Ten years ago, PayPal was the ideal solution for small businesses that couldn’t justify the high costs of a merchant account. In its infancy, the growth of PayPal user accounts came from smaller merchants.

PayPal later became the norm for eBay and large etailers because it allowed people without credit cards to shop online.

Today, more and more online consumers are flocking to payment methods they feel provide the most security. Ideally, this includes methods that rely on users logging into third-party sites they trust, which, in turn, provide merchants with only a transaction number.

Hacks and Thefts

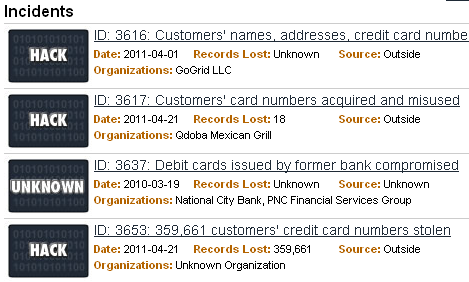

Consumers are becoming sensitive to the possibility of stolen credit card and personal data, whether reported by the mainstream media, or not. For example, DATALOSSdb is an open-source community that publishes hacks of note, showing that even breaches of other big companies often go unreported by media outlets. Through social media, online shoppers are realizing that highly publicized breaches represent just a small percentage of stores and services being hacked.

DataLossDB.org tracks hacks and other security breaches.

Consumers Are Uncomfortable

Until this past month, my father-in-law wouldn’t shop online. I would often order items for him with my own credit card because he just wasn’t comfortable supplying that information online. Now he uses PayPal, storing bank account and credit data in one place.

My in-laws are representative of millions of online shoppers who are vying to take back control of their information, selectively providing sensitive data to companies they trust. And, guess what? Your smaller ecommerce business probably isn’t on their short lists.

With the highly publicized breaches of Epsilon and Sony — and, just this past week, Sega — even seasoned online consumers are telling e-businesses they’d better rethink how they’re going to collect information and how they’re going to get paid.

In short, if you’re not offering several payment methods during checkout, you’re losing business.

Offer Multiple Payment Methods

Aside from the standards – MasterCard and Visa – all retail online stores should accept the following.

-

American Express. Yes, the rates are higher, but any of American Express’s cardholders will only use American Express when shopping online. And with its new reloadable payment card, which carries no fees, account holders can have more control of their money by restricting amounts spent and using dedicated card numbers for online purchases.

-

Discover. Discover cardholders can use a simple tool to generate secure account numbers for shopping online, never having to provide the number on their physical card.

Several in-depth studies have shown that American Express and Discover cardholders tend to spend more money per transaction, and more quickly become loyal customers.

-

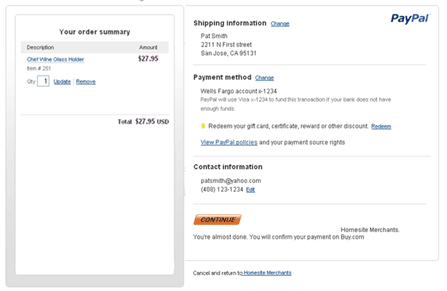

PayPal. By far the most popular alternative payment method, PayPal allows shoppers to pay via credit card or bank debits. It’s attractive because consumers need only provide PayPal with their account information. All the merchant sees is a transaction number.

PayPal’s express feature allows shoppers to store addresses, payment information and other sensitive data with one source. Merchants only see what’s necessary for order fulfillment. And merchants can offer coupon discounts for future orders paid via PayPal Express.

PayPal only provides merchants with the information they need to complete a transaction.

-

Amazon Checkout. Many seasoned Amazon shoppers give first dibs to online stores that let them checkout with their existing account with the big etailer. Additional features, like selecting a ship-to address and choosing which card to pay with simplifies the process.

Storeowners should also consider other methods, like Google Checkout — if available for the shopping cart — and cash-pay systems, where the user visits a local kiosk to send a cash payment.

Communicate Options to Consumers

Accepting multiple methods is only part of the conversion campaign, however. You first have to tell visitors they can pay with their preferred method, then make them feel the most secure.

Here are some tips to get you started.

-

Ignore statistics. Ignore statistics concerning who pays via which method. Most stores will find that Discover is the least-selected method. However, you never know how much one will spend or who may become a loyal customer.

-

Payment icons. Display payment icons prominently on all store pages. People want to know how they can pay before getting to checkout.

-

SSL certificate. Display the SSL security seal throughout the site, most prominently on checkout pages.

-

Use encryption. Make sure all payment information is transmitted securely, in encrypted form, and advise customers that their information is sent via the processor using encryption.

-

Don’t store payment data. Make sure to tell shoppers you never see the full credit card number or security codes.

Not convinced that additional methods are worth accepting? Consider this. While American Express and Discover have higher acceptance rates, most merchants actually pay higher fees on Visa and MasterCard that provide bonuses and rewards to the consumer. Some of these “standard” cards will cost you upwards of 4.5 percent to accept. Either way, people want options. Restrict how they can pay and they’re more likely to take their business elsewhere.

It is possible to negotiate lower fees with both American Express and Discover. Rather than “group” these accepted cards onto the base merchant account — which processes Visa and MasterCard — you can set up separate accounts with each and configure the payment gateway to process them directly with the different networks.