Editor’s Note: This is part two of a two-part series. The first installment, “Feds Eyeing Credit Card Processing Industry?,” we published last month.

In “Feds Eyeing Credit Card Processing Industry?,” part one of this series, I praised Robert Carr, CEO of Heartland Payment Systems, a large card credit processing company, for reprimanding the card processing industry for misleading tactics. In a speech, Carr predicted that federal regulators would continue cracking down on the industry, which, he said, should do a better job of policing itself.

My article drew both praise and criticism. In general, I find that merchants and caring salespeople appreciate and learn from my articles. However, I’m sure there are some in the industry that would prefer I not expose the misleading issues and tactics.

In this article, I will show some examples of why a CEO would reprimand his own industry. By no means do I think any of the providers in the below examples are doing anything illegal. I am confident that all of the rates and fees stated below are noted somewhere in the depths of the providers’ merchant contracts or in terms and conditions agreements. However, merchants are too often left with the impression that they are getting better pricing than they actually receive. This is due to several reasons, including the fact that the merchant may be misled to believe that the provider is simply passing through certain card company fees when, in fact, the fees have been marked up by the provider.

Merchant’s Perception Versus Reality

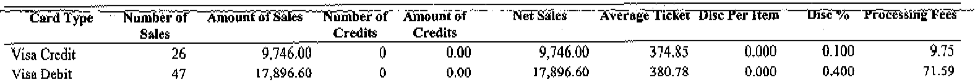

I showed an example last month of the EIRF fee — i.e., a surcharge for downgraded transactions — on a statement that was 0.50 percent higher than the actual rate published by Visa. The merchant thought that his credit card pricing was set at 0.10 percent above interchange and pass-through fees and his debit card pricing was set at 0.40 percent above interchange and pass-through fees. And, as you can see from the insert below (see last two columns on the right – “Disc %” & “Processing Fees”), it appears this is the case. The merchant was charged 0.10 percent x $9,746 = $9.75 for Visa credit cards and 0.40 percent x $17,896 = $71.59 for debit cards.

In this example, the merchant was charged an inflated interchange rate.

However, as I showed last month, the merchant did not realize that the interchange rates listed on the statement were all inflated by 0.10 percent to 0.90 percent. After all, how many merchants really understand interchange rates? The merchant was overpaying by over $18,000 per year because the merchant had the perception that he negotiated a pricing plan that was based on actual the interchange rates and pass-through fees.

Salesperson’s Perception Versus Reality

Unfortunately, many credit card salespeople also do not understand interchange rates, pass-through fees, or even how their own company charges its merchants. Salespeople, as well as merchants, periodically send me their statements to audit because they are confused or don’t trust the provider they represent.

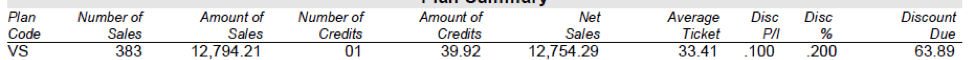

This salesperson priced her merchant on what she told the merchant was an interchange-plus pricing plan at 0.20 percent + $0.10 above the interchange rates and card company pass-through fees. As shown below, Visa (VS) transactions were 383, totaling $12,794.21. There was one (01) customer credit for $39.92, so the net sales were $12,754.29. The average ticket was $33.41 and the merchant was correctly charged 0.20 percent + $0.10 for these Visa sales, which totaled $63.89.

At first glance, the merchant appeared to be charged correctly on this statement.

However, below is an insert from the Fee Section of the same statement and what she and the merchant thought was the actual interchange rate for Visa Regulated Debit. The Visa published interchange rate for these regulated debit transactions is 0.05 percent + $0.22.

This excerpt from the Fee Section shows the merchant was overpaying for regulated debit cards.

It states above that there were 111 transactions totaling $4,665.77 of “US Reg” (regulated debit cards), which totaled $31.45. However, doing the math, 111 transactions at $0.22 = $24.42. The total cost of $31.45 – $24.42 = $7.03. $7.03/$4,665.77 = 0.15 percent. This merchant was being charged 0.10 percent more than the Visa published interchange rate. This mark-up was consistent for all the transactions, not just Regulated Debit. Therefore, the merchant was actually paying 0.30 percent + $0.10 versus the 0.20 percent + $0.10 quoted by the salesperson.

Inflated Pass-through Fees

I see more inflated pass-through fees by far than other type of inflated rate or fee. Here are two examples.

Two of the ways card companies collect revenue from the merchant account providers is by charging an assessment fee and an access fee. Visa charges a 0.11 percent assessment fee. Therefore, on a $100 sale Visa charges 11 cents.

However, in the below example, this merchant was charged a Visa Assessment fee at 0.95 percent +$0.195 (column 5 and 6) totaling $1,054. This merchant was paying $20,000 per year more in assessment fees than Visa actually charged the provider. On the surface, it seemed like this merchant was priced at 0.15 percent + $0.10 over interchange and pass-through fees. But the reality was different.

This merchant was overpaying for the Visa assessment fee.

MasterCard calls its access fee “NABU” — Network Access and Brand Usage. Currently, MasterCard charges merchant account providers 1.95 cents per transaction. However, in the below example, this provider is charging a 15 cent (column 3) NABU fee. The provider is collecting an additional 13.05 cents per transaction from the merchant. It appears some providers find this an easy way to gain revenue and put the blame on the card companies.

This merchant was overpaying for the MasterCard access fee.

Wrapping Up

I agree with the CEO Robert Carr’s comments. I believe the industry has made good strives to police and improve itself. However, as Carr stated, the industry needs to do more. There needs to be even more education and enforced standardization of terminology. In addition, there is too much of a “buyer beware” attitude in the industry.

However, due to the convoluted and perplexing nature of the rate and fee structure, it is just too easy for merchants to be taken advantage of. And, many merchants have been hurt by their merchant account providers.

Read my 5-part series, “How to Lower Credit Card Processing Costs and Obtain Better Terms,” before renegotiating with your current provider or seeking a new provider. The series not only provides the methodology to obtain a competitive processing cost, but also walks through the verbiage and verification needed to ensure the merchant actually gets the pricing he perceives he negotiated.