I presented a Practical Ecommerce webinar last month on lowering merchant processing costs. I’ve received several questions since then regarding my views on processing statements. Therefore, I want to address my views in this article, as all merchants should understand the importance.

Do Not Share Your Current Processing Statement

Never let a competing provider see your current processing statement until the provider produces a formal bid for your business.

The first thing a competing credit card salesperson wants to see, typically, is your current processing statement. However, you should never show your statement to any salesperson before he firsts provides a formal written bid for your processing. It’s none of his business to know upfront with whom you are processing or your current rates and fees. His concern is to provide an earnest bid for your processing; he does not need to see your statement to do that.

… you should never show your statement to any salesperson before he firsts provides a formal written bid for your processing.

He may tell you that he needs to see your statement to obtain risk factors and other important information, to provide a quote. However, he likely wants it to determine the minimum savings he can offer to maximize his company’s profitability and still get your business. Merchants should always seek maximum savings and minimum cost.

Instead of letting the salesman see your statement, simply ask him what information he needs, to bid. He will likely need your processing volume and average sales amount. He will also need some risk factors, such as your industry, length of time in business, future deliverables, number of monthly returns and chargebacks, and other factors. All of these you can provide without him seeing your statement.

He’ll also need to know your shopping cart, gateway, and point-of-sale system, to ensure his company is compatible.

After the salesperson provides a written bid with all rates and fees, you can then share your current statement and ask him to provide a savings analysis based on his rates and fees versus your current provider. He can also help determine if your current provider is inflating or hiding fees.

Always Review a Provider’s Statement before Selecting

Merchants are always surprised when I tell them they need to see the provider’s statement before signing any contract. Merchants are used to handing over their statements, instead of asking the salesperson for a statement.

It’s critical that the merchant obtain a statement from the salesperson. The statement should not be a hypothetical sample statement. It should be a current — within 2 months — statement of an actual merchant in your industry.

Insist on Statement Detail — Showing All Rates and Fees

Insist that the provider’s statement be detailed, showing all rates and fees.

Some statements are so cryptic that they disclose little, other than the amount processed in the month, the processing cost for the month — and an explanation that the merchant has 30 days to dispute the charges. Other provider statements show detailed deposit information but very limited processing rate and fee information.

But even reputable providers make pricing errors. A salesperson may have parts of the application that need to be completed to obtain the agreed pricing. If she misses a checkbox, the fee may default to an incorrect, standard rate.

Also, the order-entry personnel at credit card processors key-in dozens of parameters when entering an order. Order-entry mistakes are common. I’ve uncovered thousands of dollars from application and order-entry errors; up to 25 percent of merchants do not receive the correct pricing because of these errors.

Even worse, some providers may hide fees, inflate fees, or add surcharging. I addressed this in my May article, “Beware Hidden Increases from Credit Card Providers.” I explained how easy it was for a provider to hide interchange rate surcharging because the merchant’s statement lacked detail.

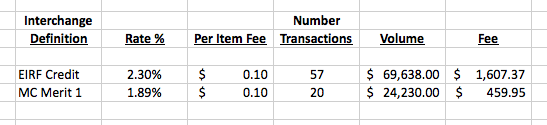

Merchants require statements that list (a) every interchange rate, (b) the number of transactions and sales volume for each specific interchange rate, and (c) the final cost for each interchange rate.

Here is an example of how a statement should appear for just two of the interchange rates: “EIRF credit” and “MC Merit 1.”

Merchants require statements that list every interchange rate, the number of transactions and sales volume for each specific interchange rate, and the final cost for each interchange rate — as shown on this example.

Merchants also need statements that list every card company pass-through fee, to confirm the provider is not inflating the fee. Here is an example of some important card-company pass-through fees and the actual cost charged by the card company.

This example shows card-company pass-through fees and the actual cost charged by the card company, to ensure the provider is not surcharging.

If the provider cannot produce a detailed statement or if it is inflating, hiding, or surcharging any of these rates and fees, end the negotiation and move on.