As a small online retailer, you may ignore the strategies of larger, multichannel brands. But if you investigate what these larger companies are doing to deliver a consistent multichannel experience, you will learn how to compete with them.

If your operations are online only, you risk a shopper finding the same or a similar item that can be purchased immediately in a local store. This is especially the case for clothing, which shoppers can actually try on before purchasing. The problem is that physical retail stores frequently do not have the size or the color shoppers are looking for.

By employing multichannel strategies that include checking availability online at any local store, savvy multichannel retailers are positioned to compete with online-only competitors and larger marketplaces. Some even match prices, so discounts offered by online retailers become less of a buying factor. With the huge investments being made by multichannel brands, smaller online-only retailers will likely face a much more aggressive competition in the future. You may also see these brands experimenting with niche, online-only stores that compete directly with your own store.

Case Study: Gap Inc.

This article will focus on Gap Inc. as a mini-case study. It is a true multichannel and multi-brand retailer. Its online strategy is different than many other multi-brand retailers. It’s a good company to evaluate in more depth.

- Multiple brands. Gap Inc. operates five brands targeting different markets with different products — The Gap, Old Navy, Banana Republic, Piperlime, and Athleta.

- Physical stores. Each brand operates many physical stores throughout the world, except Piperlime, which recently opened its first U.S. store the U.S. in New York City.

- Shared online checkout. Gap Inc. is one of the few multi-brand retailers that share an online shopping bag and checkout. Consumers can shop in five different branded stores but complete a single sales order.

- Mobile. It supports standard and mobile websites and offers a single shopping app for all stores, with a consistent customer experience. The app includes easy-to-use store locators and offers a simple interface to check local availability of any item.

- Free shipping is available on $50 orders from all brands; Piperlime offers it on all orders.

- Rewards program. Gap Inc.’s rewards program is tied to a Gap credit card that delivers a $10 reward for every $200 spent in its stores. Cardholders can also accumulate points for purchases in other non-Gap businesses. And exclusive offers and advance notice of sales are part of the program.

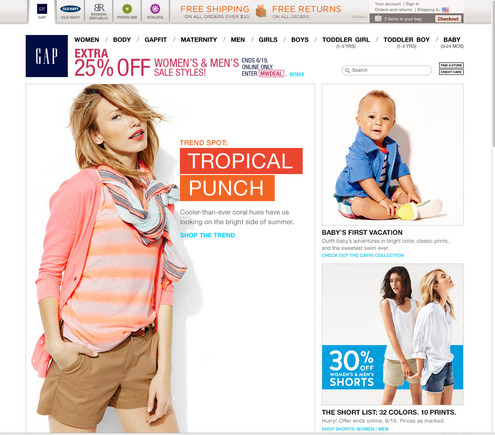

The Gap’s home page. Enlarge This Image

Enlarge This Image

When you enter Gap.com, you will see tabs across the top that link to its various stores. Each one delivers a different user experience and targets different consumers, who can browse in all stores if they don’t find what they are looking in any one of them. By allowing shoppers to use a single shopping cart, Gap encourages more purchases.

I found all the stores had appealing and functional designs. The navigation was logical based on the number of categories and types of products in each store.

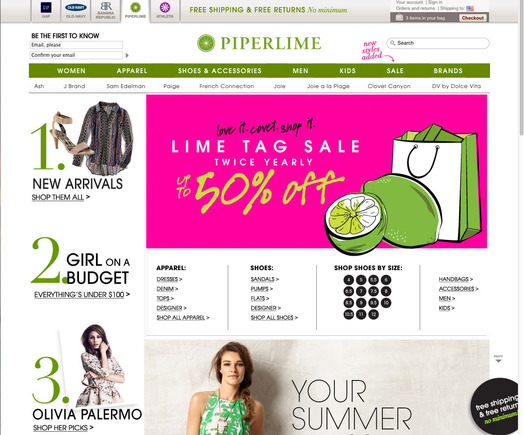

Piperlime home page. Enlarge This Image

Enlarge This Image

Piperlime delivers different navigation and branding. It also offers free shipping on all purchases, as I’ve noted. There are different promotions in each of the stores.

Banana Republic search results page for jeans men. Enlarge This Image

Enlarge This Image

All stores do share some common elements. The navigation in the site-search results is virtually the same, making the user experience consistent. Each store has a separate site-search, but I wish there were an option to search all stores at once. It could generate more revenue and it would deliver a superior customer experience.

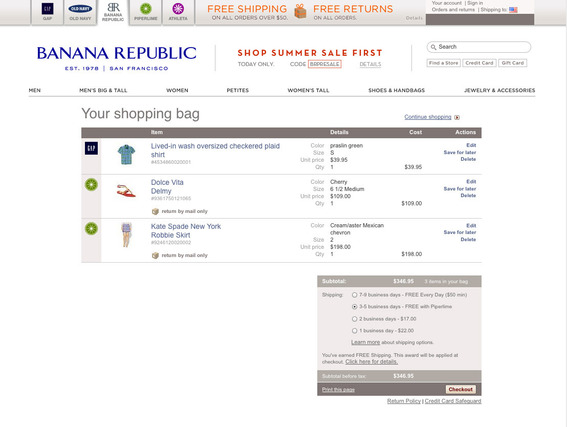

Banana Republic shopping bag. Enlarge This Image

Enlarge This Image

Shoppers can access the shopping bag from any store. The shipping calculation adjusts for the “always free shipping” policy of Piperlime. I expected to see a “Gap” shopping bag at checkout. But I stayed in the brand of the store where I initiated my checkout. The logo of each store appears in the shopping bag to indicate the store where you selected the item. A shipping estimate appears in the shopping bag, which is a nice feature that should be standard for all ecommerce sites.

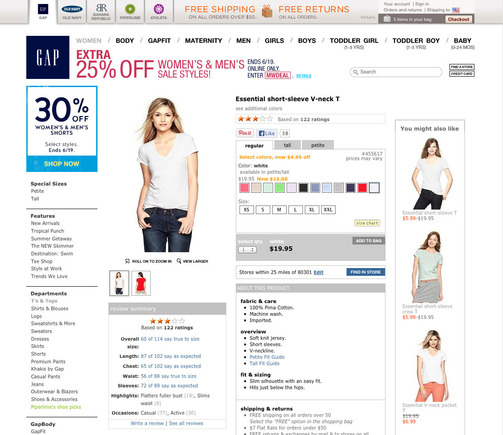

Product Detail page on Gap.com Enlarge This Image

Enlarge This Image

The product detail pages are well done with a tight configuration of colors, sizes, and options. Zoom and quick views of related items are fast and easy to use.

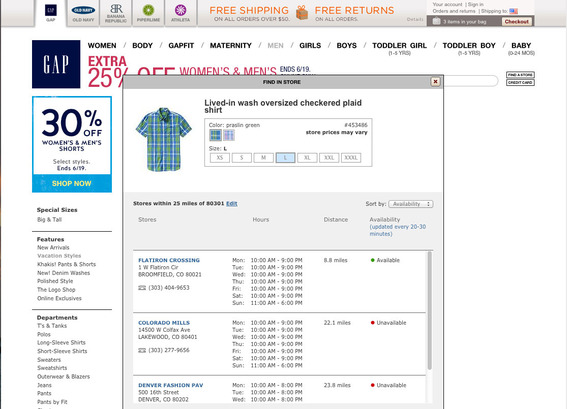

Availability results. Enlarge This Image

Enlarge This Image

Shoppers can easily check on the local availability of any item in all sizes, colors and configurations. They simply click on the “Find in Store” link on the product detail pages. But these results are actually delayed by 20 to 30 minutes, so Gap includes a phone number for shoppers to call for immediate stock verification. Unfortunately Gap has a disclaimer that in-store prices may differ from online prices. They need to fix this. Prices need to be consistent regardless of the sales channel. This is still a major flaw in many multichannel strategies.

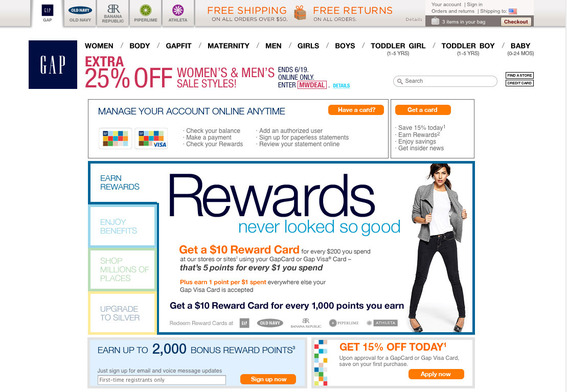

Rewards offered by Gap.com. Enlarge This Image

Enlarge This Image

Gap, Inc. promotes its credit card in many places, including a link next to the primary search. I view the credit card more as a rewards program, but Gap chooses to market it first as a credit card. I would be more inclined to respond if it were more of a rewards program since I don’t need another credit card.

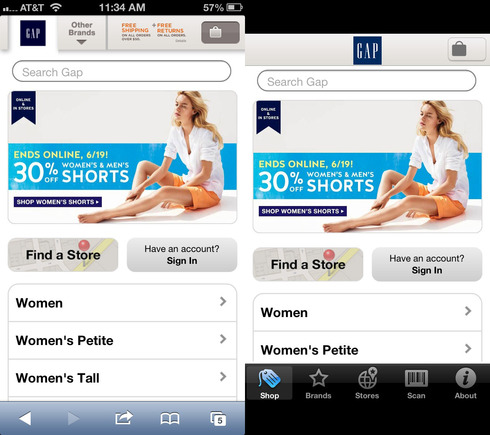

Gap mobile website and iPhone apps. Enlarge This Image

Enlarge This Image

One important element of multichannel strategies is to deliver consistent user experiences regardless of device or platform. Gap’s free mobile app and mobile friendly implementations are virtually identical. The content is the same, as is the user interface. The app is faster than the mobile-optimized site and offers faster access to the other brands, store locations, and includes product scanning.

Overall, this is a solid implementation of a multi-brand strategy. There is room for improvement in the “Find in Store” process. Beyond that, large retailers struggle with cross-channel pricing tactics. These will likely become more sophisticated.

Wrap Up

The bottom line is that multichannel retailers are striving to deliver consistent customer experiences. They know they will never be able to offer the same level of inventory in physical stores as they do online. So they are working to deliver online ordering in kiosks and in physical stores. As they improve the online and in-store experience, they become more attractive to shoppers.