While ecommerce continues to take a larger share of overall retail sales in the United States and Western Europe, the biggest growth rates are occurring in emerging markets such as Brazil, China, India, and Russia, where both domestic and cross border sales are showing healthy increases.

I’ve addressed the cross border market previously, in “Cross Border Ecommerce Booming.” The Indian ecommerce market I described in “Ecommerce in India Takes Off; Potential for U.S. Sellers.”

In this article I will analyze the Russian market.

Like China and India, Russia suffers from limited payment options because most consumers do not have credit cards. Logistics are primitive in a country that spans nine time zones, many of them sparsely populated. Cash on delivery is the most prevalent payment system. Russia has the added burden of never being a consumer-goods-focused society because communism downplayed materialism. Unlike China, Russia never developed a middle class. Choice has always been limited and quality has been shoddy.

Russian Ecommerce Statistics

The report “E-Commerce in Russia,” from East-West Digital News, lists the following statistics.

- Almost 30 million Russians shopped online in 2013, representing 23 percent of the population 18 and over.

- The ecommerce market is composed primarily of small merchants and is fragmented. There are 39,000 Internet shops but fewer than 20 earn at least $100,000 a year.

- The market is growing 20 percent a year.

Russian research firm Data Insight reports that:

- Ecommerce revenue in 2013 was $16.5 billion, up 28 percent from 2012 and representing two percent of total retail expenditures;

- Consumers in Moscow and St. Petersburg account for 30 percent of total Internet users in Russia but do 60 percent of ecommerce purchasing.

Almost everything is more expensive in Russia than in Western Europe and the United States because of inefficiencies and a lack of focus on consumer items. Russian Post, the national postal operator, is notorious for slow service and losing parcels, so companies rely on retail or warehouse distribution center pick-up points.

While non-Russian sites have a price advantage on products, if they rely on Russian Post, the local competitors who have distribution centers or courier delivery have an advantage on delivery time and possibly cost.

Local Ecommerce Sites

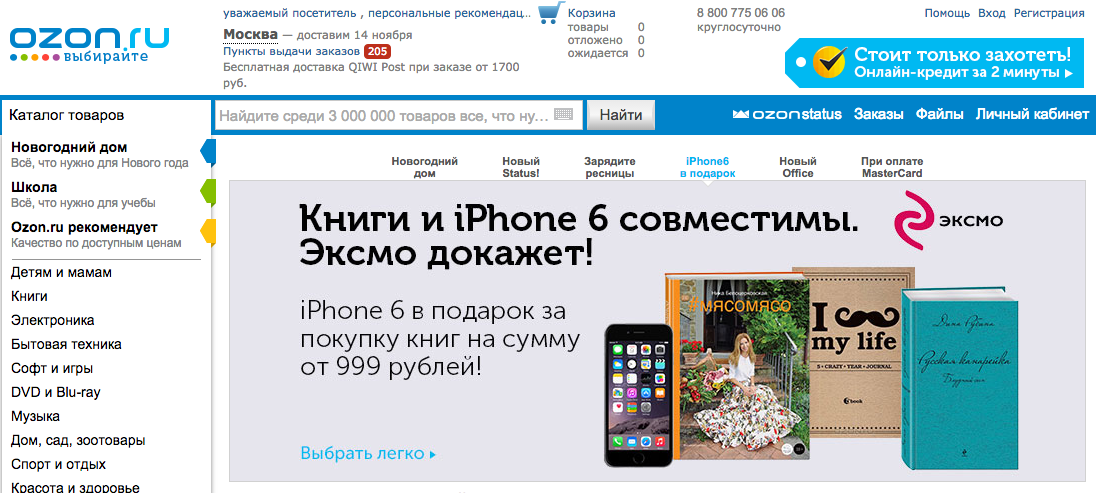

While most Russian online merchants are small, two local companies have outpaced the others. Ozon, considered the Amazon of Russia, offers 3 million products for sale and recorded $700 million in revenue in 2013.

Many observers consider Ozon.ru the “Amazon of Russia.”

Ulmart, a hybrid online-offline retailer of computers, home electronics, and household appliances, offers a relatively meager 55,000 items for sale but had revenue of $1.2 billion in 2013. Ulmart also has a delivery service — with a fleet of 90 trucks — in the major urban centers of Moscow and St. Petersburg. While Ulmart targets the major cities, Ozon serves the entire country.

Couriers are an important part of the ecommerce story in Russia. As in China, the drivers deliver products that consumers have purchased online and then wait patiently as they try on clothing to see if it fits or turn on the electronics to make sure the product is working. If all is well, customers pay in cash.

A Russian online payment system does exist. The QIWI Wallet electronic payment system now is used mostly for recurring bill payments such as utilities, but it will likely eventually penetrate ecommerce.

Non-Russian Sites

Ebay launched a Russian-language website in 2013 and received permission from Russian regulators to use its payments service, PayPal. This year the government gave permission for Russians to sell as well as buy items on the site.

Chinese ecommerce giant Alibaba Group launched a Russian-language site for its AliExpress B2C marketplace early this year. Within months it became Russia’s most visited ecommerce site, with 16 million visitors in July, according to research firm TNS.

What Do Russian Consumers Buy?

Not surprisingly, Russian online shoppers are young, better educated, and have higher incomes than the average Russian citizen and have more sophisticated tastes.

Fashion is not something the domestic brick-and-mortar market does well. So clothing, shoes, and accessories are very popular online. Although a few retail brick-and-mortar stores in the major urban areas sell designer clothing, their prices are double or triple what is available online. Beauty products also sell well for the same reason. Online shoppers are willing to wait for several weeks — or risk not receiving the goods at all — in exchange for the lower online prices.

Electronics, including all things Apple, are the other major online purchase category. Household appliances are becoming a bigger part of the market.

Do-it-yourself car repair is popular in Russia, so auto parts are also a big seller. Diapers became a major item in 2014 and now toys and other baby goods are gaining traction.

Issues that Inhibit Growth

There are other factors that hurt ecommerce growth in Russia.

- Lack of qualified personnel in areas such as IT, marketing, logistics, inventory management, and finance.

- Poor infrastructure and logistics, especially in remote areas, which makes shipping very expensive.

- Venture investment in Russian ecommerce fell to $235 million in 2013 from $360 in 2012 in 2013. Ecommerce merchants need money to improve their websites and their logistics.

Opportunity for Foreign Sellers?

A desire for good quality foreign goods certainly exists in Russia. But the country has more hurdles than either China or India, and short-term prospects are not good. Russian consumers can buy from foreign sites now but only the rich and educated can maneuver around language barriers and limited payment options. In the long term, if an inexpensive and reliable alternative delivery system can be established, and merchants can localize their sites, prospects will be better. For now, non-Russian merchants may wish to try Ebay as a means of selling into the Russian market.