The combination of pandemic lockdowns and rising freight prices has forced some companies to focus on supply chain vulnerabilities.

Many commerce businesses — ecommerce, omnichannel, direct-to-consumer, B2B — have experienced some form of supply chain disruption in the past 18 months.

Each business and industry likely has unique experiences relative to products and suppliers. Those experiences inform a new sense of supply chain awareness to guide purchasing, inventory, and promotional decisions.

Pandemic

“You cannot assume that [your supply chain] is going to work the way it did in years past,” said Rick Wilson, CEO of Miva, the SaaS ecommerce platform.

Wilson’s company witnessed the pandemic’s impact across thousands of commerce businesses.

At first, there was a sense of the unknown.

“It is hard to take yourself mentally back to a place in time, but if you reflect back to March 10 through April 30 of 2020 … we were worried that our merchants might go out of business,” said Wilson, adding he was concerned the entire worldwide economy would suffer.

Soon, however, the effect on ecommerce became clear. Sales soared. Wilson’s clients experienced Black-Friday-like revenue in the middle of summer.

Concerns about the economy gave way to supply chain worries.

Lockdowns

In 2020, global shutdowns meant to “flatten the curve” slowed or stopped manufacturing the world over.

Not surprisingly, inventories began to shrink.

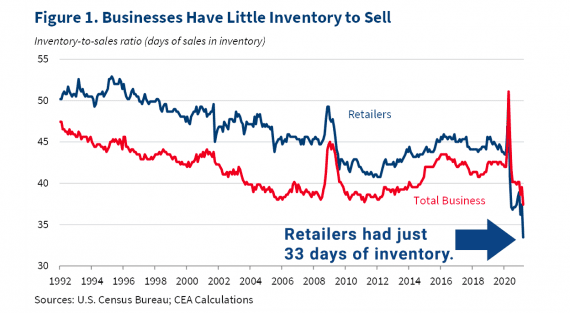

In February 2020, for example, U.S. retailers held approximately 43 days of inventory, according to an article from the White House citing data from the U.S. Census Bureau. By June 2021, retail inventories had fallen to about a 33-day supply, the lowest in 30 years.

U.S. retail inventory levels were at a 33-day supply in June 2021, the lowest level in decades. Source: WhiteHouse.gov.

Thus businesses should think about the manufacturing facilities they depend on, including the risks of further lockdowns and other pandemic-related disruptions.

“It’s simple project management,” Wilson said. “You have to reverse engineer [the supply chain]. You take a Gantt chart, and you work back from delivering to the customer. You check every step.”

If manufacturing is vulnerable, a merchant might purchase earlier, hold more inventory, or promote relatively less. For example, a retailer without adequate holiday inventory could avoid offering Black Friday discounts and, instead, sell available stock at full margin.

Freight Challenges

Slowed manufacturing is not the only potential supply chain problem. Worldwide container shipping costs have quadrupled in the past year, according to The Wall Street Journal. Some container prices have risen more than 50% since May 2021.

The factors driving the increase are complex but likely include pent-up demand, the March 2021 Suez Canal blockage, and overworked ports in California and China. Regardless, the effect is painful for commerce companies.

“Just this past week, I got some really bad news. One 40-foot container going through Surabaya, Indonesia, used to cost $5,000. It’s up to $19,500,” said Kyle Tortora, owner of Lotus Sculpture, an Oceanside, Calif.-based retailer of artisan-made Hindu and Buddhist statuaries.

“Indonesia is typically the most expensive place I ship from, but this is way too cost-prohibitive,” said Tortora, “so I changed my plan.”

Lotus Sculpture has had to change its purchasing and inventory practices in response to supply chain challenges.

Tortora generally purchases garden statues from artists in Indonesia, buying a container load every month or so. This year he took a different approach, placing a massive five-container order but not shipping it immediately. Instead, his suppliers are holding the goods in the hope that container prices will fall in the coming months.

Businesses with similar vulnerabilities may want to evaluate supplier and transport options. If no meaningful alternatives exist, raising prices now — well before the holiday shopping season — is likely prudent.