform and threatened to take action against the company.

Last July Amazon announced plans to reduce the number of private brands, citing weak sales. The move could lower the number by as much as 50%, per The Wall Street Journal.

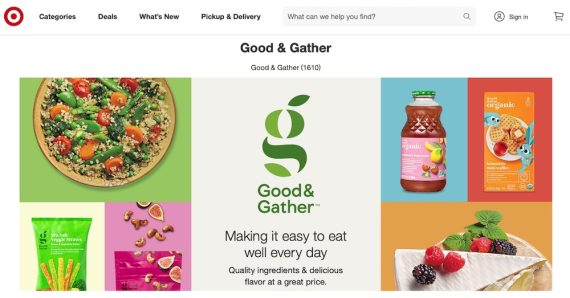

Target

Target’s private-label brands are among the most successful of leading retailers. It started with groceries and then moved to apparel. Target is known for quality, and its “cheap chic” image is popular with younger consumers. It has 48 private brands in various categories and intends to expand this year. Ten of them have sales of at least $1 billion. Roughly 15% of Target’s revenue for grocery, household, and health and beauty items comes from its own labels.

Among the most popular are:

- Market Pantry, Good & Gather. Food.

- A New Day. Apparel.

- All in Motion. Activewear

- Made by Design. Housewares, luggage.

- Up & Up. Personal care

Bed Bath & Beyond

Not every private label initiative is successful. In 2019, struggling Bed Bath & Beyond hired Target’s chief merchandising officer Mark Tritton as CEO to spearhead a turnaround. Tritton quickly implemented a private label strategy, cutting back on national brands. This proved unsuccessful as the chain’s customers preferred name brands. Some analysts suggested the company did not allocate sufficient resources to the concept.

Even in inflationary times, private labels require a good deal of work.