The Internet sales tax issue continues to roil, with California the most recent state to enact a bill mandating that out-of-state online retailers with affiliates in the state collect state sales tax. Amazon and Overstock immediately responded by cutting off their affiliates in California. Amazon alone had about 25,000 affiliates in California, according to the Orange County Register. We’ve covered this issue before — most recently at “Amazon Versus States: A Sales Tax Roundup” — but the addition of such a populous state, with a large number of affiliates, may provide the impetus for a nationwide solution.

California is hoping to increase sales tax revenues by $200 to $300 million. Other cash-strapped states are looking for any means to increase tax revenues; Internet sales by out-of-state companies are a prime target. With more states taking this route, or considering it, the dispute may soon reach a tipping point.

How Much Sales Taxes Are the States Losing?

In many states, customers are supposed to declare their online purchases and pay the sales tax on their income tax forms. But most ignore this requirement and it is too costly for states to pursue those who do not comply. A 2009 University of Tennessee study, backed by the SST Governing Board — consisting of member states that seek to simplify sales tax administration and collection — estimates that the 46 states that impose a sales tax will collectively forego $11.4 billion in uncollected online sales tax in 2012. However, another study, published in 2010 by NetChoice, a non-profit coalition of trade associations and Internet businesses including eBay and Overstock.com, asserts the loss in sales tax revenue will be only $4.7 billion in 2012.

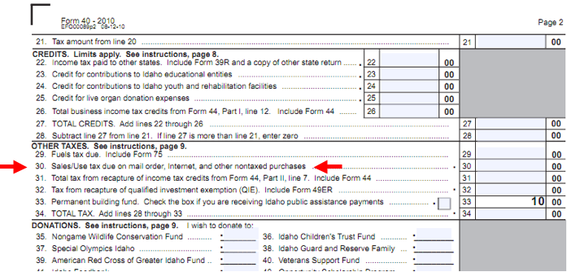

Sample excerpt from Idaho state income tax return, with line for tax due from Internet purchases.

The Legal Issue

Under federal law, states can tax sales only if the seller has a physical presence or “nexus” in the state. This stems from Quill v. North Dakota, the Supreme Court case in 1992 that ruled catalog sales — “Quill” is the office supply catalog company — are not subject to sales tax unless the seller has a physical presence in the jurisdiction (states, municipalities and local taxing districts) imposing the tax. Fast-forward to the Internet age, and online merchants and various state lawmakers rely on this ruling for similar ecommerce sales-tax guidance.

The California law defines the affiliates as agents of etailers, thereby establishing a nexus. California followed the approach taken by New York that, in 2008, passed a law requiring out-of-state retailers and etailers to pay New York taxes on the activities of their New York business associates who were classified as agents. Amazon challenged the constitutionality of the law — citing Quill — but a New York State court found that New York could tax these sales. Amazon decided to comply, kept its New York affiliates, and collects sales tax in New York, depositing the money in an escrow account, but the issue is still in the court system. However, Amazon has cut off affiliates in Arkansas, California, Connecticut, Hawaii, North Carolina, and Rhode Island, all states that have all enacted laws to collect sales tax from etailers. In California, rather than going through a long court battle, Amazon is collecting signatures for a state-wide referendum to kill the law — Amazon’s referendum request to the California Attorney General is here, as a PDF. To bring the measure before Californians in the next state-wide election in February, Amazon must gather over 500,000 signatures by late September.

The Consequences

Both the affiliates — mostly small businesses — and the online retailers are being hurt. The affiliates earn referral commissions, and the retailers collect sales from those referrals. (It’s worth noting that Amazon invented affiliate marketing in the 1990s as a method to grow revenue. Amazon doesn’t disclose revenue derived from its affiliate program, but it’s material, in our view.) But etailers are adamant that they will continue to shed affiliates in states that pass Internet sales tax laws — figuring the cost of paying the tax is more than the profits they derive from the referral sales.

They also claim that states overestimate the amount of sales tax that will be collected because they don’t account for decreased sales or affiliates that move out of state. Some former California affiliates are looking to locate servers in neighboring Oregon or Nevada to get around the rules. To further complicate the issue, some states — Texas, for example — are taking the position that using a server within their borders establishes a nexus. Also, for those who are tempted to simply list themselves as having a new address in another state, some affiliates that have moved report that Amazon requests proof of actual residence, either a utility bill or a rental agreement.

Retailers that already collect sales taxes on online or offline purchases argue that the current system gives an unfair competitive advantage to etailers like Amazon that do not have brick-and-mortar stores and therefore can avoid all sales taxes. They point out that traditional retailers have lost revenues and jobs because of the inequity of the sales tax situation. The California Retailers Association — comprised of mainly physical retailers — thanked Governor Jerry Brown for signing the law and added, “Small and large businesses across the state have been held at a major disadvantage by the current law that out-of-state online companies like Amazon.com and Overstock.com have exploited for years.”

Federal Legislation Coming?

Amazon CEO Jeff Bezos has publicly stated his wish for federal legislation to resolve the issue. It’s the Commerce Clause in the U.S. Constitution that allows the federal government to tax interstate commerce. And it’s on those Constitutional grounds that many of the sales-tax court cases revolve.

Towards that end, Sen. Dick Durbin (D-Ill.) is expected to introduce a bill, entitled “Main Street Fairness Act,” that would allow all the states — plus Washington, D.C. — that impose sales taxes to require out-of-state businesses to collect sales tax. The anticipated bill is similar to some earlier congressional efforts to provide a level playing field, but those attempts failed. This year may be different because the states have such huge deficits. Despite the urgency of the issue, Congress is currently focused solely on resolving the debt issue and other legislation has been pushed to the back burner. So for now we will likely continue to see a piecemeal, state-by-state approach to the sales tax dilemma.

Governor Bill Haslam of Tennessee supports national action. He says that untaxed Internet sales are eroding Tennessee’s tax base with the state losing between $300 million and $500 million a year. He stated his willingness to assume a leadership role among governors to urge Congress to change the laws. “Something has to happen nationally,” he claims.