In 2021, employee retention became a trending topic. Companies feared labor shortages, and the media covered the so-called “Great Resignation.”

However, by the second quarter of 2022, inflation pushed stock prices down and forced some layoffs from public or venture-capital-funded businesses. Labor demand wavered, perhaps, slightly.

Regardless of the ebbs and flows of economic tides, businesses must consider how employee compensation enriches both the company’s shareholders and the employees themselves.

Factors for Compensation

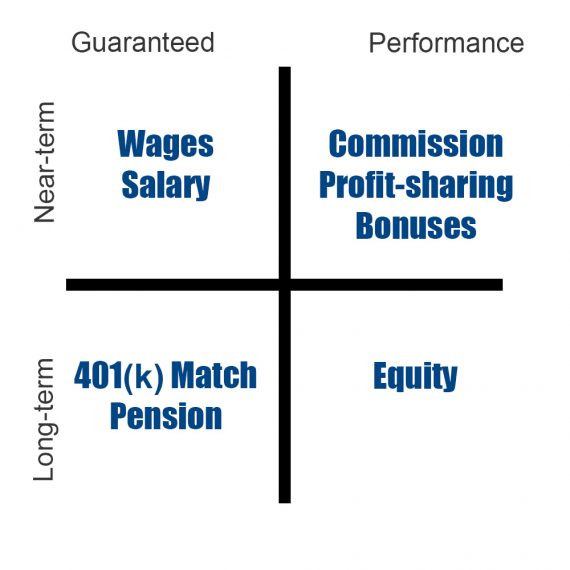

Focusing on remuneration or monetary compensation, excluding benefits and perks, one could argue that there are three essential factors or considerations.

- Is the compensation enjoyed in the near term or long term?

- Is the compensation guaranteed or based on performance?

- Can the employee access the compensation value?

Some examples will help to clarify these factors.

Salary or Wages

Remuneration can take the form of an hourly wage or an annually negotiated salary paid out in regular installments after completion of work.

This form of employee compensation is both guaranteed and near-term.

The employee trusts that a paycheck will arrive at a designated date. And the interval between payments is typically only a week or two.

Short-term, guaranteed payments give employees financial stability at ground level. They have a predictable income to help guide their money decisions.

Performance-based

There are also some near-term but performance-based forms of employee payment. Perhaps, the most common of these are commissions paid to salespeople, profit-sharing proceeds divided among workers, and bonuses for exceptional work and merit.

These employee payments might be added to a regular paycheck or divvied up quarterly or annually. This form of compensation may be considered near-term and performance-based.

These payments give workers something to strive for and help the business rally them around set goals.

401(k) Matching

Company-sponsored retirement plans are the most favorable to employees when the business matches the worker’s contribution.

So if someone decided to save 7% of each paycheck and place it — pre-tax — in a 401(k) plan, the employer adds a matching 7%, effectively doubling the investment.

Good 401(k) matching starts the first day on the job and is at once fully guaranteed and long-term. The employee can depend on the matching but won’t enjoy its benefit until retirement.

A 401(k) matching plan ensures that employees can look forward to retirement and trust that they will have funds available when they are no longer working. These programs may also contribute to relatively better employee retention.

Pensions

The Hearst Corporation, a large media business, is known to have a funded and successful pension plan for employees that began in 1967.

In the case of the Hearst pension, employees will receive a regular payment after retirement in proportion to their peak salary and time with the company.

Like 401(k) plans, pensions provide guaranteed long-term compensation.

This form of compensation may not be as popular with relatively new businesses, but many companies still use it, especially with union workers.

Equity

When employees share ownership in a company, they receive long-term and performance-based compensation.

Equity is the value an owner (shareholder) would receive if a business gets sold and its debts paid off.

The long-term nature of equity means that the business (or a portion of it) gets sold before the employee can enjoy its value.

Equity is performance-based because the company must thrive, or at least survive, before selling.

Finally, equity is an employee favorite because, in some companies, it can make employees quite rich. Imagine having received equity in Amazon early on.

Combining Compensation Types

As a company develops its employee compensation plan, it may be good to include at least four types of compensation.

- Near-term and guaranteed,

- Near-term and based on performance,

- Long-term and guaranteed,

- Long-term and based on performance.

A company could consider four types of compensation.

When a company provides this sort of compensation array, it is helping its workers find financial security now and in the years to come.

Availability

A final consideration is an employee’s ability to access value when needed.

Here are two more examples that will help to explain the advantage of making money available to workers.

Access Wages Now

For the first example, consider a new employee at a retail store. Paid an hourly wage, this individual could be among a company’s most financially vulnerable workers.

A report from LendingClub and PYMNTS estimated that 67% of American workers lived paycheck to paycheck in January 2022. If this was the case for the retail clerk described above, something as common as a minor car problem could be an emergency.

Too often, this employee will have to turn to an almost usurious pay-day loan to survive, paying annual interest rates as high as 499% in some locations.

This single loan may impact employee attendance and performance as the worker turns to a second job or gigs like Doordash or Uber to cover the interest.

Some businesses are helping resolve this problem by making a portion of a worker’s paycheck available on demand.

For example, the retail employee described above might be able to access something like 70% of her daily wages an hour after a shift ends.

In this case, availability might help a vulnerable employee avoid high-interest loans.

Access Equity

Hourly workers are not the only ones living paycheck to paycheck. The same LendingClub and PYMNTS report estimated that 48% of workers who earned more than $100,000 per year lived paycheck to paycheck in January 2022.

According to the report, these employees would not be able to cover an emergency of just $400.

This report implies that many salaried and highly-compensated workers have either high debt or high expenses, which they might alleviate with the value stored in equity.

To this end, some businesses are making it possible for employees to sell their vested options. These sales might take the form of a direct buyback from the company or a secondary sale.

For example, AngelList Venture has a liquidity product called Transfers that effectively allows equity holders to sell shares. A business could schedule this sort of sale every 24 months, permitting vested employees to access the value of their equity to pay off debt or buy a house.

Companies that care about employees will develop compensation plans that ultimately lead to financial security.