Thanks to the JOBS Act, startups and small businesses can now publicly raise equity funding via online crowdfunding sites. In September 2013, Title II of the JOBS Act went into effect, enabling small businesses to generally solicit from accredited investors (investors with over $1 million net worth or making over $200,000 per year for the past three years). Title III of the Jobs Act, which should go into effect in 2014, will create rules for non-accredited investors to participate as well.

Here is a list of equity crowdfunding sites to fund your business. List your company now to access capital from accredited investors, or wait until Title III to raise money from one and all.

EquityNet

EquityNet is a platform designed to make the funding process more efficient for entrepreneurs and the investment decision process more effective for investors. Its software analyzes privately held businesses and estimates business valuation, risk, investment return, under-capitalization, and many other business scoring factors. It also compares and validates dozens of business projections and assumptions based on its peer benchmarking database. So far, EquityNet has helped businesses raise over $230 million.

—

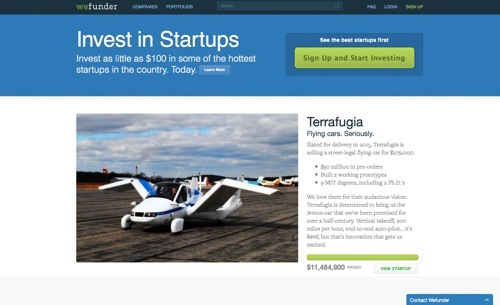

Wefunder

Wefunder is a platform to help everyone invest as little as $100 in their favorite startups. Started by three developers during their time at the prestigious Y Combinator startup accelerator, Wefunders’ goal is to democratize venture financing, giving people of all income levels a chance to invest. Their goal should become a reality once Title III goes into effect. Investors can also invest in Wefunder itself, which has set a $15 million market cap.

—

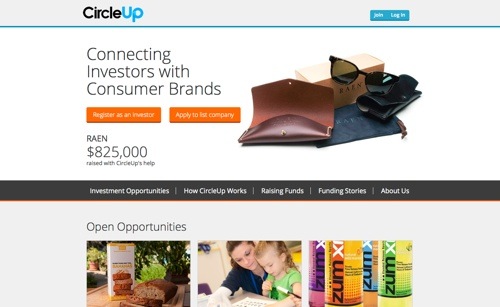

CircleUp

CircleUp is a crowdfunding platform connecting accredited investors with innovative consumer and retail companies. CircleUp only lists a small percentage of companies that apply, focusing on businesses with substantial revenue or other indicators of potential success. Entrepreneurs can screen interested investors and select the most relevant ones for their companies as well as structure the terms of their raises.

—

EarlyShares

EarlyShares.

EarlyShares is a funding platform that connects entrepreneurs and business owners to investors through a user-friendly online system. EarlyShares offers four types of fundraising options: direct investments, early funds, rewards campaigns, and combination campaigns. EarlyShares typically sees businesses applying for funding amounts between $100,000 and $2 million.

—

CrowdCube

Crowdcube is an equity-based crowdfunding platform for U.K. businesses. Its goal is to give British entrepreneurs the opportunity to take control of raising funding from their own network of friends, family, customers and strangers. It has successfully gained funding for over 100 business with nearly £22 million.

—

Fundable

Fundable doesn’t take a percentage of raised capital. Instead, it charges a flat-fee of $179 per month. Fundable uses an “all or nothing” fundraise model which means startups must meet or surpass their goal in order to successfully collect funds. In its first year, Fundable generated over $80 million in funding commitments from investors, customers, and friends.

—

Crowdfunder

Crowdfunder hosts over eight thousand companies and over forty thousand accredited investors, financing nearly $60 million to date. Once a deal is set up, Crowdfunder charges a flat monthly fee, depending on the amount of distribution and exposure businesses want for a raise. Plans start at $99 per month.

—

RockThePost

RockThePost is an equity crowdfunding platform located in New York City. It has some notable advisors and directors, including Barbara Corcoran from ABC’s entrepreneurial reality show, Shark Tank. RockThePost will unveil financing plans at the end of April. Businesses will have the option to independently manage fundraising for a monthly fee or use RockThePost management for a success fee. RockThePost has helped businesses raise nearly $30 million.

—

AngelList

AngelList is a platform for startups. Its purpose is to introduce entrepreneurs to accredited investors, simplifying the capital-raising process for early stage business. Startups can also post job openings and display that they’re hiring. Accredited investors can also invest as little as $1,000 in syndicate deals with notable co-investors.

—