I have addressed the importance of understanding credit card processing statements in previous articles. However, I’ve recently seen statements with little or minimal detail that make it virtually impossible to understand fees and charges. Credit card statements should show the detail of all rates, fees, and card types.

To illustrate, in this article I’ll show three examples of statements I have recently received from three different merchants.

Example 1: Statement with No Significant Detail

This statement — reproduced here for legibility — provides no significant detail.

I’m amazed at the number of merchants who prefer a no-detail credit card processing statement. In their minds, they do not understand the detail so they just prefer to receive a statement that shows the processing volume and the processing cost.

In my articles here over the last three years I have shown numerous examples of merchants paying far more than they should because of provider order-entry errors, inflated interchange and pass-through fees, high monthly, quarterly, and annual fees, merchant operational and system issues, plus on-going rate and fee creep by certain providers. A merchant who receives a statement with no details is putting all his faith in the provider to be correct, fair, and honest. But the less detail I see on statement, the more skeptical I am of the provider. The only thing this statement confirms is that the merchant is overpaying for his processing services.

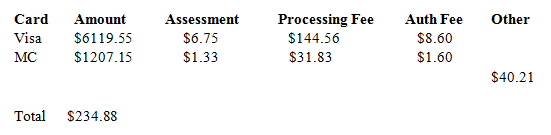

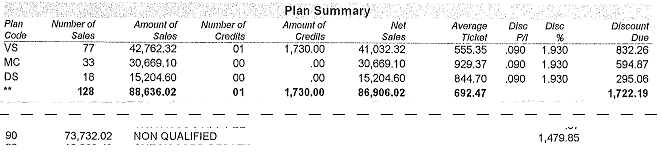

Example 2: Statement with Minimal Detail

This statement provides minimal detail.

The above statement has more detail, such as the number of transactions, cost per transaction, and itemized monthly fees. I show only the processing portion of the statement to address the point.

This merchant is on standardized pricing plan for his industry. By that I mean other merchants in the same industry are set up at the same rate by this provider. Cookie-cutter pricing plans are common with trade associations, chambers, buying groups, and other organizations that endorse a specific provider. I am not a fan of endorsements or cookie-cutter rate structures because it is common for the organization providing the endorsement to be paid by the provider it endorses. I don’t like cookie-cutter rate plans because every merchant has different issues and needs.

I have seen this rate plan several times before and therefore I know that the merchant has bigger issues than just being on the wrong pricing plan and overpaying for processing.

Specifically, this merchant is on a tiered pricing plan. The qualified rate is 1.93 percent + $0.09 per transaction. The merchant processed $88,636.02 in gross Visa, MasterCard, and Discover sales. The merchant does not accept American Express because he believes the American Express rate of 2.89 percent + $0.15 for this industry is too high.

However, note that this merchant also had $73,732.02 in non-qualified fees totaling $1,479.85 or an additional 2 percent (1479.85/73732.02). In other words, the merchant is actually paying 3.93 percent (1.93 percent qualified rate + 2 percent non-qualified rate) + $0.09 on 83 percent (73,732.02/88,636.02) of the merchant’s Visa, MasterCard, and Discover gross sales volume. Again, the merchant thought the American Express rate of 2.89 percent + $0.15 was too high.

Looking at the statement, it’s tempting to suggest changing providers, reducing the rate, or changing pricing plans. However, there is something deeper here because I know there can be several rate tiers under the single heading “Non-Qualified.” Therefore, the increased cost may be a result of procedural errors or system issues. As you will see in the next example, changing providers or the pricing plan alone may not help the underlying issue.

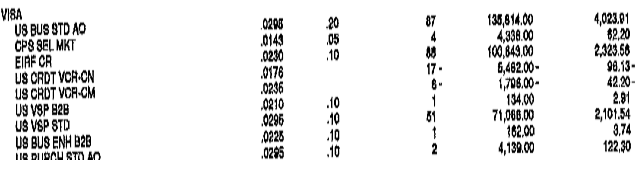

Example 3: Statement with the Necessary Detail

This statement provides sufficient detail.

The above Example 3 statement also shows considerable detail with respect to all other provider and card company fees. I show only the processing portion of the statement to follow up on the point I made in Example 2. This merchant processed $316,392 in gross Visa sales during the month — that figure is not shown. The merchant is on an interchange-plus pricing plan, which is the correct plan for this merchant.

This company asked that I audit its statements to ensure it was not overpaying for processing. Because it had a detailed statement I could see that the merchant had far more costly issues than the provider’s discount rate.

Note the verbiage in the first column of the first, seventh, and ninth entries – “US BUS STD AO,” US VSP STD,” and “US PURCH STD AO.” Over $200,000 in sales was processed at this higher standard interchange rate. Note the verbiage in the third entry, “EIRF CR.” Over $100,000 was processed at this higher EIRF interchange rate.

I have discussed “EIRF” and “Standard” in a prior article so I won’t go into the detail of their cause and solution in this one. However, understand that EIRF and Standard are not card types. These terms indicate a procedural or system issue that downgrades the merchant to much higher interchange rates.

This merchant was overpaying by $6,000 per year because the provider’s rate was too high. Moreover, about 95 percent of the Visa sales were downgraded to the higher EIRF and Standard interchange rates. As a result, this merchant was paying an additional $12,000 per year. Lowering the discount rate will resolve provider rate issues but it won’t necessarily solve the EIRF and Standard issues. These issues require research and corrective action no matter what provider or pricing plan is used.

The merchant in Example 2 may have the same issue and not realize it because the statement provides minimal detail. The merchant in Example 1 may have a multitude of issues because the statement shows no detail. Therefore, changing providers or lowering the rate alone may not resolve all of the issues.

Do Not Trust All the Detail on the Statement

Note the third and fourth entry in the Example 3 statement: “US CRDT VCR CN” and “US CRDT VCR CM.” Visa refunds the interchange to the provider when the merchant credits its customer on returned goods and services. The statement notes the return amount, the appropriate interchange rate, and dollar amount to be refunded — shown in the far right column at $96.13 and $42.20. Therefore, a merchant may think that just because the credited amount is noted on the statement that he is receiving the credit. This is not the case here. This merchant is not receiving the interchange refund and that is also costing this company up to $2,000 per year.

Summary

- Merchants need detailed statements whether or not they understand it.

- EIRF and Standard interchange rates indicate a potential issue that should be investigated with the provider.

- Don’t trust the information on the statement without confirming the math.