Editor’s Note: Contributor Phil Hinke is a credit-card veteran who now consults with merchants on lowering their processing costs. Hinke believes the credit card processing industry is often unfair to merchants. He believes the Durbin Amendment — which lowers debit card interchange rates — is fostering deceptive pricing practices by some merchant account providers. He explains his views in the article below.

As I stated in “Part 1” and “Part 2” in this series, I am a strong advocate of interchange-plus pricing. However, I am concerned that some merchant providers and their salespeople appear to be misrepresenting interchange-plus pricing . For that reason, I’ve concluded that interchange-plus pricing does not automatically mean fair or honest pricing. The purpose of this article is to discuss deceptive interchange-plus practices that I have seen recently from credit card merchant providers.

The Term ‘Interchange Plus’ Is Used Loosely

Many years ago, I endured a timeshare sales presentation in Hawaii because the promotion offered the use of a Jeep for the weekend just for attending. When I went to pick up my Jeep, the company gave me a mini-Jeep looking vehicle that in no way could fit all four of us. Fortunately, “Jeep” is a trademarked name so I threatened to file suit if I did not receive what was offered. I got my Jeep.

However, the term “interchange plus” is not trademarked. When a salesperson offers interchange-plus pricing, you may think it means the pricing is based on published interchange rates and pass-through fees plus the mark-up you negotiated with the provider. Many merchant account providers do, in fact, price this way. However, as you will see below, not all of them do and you need to be specific in what you ask for and perform a detailed audit of what you receive to confirm.

A Real Example of an Incorrect ‘Interchange’ Rate

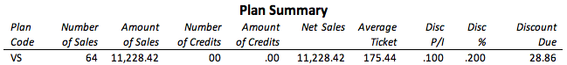

The following images were copied from two sections of an actual merchant statement. The first is from the summary page and shows this merchant processed $11,228.42 in Visa sales for the month. The merchant negotiated “interchange-plus” pricing with a provider mark-up of 0.20 percent (see “Disc %”) and a 10 cents per-item fee (see “Disc P/I”). Based on the mark-up, the provider received $28.86 (see “Discount Due”) for the mark-up. This is correct.

Sample summary page.

The following images, however, are from the itemized fee section — interchange rates, pass-through fees, and monthly fees — of the statement.

The first image, below, states the 0.11 percent “Dues & Assessments” charge by Visa that equals $12.35. This is correct.

Dues & Assessments.

The image below states the “Visa Acquirer Processing Fee” — sometimes listed as “APF fee” on merchant statements. This equaled $1.31. It is also correct, as the APF fee is 1.95 cents ($.0195) per transaction.

Visa Acquirer Processing Fee.

From the three images, above, we have the (a) provider mark-up, (b) “Dues & Assessments,” and (c) “APF.” The main component remaining, then, with interchange-plus pricing is the actual interchange rate. Let’s look at one of the card types listed on the statement.

Visa rewards card rate.

“CPS/Rewards 2” is a Visa rewards card rate. Three customers used this type of card for their purchases during the month for a total of $2,427.71. Supposedly, the interchange cost was $59.05. However, let’s do the math.

Namely, $59.05 on $2,427.71 in sales with three transactions means the rate is 2.42 percent + 10 cents. There is just one problem. Visa’s published interchange rate for the Reward 2 card type is 1.95 percent + 10 cents. Apparently, what this merchant account provider calls “Interchange” for CPS/Rewards 2 is 0.47 basis points — 2.42 less 1.95 — more expensive than what Visa publishes as interchange.

The merchant thought he was paying 0.20 percent +10 cents over the published interchange rate and pass-through fees. In reality, the merchant was paying 0.67 percent plus 10 cents over published interchange rate and pass-through fees for Visa Reward 2 transactions. There were other card types on this statement with questionable interchange costs as well.

I reviewed my findings with the salesperson. He honestly thought that he was offering interchange-plus pricing based on published interchange rates. I have talked to other salespeople — with other merchants — who thought the same thing. Remember, there is no regulated certification program to sell card processing — like there is with securities or real estate. A high percentage of credit-card-processing salespeople and customer service personnel do not have a detailed understanding of interchange and how it works.

Improper Card-Association Pass-Through Fees, Too

Interchange-plus pricing should include (a) published interchange rates, (b) card associations — Visa, MasterCard, Discover, and American Express — pass-through fees, and (c) the provider’s negotiated mark-up. Unfortunately, in addition to misstating the actual interchange rates, I am seeing more statements where merchant account providers are inflating the actual card association pass-through fees.

The following is one example. The image below is from a merchant statement and shows the Visa pass-through fee, called “Acquirer Processing Fee (APF).” It states that there were 190 transactions where the Visa APF was charged. The fee was 5 cents for each transaction and totaled $9.50. There is just one problem, Visa only charges 1.95 cents for this fee.

Inflated pass-through fee.

I am seeing more and more of this. I am seeing statements where a “Visa Access fee” or “Visa Auth fee” is being charged in lieu of the APF. I have seen these fees as high as 10 cents — where Visa actually charges just 1.95 cents. I’ve seen the same for MasterCard and Discover fees. These inflated fees, in my view, are nothing more than a way for some providers to squeeze an additional transaction fee out of the unknowing merchant while putting the blame on the card companies in the process. Do not expect the salesperson or customer service personnel to have a detailed understanding of interchange and fees.

Summary

- Interchange-plus pricing is not a panacea.

- Interchange-plus pricing is not immune to deceptive practices.

- Be specific in what you want during negotiations.

- Review your statement to make sure you get what you negotiated.

- Your salesperson and customer service personnel may not understand card-pricing details.