Walmart’s ecommerce sales grew 23 percent in the fourth quarter 2017. Despite this, its stock dropped as analysts expected more.

Last month the Department of Commerce announced its estimate of U.S. retail ecommerce sales for the fourth quarter of 2017. The Department issues two sets of figures. One is seasonally adjusted, and one is not.

Non-adjusted ecommerce sales for the fourth quarter were $143.1 billion, an increase of 33.7 percent over the third quarter of 2017 and 16.8 percent over the 2016 fourth quarter. In contrast, total retail sales — online and brick-and-mortar — increased 5.3 percent over the fourth quarter of 2016. Ecommerce comprised 10.5 percent of total 2017 retail fourth quarter sales.

For the full year, total ecommerce sales came to $453.5 billion, an increase of 16 percent over 2016 on a non-adjusted basis.

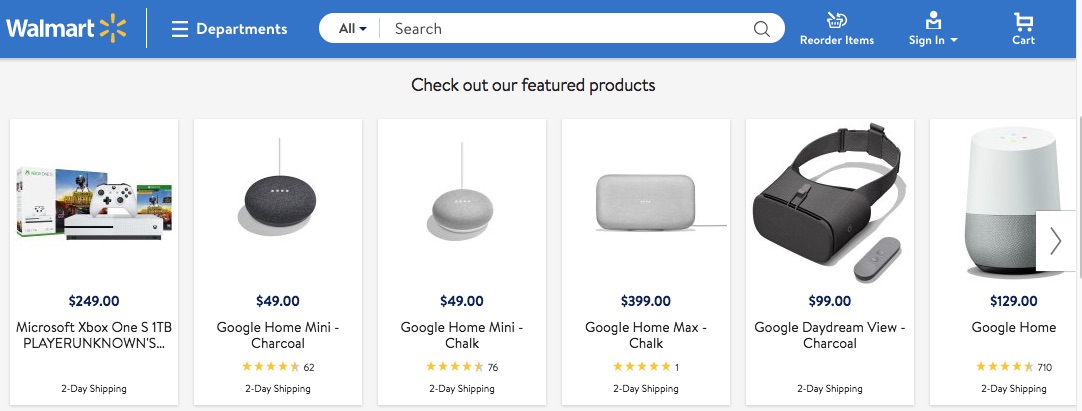

Walmart

For most companies, quarterly ecommerce growth of 23 percent would be cause for celebration. But not for Walmart. Its stock dropped after it announced fourth-quarter financials that fell below analysts’ expectations.

Walmart’s stock fell 10.2 percent, its biggest single-day percentage drop in 30 years, taking about $30 billion from its market cap. The company’s fourth-quarter growth rate for online sales slipped from 50 percent growth in the third quarter of 2017. The results include revenue from Jet.com, which Walmart acquired in August 2016.

The consensus is that the drop in value has less to do with Walmart’s holiday ecommerce performance and more to do with its perceived failure to put a dent in Amazon’s dominance.

For the full year, Walmart’s ecommerce sales shot up by 44 percent to $11.5 billion, contributing roughly 3 percent to total U.S. ecommerce sales. In contrast, Amazon contributed roughly 44 percent ($199 billion) of all U.S. ecommerce sales last year, and about 4 percent of the country’s total retail sales figure, according to One Click Retail, an ecommerce analytics provider.

Walmart earned $1.33 a share during the fourth quarter, falling four cents short of analysts’ estimates. Additionally, the company’s gross margins decreased during the fourth quarter due to promotional activities.

Although Walmart increased its minimum wage to $11 an hour at the beginning of 2017, it also announced the closure of 63 Sam’s Club stores and layoffs of thousands of employees at headquarters and stores.

Walmart’s 2018 Plans

After all the hoopla about acquiring Jet.com, Walmart in 2018 will focus on lower-income, lower-cost customers who will buy goods on Walmart.com, not Jet.com.

The company will focus on selling groceries online to the core Walmart customer and plans to double the number of stores, to 2,000 locations, where groceries can be ordered online and picked up curbside.

In the earnings call last month, C.E.O. Doug McMillon stated, “The cost to acquire a new customer on a nationwide basis is cheaper with the Walmart brand, so we’ve been investing more in Walmart.com on a national basis and reducing marketing investment in Jet, except in certain urban markets. Due to this change, Jet will not grow as quickly as it did in early days but it will be well positioned where we’ve chosen to focus the brand.”

McMillon is predicting a 40-percent ecommerce growth rate for 2018.

To bolster its offerings, Walmart this week announced that Sam’s Club is partnering with Instacart to provide same-day delivery of groceries starting March 1 to counter Amazon’s similar service. Initially, the service will be available only in Dallas, Austin, and St. Louis. Instacart customers will be able to shop without a Sam’s Club membership.

Amazon vs. Walmart

Several financial analysts have already declared that Walmart has lost the battle with Amazon. But it is too soon to declare Amazon the victor. Food and apparel are expected to be the product categories where the two companies will most aggressively compete. Walmart is trying to match Amazon in these areas.

Walmart also announced last month that it is launching four private-label apparel brands as it beefs up its clothing offerings both online and at its brick-and-mortar stores.

According to market research firm SimilarWeb, Walmart is focusing on search — with almost 48 percent of its online traffic in the last 18 months coming from organic and paid search. The company is also emphasizing referrals and is improving its referral conversion rates. Walmart is devoting substantial resources to increasing online sales.

Wall Street analysts seem to forget that while Amazon always had robust revenue, it took many years for it to become profitable. The lack of profits seldom affected Amazon’s stock price. Though it has about one-third the revenue of Walmart, Amazon has a higher market cap, at $700 billion vs. $310 billion for Walmart.

Walmart’s greatest challenge will be converting its core store customer base to online shoppers. If the company can do that, it could, in time, become a major online rival to Amazon.