Many trends will emerge from the 2019 Christmas shopping season, but I believe three will be prominent.

First, click-and-collect may encourage shoppers to wait for last-minute deals and convenience. Second, mobile commerce will come into its own. And third, Amazon will account for nearly half of all online U.S. holiday sales in 2019.

Many trends will emerge from the 2019 Christmas shopping season…

1. Click-and-collect Will Drive Last Minute Shopping

Buy online, pick up in-store — which I call “click-and-collect” rather than a foul-sounding BOPIS or BOPUS — has made it much easier for folks to shop last minute.

In bygone times, last-minute Christmas shopping was a painful combination of not finding a parking space, scouring half-empty shelves for something worth giving as a present (like an Old Spice gift set), and waiting in line to pay. Click-and-collect has eliminated several of these pain points, effectively enabling procrastinators.

Thus, we could see an increase in Christmas sales (some of which could be attributed to ecommerce) after the regular shipping deadline of December 14, 2019.

This trend may be a concern for small and mid-sized online-only retailers, since some shoppers may decide to wait for last-minute deals and click-and-collect convenience. Brick-and-mortar merchants know this is a competitive advantage.

2. Sales from Mobile Will Account for More Than Half

I am doubling down on mobile commerce for the 2019 Christmas shopping season. I believe that more than half of U.S. online holiday retail sales will originate on a mobile device.

I made this same prediction last year, and I was pretty close, with some sources reporting that mobile commerce represented 40 percent of total U.S. online retail sales.

A few factors could give mobile a boost in 2019.

First, mobile commerce is already popular outside of the United States.

For example, Shopify, whose customers tend to be small-to-midsize ecommerce companies, reported that 39 percent of 2018 U.S. holiday sales on its platform came from mobile devices. In contrast, 66 percent of 2018 global holiday orders were on mobile devices.

Multiple causes drive the difference between mobile purchases in the United States and the rest of the world, including desktop computer ownership and lagging mobile infrastructure. But for 2019, American shoppers may come closer to the global trend.

Second, one factor driving mobile commerce could be social media. In its 2018 holiday recap, Salesforce said “the 2018 holiday season proved that mobile and social should be the pillars of your strategy next year” noting that “8.5 percent of all Cyber Week mobile traffic came from a social channel.”

3. 45 Percent of Sales Will Be on Amazon

In 2018, Amazon had 41 percent of total U.S. online sales, according to FTI Consulting. Some 14.7 percent of U.S. online sales were Amazon first-party transactions, meaning Amazon was the seller. About 25.9 percent of 2018 U.S. online retail sales came from third-party sellers on the Amazon marketplace.

Massive retail businesses such as Walmart will attempt to make a dent in Amazon’s market share, but I don’t believe that will happen in the 2019 Christmas shopping season. Amazon will grow both first-party and third-party sales in my estimation.

Last Year’s Predictions

Each autumn since 2013, I have made a series of ecommerce-related predictions for the coming holiday season. Last year, my list included four previsions.

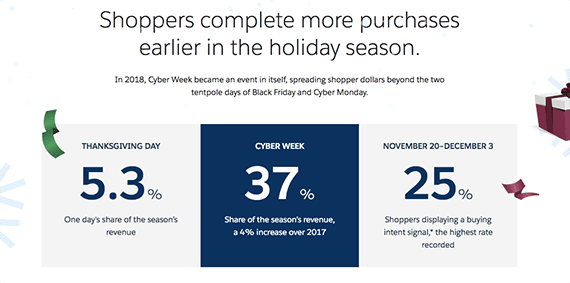

“Black Friday, Cyber Monday Week Will Be 37 Percent of Total.” I had high hopes for the 10-days beginning on Thanksgiving Day, November 22, 2018, and ending December 1.

Salesforce estimated that 37 percent of U.S. holiday retail sales in 2018 occurred during Cyber Week.

I was pretty much spot on. Salesforce reported that “Cyber Week” accounted for exactly 37 percent of total holiday retail sales. To be fair, Salesforce’s definition of Cyber Week was slightly different, running from the 20th to the 26th. But I am still calling this prediction a win.

“Mobile Sales Will Be 52 Percent of Total.” Here I predicted mobile commerce to account for just more than half of holiday ecommerce sales. Whether I was right or not, depends on whom you ask.

Salesforce stated, “This year [2018], the convenience of mobile was a busy shopper’s best friend. For the first time, mobile phones processed the majority of all digital orders in a fast-growing trend, peaking on Christmas Day due to last-minute shopping.”

So, if we take the Salesforce results, it would appear I was very close. Adobe, however, put mobile commerce at about 40 percent of total holiday ecommerce sales. That figure had smartphones accounting for 31 percent of holiday online sales and tablets for 9 percent.

“Voice Shopping Will Be 3 Percent of Sales.” As an avid Alexa user, I expected voice-driven shopping to represent 3 percent of total ecommerce sales last Christmas. But I let my interest in voice commerce influence me too much, and I missed the mark on this one.

Total voice commerce sales for 2018 were an estimated $2.1 billion. To hit my prediction, I needed some $3.6 billion in voice commerce sales for just the holiday season. However, Amazon reported that “customers use of Alexa for shopping more than tripled this year [2018] compared to last year.”

“More Than Half of Holiday Orders Will Include Free Shipping.” Some 81 percent of online retail orders included free shipping during the 2018 holiday season, according to Comscore. What’s more, nine out of 10 orders placed from a desktop computer included free shipping.