My agency is often called on to do formal audits of Amazon seller accounts. In the last 12 months, we’ve audited more than a dozen small-to-medium sized accounts, from companies that sought improvement on how they sold on Amazon. All fell into surprisingly similar patterns, with common mistakes.

Compare your own situation against this list.

Neglected Brand Registry

According to Amazon’s Seller Central, the Amazon Brand Registry is a program for those sellers that manufacture or sell their own branded products.

It is surprisingly common for a small-to-medium sized business with their own products to not claim their own brand or know about this program. Businesses often put off registering because of the red tape involved, expedience trumped completeness as they first got up on Amazon’s platform, or they simply do not know about the program.

Brand registry comes with the exclusive right to edit one’s branded listings. Otherwise, the norm is that the first company who lists a product controls that listing.

Controlling the details on a listing allows you to make sure details are correct and the right benefits are emphasized.

This may be unusually important to your bottom line. Margins often differ across a product set offered by any seller on Amazon, with branded products usually have the highest margins.

Amazon Titles Not Optimized

Consumers search on Amazon using language that may or may not be consistent with the product titles in your database or on your website.

Your chances of appearing in the Amazon search results depend on many factors. One of them is how well your titles are resonant with Amazon searchers.

Some sellers have problems optimizing titles for technical reasons. Their Amazon titles may be automatically populated from website title fields with no opportunity to change or optimize them for the Amazon environment.

If that is your situation, find a way to inject an interim step in your procedures where you can include Amazon-appropriate titles. Because Amazon selling tends involve several departments in small-to-medium companies, including sales and distribution, marketing, and development, the solution may be as simple as distribution or marketing communicating the database need to your developers.

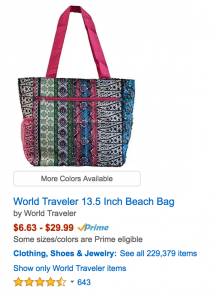

For example, say you sell a tote bag that consumers often use for trips to the beach. If “beach bag” is a term that consumers actually use in searches, title your product “beach bag” instead of “tote bag.”

If “beach bag” is a term that consumers actually use in searches, title your product “beach bag” instead of “tote bag.”

When optimizing, consider the point of view of the searchers. What terms would they use on Amazon to find your product? What does Amazon autosuggest as you start to type in searches about your product? Research what other companies are doing in your field, especially those successful on Amazon and even on Google Shopping.

An All or Nothing Mindset

Maybe you sell 15 products on Amazon. Maybe you sell 450,000.

Once your products number in the thousands, it is difficult to make sweeping changes across your entire set, to correct your file if an optional field is missing, or your titles are not well optimized for Amazon.

Too often this results in no updates made instead of a prioritized set of changes.

The 80/20 principle holds true for Amazon. A disproportionate amount (80 percent) of your revenue comes from your top (20 percent) products. Do not let perfect be the enemy of good: Prioritize your work and at minimum make sure your top revenue products have appropriate updates and benefits.

In restaurant ownership there is a saying: “It is easier to make a good Saturday great than to make a bad Tuesday good.” On Amazon, it is similarly true that exaggerating your wins beats pushing sales through marginal products.

Products with Bad Parent-Child Relationships

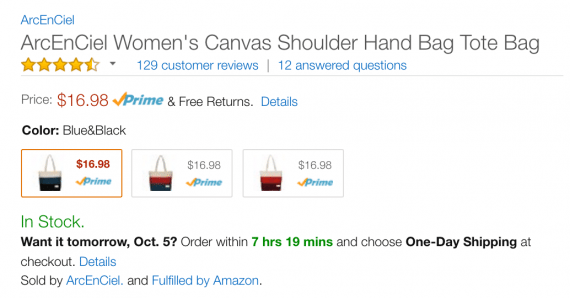

Proper parent-child relationships in Amazon product info allow you to sell to shoppers easier.

If someone finds your listing and has an interest in your product, there’s no need to leave your listing to find a different color or appropriate size if your parent-child relationships are set correctly. On mobile, where every additional thumb movement matters to a sale, this is especially important.

Because parent-child relationships are set correctly, all three color variations for this tote bag occur under one parent listing. An interested shopper does not have to leave the page to see color options.

Instead, businesses often list each variation of a product as a separate listing. That can ease a workload and streamline internal data processes — a tempting move, given the common pressure to get products on Amazon fast. But this hurts your product set in ways beyond color choice or size availability.

Your family of products will seem more attractive to Amazon and get more attention if one ASIN — Amazon Standard Identification Number — gets all the credit for sales, rather than dividing credit among several product variations. The sell-through of an ASIN carries power. Dilute that ASIN’s potency and you affect how often you appear in the search results.

Neglected Inventory Management

If your products sell well and you fail to keep them in stock, it obviously leaves money on the table.

It would be rare for a company to not know about the Inventory Dashboard or Selling Coach in Amazon.

However, ignoring that information is commonplace.

The most effective way to force attention to proper stocking is to quantify the financial loss when inventory is not maintained. Numbers in the hundreds of thousands of dollars motivate, and, yes, numbers do, in fact, commonly add up to hundreds of thousands of dollars of missed opportunity.

Inventory management problems go beyond simple inattention, though. Reactive inventory management also is a trap. Sometimes companies dutifully maintain stock by reacting to dashboards, but they ignore predictable seasonal fluctuations.

Review what your Amazon seasonality was last year. Make sure this year’s inventory planning takes last year into account.

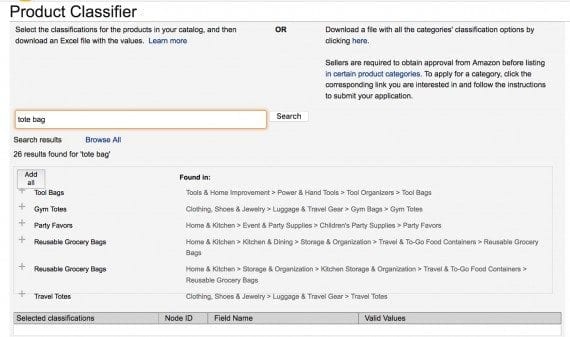

Incorrect Categorization

You can post products to Amazon even if your product categorization is wrong. Amazon will not prevent this.

Some businesses put their entire product catalog in the same category. If a business’s products fall mainly in one category, it’s tempting to ignore categorization for the outliers.

Amazon will not prevent this, but Amazon will indirectly penalize you.

Apparel as a category has additional approval requirements. So it’s tempting to post tote bags in an incorrect category, such as listing them as reusable grocery bags in Home & Kitchen. However, searchers won’t find them as easily if they are posted incorrectly.

If you post in incorrect categories, you are not going to have any subordinate information for your products, such as size, weight, colors, and other details — recognizing that those fields differ greatly among categories. Without that foundational information, it will be harder for your products to be found on Amazon, and harder for you to convey the benefits that sell your products.

Buy Box Ownership

The economics and strategy of the Buy Box on Amazon could warrant its own article. Yet an alarming amount of businesses do not even consider the impact.

Clicking “Add to Cart” for the Duncan Imperial Yo-Yo, automatically defaults to buying this product from “Market Candles On Line,” even though several other sellers offer the product — see “Other Sellers on Amazon,” at lower right. Click image to enlarge.

Here is a good example. Note that if you click “Add to Cart” for the Duncan Imperial Yo-Yo, shown above, you will automatically default to buying this product from “Market Candles On Line,” even though several other sellers offer the product — see “Other Sellers on Amazon,” at lower right. You’d have to go out of your way to buy from anyone else other than “Market Candles On Line.” This is a significant advantage for that company, as a seller.

The dramatic revenue impact of Buy Box ownership is not often understood or properly quantified. As a result, there can be great hesitancy to lower prices in an effort to secure the Buy Box, even though being the lowest price vendor is a prominent factor determining Buy Box ownership.

Indeed, there are complicating factors when lowering prices on Amazon. But prudent math shows that overall net revenue or profit on Amazon is often higher – much higher – with a lower price. The Amazon Buy Box can yield hundreds of times more traffic, making the overall business picture much more favorable at the lower price.