The pay of most salespeople in the credit-card-processing industry is 100-percent commission. Salespeople therefore presumably do not want to lose an account from an ecommerce or any other business.

Unfortunately, many salespeople do not understand the credit-card-processing industry and may not even realize that they represent a less-than-acceptable provider. Many have been poorly trained and have learned to sidestep questions by saying things like “that’s a Visa fee” — no matter what facts may be.

Fortunately, there are also many knowledgeable salespeople, representing reputable providers, who can help resolve issues, fight for merchants, and improve a merchant’s profits.

Unfortunately, many salespeople do not understand the credit-card-processing industry and may not even realize that they represent a less-than-acceptable provider.

This article is the first installment of a three-part series to help merchants identify acceptable salespeople, set expectations for both parties, and convince the salesperson to work with them, not against.

Necessity of Detailed Monthly Statements

The first step for merchants is to receive the correct type of monthly statement from their provider. If you do not receive a detailed processing statement each month, don’t be surprised if you are paying more than you negotiated

For example, no merchant in his right mind would pay an invoice as follows.

Items: Truckload of stuff

Amount: $15,425

But this is exactly what many merchants are doing when it comes to paying for credit card processing.

Some processing statements are so cryptic that they do not state, for example, anything more than “$45,675.38 was processed and the account was debited $1,918.17. Merchant has 30 days to dispute the charges.” How can any merchant know if she is paying what she negotiated?

Moreover, some statements may appear to provide sufficient detail by listing certain pass-through fees, processing rates, and other fees. However, those statements can lack other, critical information.

Accuracy and transparency in the credit-card-processing industry is poor. In my experience, a high percentage of merchants do not receive their negotiated rates and fees because of a provider’s order-entry errors. Some rates and fees default to the provider’s highest levels if a salesperson incorrectly completes the merchant application form. Other providers inflate, surcharge, or hide certain rates and fees. These are identified only with a detailed statement, one that fully itemizes each rate and fee even if the merchant doesn’t understand all of them.

Fortunately for the merchant, a knowledgeable salesperson will also want a fully itemized statement so that he can verify his commissions are correct. Naive salespeople don’t understand that a provider that supplies limited information to the merchant is also, likely, supplying limited information to the salesperson, who cannot otherwise confirm his sales commissions.

In fact, I recently helped a salesperson recover more than $3,000 in commissions. The provider stated that it does not attempt to resolve underpaid commissions unless a salesperson can prove the error. Because of the way this provider treats merchants, this did not surprise me.

3 Components to Processing Cost

How do merchants know if they are receiving the correct statement, with all rates and fees itemized?

There are three components to credit card processing cost: interchange rates, pass-through fees, and provider mark-ups and fees. All three components must be listed in detail on the statement so they can be verified.

Interchange rates are set by the card associations: Visa, MasterCard, Discover, American Express. Interchange rates go to the bank that issued the card used by your customer. If your customer paid with a Chase credit card, for example, then Chase receives the interchange.

There are dozens of interchange rates. Visa and MasterCard publish theirs for all to see: Visa interchange (PDF), MasterCard interchange. Note the MasterCard requires you to click on “Download Interchange Rates” in the orange band to obtain a PDF copy.

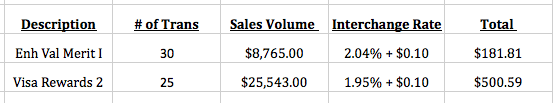

This information from Visa and MasterCard can seem daunting. However, as I’ll explain in this series, both you and your salesperson can verify that the provider is charging the correct amount. Your statement must list each interchange rate you were charged. The statement must also include the number of transactions and the amount of sales charged that interchange rate. For example, the statement will list several if not dozens of interchange rates, such as the two below.

A processing statement must individually state each interchange rate. It must also state the number of transactions and the amount of sales charged that interchange rate.

On page 1 of the aforementioned MasterCard interchange rate table, on the seventh row from bottom and in the second column of rates, it states the interchange rate for “Enhanced Value Merit I” as 2.04% + $0.10. Page 8 of the Visa interchange tables states the “CPS/Rewards 2” interchange rate is 1.95% + $0.10. This detailed information confirms that $181.81 and $500.59 — above — are the correct charges. No hidden surcharges are being added by the provider.

The card companies also charge providers pass-through fees. Many providers inflate some of these fees before passing them through to the merchant. Merchants should therefore verify that they are paying only the actual fees charged by the card companies. I’ll list these fees later in the series.

You will likely not be charged every pass-through fee charged by the card companies. However, the pass-through fees you are charged must be clearly stated on the statement so you can verify that they are not inflated.

The third component, provider mark-ups and fees, must be itemized on the statement to verify that you are being charged only the agreed-upon amounts and that there are no surcharges, inflated fees, and mistakes. The statement must clearly state the percentage mark-up on each transaction (say 0.15 percent), the fee charged on every transaction (say $0.10), plus period fees (say a $5 statement fee), and all event fees (say a $15 chargeback fee).

In short, merchants that do not receive a detailed monthly statement assume their provider is not inflating fees, hiding fees, or committing order-entry mistakes. Without a detailed statement, merchants cannot confirm their rightful costs and salespeople cannot determine if their commissions are accurate.

See the second installment of this series, at “Part 2: Setting Expectations.”