Namshi.com is an ecommerce clothing company based in the United Arab Emirates. Ecommerce penetration in the Middle East is low, providing an opportunity for merchants.

The Middle East, long a laggard when it comes to online shopping, caught the attention of the industry earlier this year when Amazon purchased Souq, a local online marketplace. New local ecommerce sites are also coming online.

Middle East countries have some of the highest levels of per capita income but the area is an underpenetrated ecommerce market. Digital commerce accounted for less than one percent of the region’s gross domestic product in 2016, according to research firm Gartner Inc.

“Today only 15 percent of the businesses in the region have an online presence, and 90 percent of the online purchases are bought from outside the region,” according to a press release from Gene Alvarez, managing vice president at Gartner. “With leading digital commerce players investing in product offerings, logistics and payment, along with supporting government initiatives, the Middle East will see strong growth for digital commerce in the coming years.”

There are different definitions of what constitutes the Middle East, making it difficult to assess market size. One includes North African countries such as Algeria, Egypt, Morocco, and Tunisia, while other definitions limit it to the Gulf Cooperation Council, the “GCC,” an alliance of six Middle Eastern countries: Saudi Arabia, Kuwait, the United Arab Emirates, Qatar, Bahrain, and Oman.

Currently, more than 90 percent of the GCC ecommerce market is in only four product categories: consumer electronics, fashion, lifestyle, and health and beauty.

Management consulting firm A.T. Kearney estimated the Middle East ecommerce market at $5.3 billion in 2015 when consumers in the U.A.E. contributed 44 percent of total ecommerce sales in the region. By 2020 Saudi Arabia is expected to overtake the U.A.E.

Marketplaces and Websites in the Middle East

In July of this year Amazon completed its purchase of Dubai-based Souq.com, known as the Amazon of the Middle East. Its market was primarily the GCC but the reach is now expected to expand. Amazon will be offering its Prime program and will likely be adding warehouses to speed delivery times. It will offer quicker delivery than local online vendors, presenting a challenge to the nascent local ecommerce market.

Local marketplaces include Wadi.com, which operates in the U.A.E. and Saudi Arabia, offering electronics, beauty products, jewelry, apparel, and home and kitchen items. Launched in 2015, Wadi is part of the Middle East Internet Group, a joint venture between investment firm Rocket Internet and South African telecom provider MTN. It offers more than 150,000 products from 2,000 international brands. In 2015 Wadi raised $67 million in a Series A round of funding.

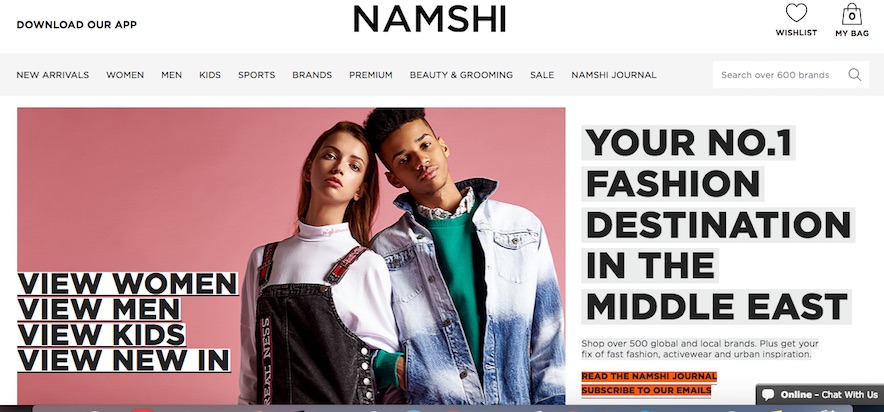

Namshi.com, also based in the U.A.E., serves Saudi Arabia, Qatar, Oman, Bahrain, and Kuwait. The site sells Western-brand apparel for men and women as well as shoes and accessories.

Both of these websites are in both Arabic and English and offer women’s clothing that most of the local female population would not wear in public.

Announced with great fanfare and marketed as a competitor to Amazon, marketplace Noon.com will accommodate third-party sellers when launched. Funded by Saudi Arabia’s state investment fund and a prominent Dubai businessman, Noon created a beta site in January 2017 and was expected to have a full operational site by this summer. In May, however, the C.E.O. and several other employees left Noon and no firm date has been set for the site to go live.

Themodist.com caters to women who wish to dress modestly for religious and cultural reasons. Based in London and the U.A.E., it features luxury designer brands in clothing and accessories and expects half of its sales to come from the Middle East.

Positive Factors for Ecommerce Development

Smartphone penetration in the region is greater than 65 percent. In addition, more than two-thirds of the population use the Internet, with penetration in the U.A.E. and Qatar exceeding 90 percent.

The region has a substantial population of wealthy individuals with an appetite for luxury goods. More sophisticated consumers prefer non-local platforms that offer more product choices.

Payment options that seek to address consumers’ concerns about fraud are being implemented.

Only 15 percent of GCC brick-and-mortar retailers sell online, so a substantial opportunity exists for online-only vendors.

Barriers to Ecommerce

Only 35 percent of Internet users in Saudi Arabia and 55 percent in the U.A.E. are aware of the availability of online shopping, according to A.T. Kearney.

A lack of consumer trust about buying online exists. Consumers have concerns about data security and fraud.

There are gaps in payment systems, especially low credit card penetration.

Logistical infrastructure is deficient.

According to A.T. Kearney, consumers make a disproportionate number of payments in cash, with about 60-70 percent of all ecommerce payments in both Saudi Arabia and the U.A.E. — two of the more advanced countries — being made cash on delivery.

Women in Middle East countries will not answer their door for a man. If no male is at the house, the item — which may have taken months to arrive — will not be delivered if the payment method is COD.

The last-mile of the delivery system is hampered by the fact that much of the region lacks postal codes. The limited number of couriers has resulted in high costs for last-mile delivery.

Middle East countries impose high trade tariffs and moving goods through customs is difficult. Orders placed with overseas merchants can take weeks to arrive.

Ecommerce merchants who wish to take advantage of the opportunity in the Middle East should use Amazon, or Noon when it launches.