In “Ecommerce Briefs,” an occasional series, I review news and developments that impact online merchants. In this installment, I’ll address Walmart’s effort to differentiate Jet.com, new ecommerce shipping options from FedEx and DHL, product returns, and vacancies at shopping malls.

Jet.com Stumbles

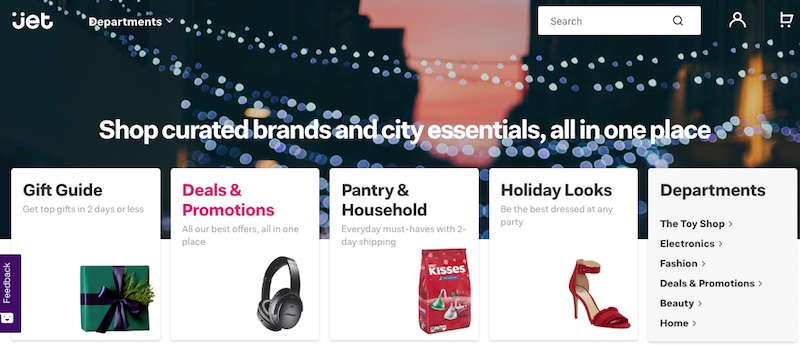

Jet.com announced a re-launch of its website and a modified business strategy with a fresh assortment of goods, new partnerships, and new three-hour and next-day delivery options. Jet now positions itself as “the shopping destination for city consumers.”

As part of this strategy, in October the company announced that it would partner with meal kit provider Blue Apron to sell an assortment of kits on Jet.com to customers in New York City, Jersey City, and Hoboken, New Jersey. Customers can receive the meal kits through Jet.com’s same-day or next-day delivery offering.

Jet.com’s sales fell by 39 percent on Cyber Monday 2018 compared to 2017. Walmart’s online sales on Cyber Monday grew 32 percent.

What’s the rationale for the change? Parent company Walmart does not want Jet to compete for Walmart’s online customers who live in more suburban and rural areas and are not as affluent as Jet’s. However, with Walmart improving its own website and adding more than 2,000 brands — ranging from kitchenware to outdoor clothing — competition and cannibalization are inevitable.

This strategy does not appear to be working. Jet.com’s sales fell by 6 percent on both Thanksgiving Day and Black Friday, followed by a massive 39 percent decrease on Cyber Monday compared to the same days in 2017, according to market research firm Edison Trends.

In contrast, Walmart’s online sales on Cyber Monday 2018 grew 32 percent over last year. It’s clear that for products that do not have to be delivered on the same day, shoppers are just as happy to shop on Walmart.com, which offers free two-day delivery on many items for the holidays. Not enough differentiation exists between the two websites.

As for other multichannel merchants that did well on Cyber Monday, Walmart was joined by Kohl’s with a 42 percent increase in online Cyber Monday sales over 2017 and Nordstrom with a 33 percent gain from Cyber Monday 2017.

FedEx, DHL Enhance Ecommerce Shipping

This month FedEx launched FedEx Extra Hours for customers in limited U.S. markets. In a statement, a FedEx spokesperson explained, “The majority of online orders are placed after 4 p.m., and 64 percent of online shoppers expect orders placed by 5 p.m. to qualify for next-day shipping. FedEx Extra Hours aligns with the needs of online shoppers while offering retailers a way to balance inventory and reduce transportation costs.” Merchants benefit from an extended cut-off time of up to eight hours during the night via late pick-ups by FedEx Express.

DHL eCommerce has entered into a partnership with Easyship, a global cloud-based shipping software company, enabling ecommerce merchants using the Easyship software platform to offer same-day and next-day shipping to their customers via the DHL Parcel Metro service. This new capability went live December 17 for ecommerce merchants in Los Angeles, New York City, and Chicago.

Product Returns

Merchant return process influences buying habits. How an online merchant handles returns greatly influences consumers’ buying behavior, according to a recently completed survey from Voxware, a supply-chain software provider. Buyers want both choice and convenience in the returns process. Eighty-eight percent of survey respondents said they want the option of returning an item to a physical store or via a prepaid shipping system. Ninety-five percent stated that the ease of the return process influences their willingness to buy from that merchant again.

Timing of holiday returns. UPS reports that on 2018 National Returns Day (December 19) about 1.5 million items were returned, setting a record for the sixth consecutive year. UPS expects a second return spike of 1.3 million on January 3.

In past years, National Returns Day occurred in early January and represented the highest rate of package returns for the entire year. UPS attributes the change to ecommerce, including the focus on November sales and better retail promotions. Free return policies also contribute to the increase. Seventy-nine percent of ecommerce shoppers surveyed by UPS noted that free shipping on returns is important when selecting a retailer.

Mall Vacancies

Real estate market research firm Reis reported that the third-quarter U.S. mall vacancy rate hit 9.1 percent, the highest percentage since the fourth quarter of 2011. Sears and Bon-Ton department store closings (Bon-Ton liquidated all 256 of its stores) accounted for much of the increase. As a result, the third-quarter 2018 average mall rent decreased 0.3 percent from the second quarter to $43.25 per square foot, the first such decline since 2011.