This is a follow-up to two topics I addressed previously on credit card processing: EMV chip cards and the American Express OptBlue program.

I described earlier this year the changes affecting EMV cards, whereby certain types of liability for fraudulent losses is shifting from the card issuers to the merchants. EMV cards and the related equipment to process them apply mainly to physical, brick-and-mortar merchants.

Prior to the EMV series, I reviewed the new AmEx OptBlue program, which allows merchant account providers to determine AmEx processing rates, thus potentially reducing the rates for ecommerce merchants. I discussed OptBlue in a 3-part series, in July, August, and September of 2014.

EMV Chip Cards

My January and February 2015 articles were devoted to the EMV chip cards and the decisions brick-and-mortar merchants need to make prior to the October 1, 2015 shift in liability, wherein the card companies force merchants to assume the risk of fraudulent losses in certain instances.

As I predicted, some salespeople-providers are using the October 1 date as a scare tactic to sell processing services or to sell or lease equipment at absurd prices.

I’ve heard of some providers selling PIN pads for up to $600. I continue to hear stories of salespeople trying to lease terminals for more than $100 per month for up to four years. A basic PIN pad may cost the provider $125 — perhaps $190 for one with near field communication that integrates to a software system. Terminals generally cost the provider less than $300 each.

EMV Credit Cards

Remember, one of my important rules when dealing with credit card salespeople is this: If the salesperson tries to lease equipment to you, walk that person to door. He is not the salesperson you want for your account for more reasons than just trying to lease the equipment.

Merchants who use a software system that is proprietary to one provider can be at a higher risk of being overcharged for EMV chip card equipment. I’ve seen providers try to sell PIN pads for two or three times what it cost them. Unfortunately, merchants can’t simply shop online for PIN pads as they are encrypted devices and the encryption is unique to the provider or processing service.

This is a good time for brick-and-mortar merchants to review their processing situation, as some providers are offering free EMV equipment for as long as the merchant processes with them. Unfortunately, some of the providers offering free equipment are not the most reputable. Nonetheless, merchants have frequently done well with these programs.

Merchants should read the articles I’ve written over the last few years to ensure they are receiving a good processing value — along with the free equipment. Especially, make sure there is no early termination fee as some of these free equipment offers come with punitive early termination fees.

American Express has launched a program to help small merchants better afford EMV equipment. Eligible merchants that upgrade to an EMV terminal can request a one-time $100 reimbursement from American Express.

American Express OptBlue Program

My July, August, and September 2014 articles were devoted to American Express OptBlue, a new processing program offered by the company. However, merchants likely won’t hear that name — “OptBlue” — from their salesperson-provider. Instead, providers may refer to it as a direct processing program they have for American Express transactions.

Prior to OptBlue, American Express set the merchant rates and serviced the account. Under OptBlue, the provider receives a wholesale rate from American Express. The provider then sets the retail rate and services the account. This is very similar, but less complicated, to the way providers sell and service Visa, MasterCard, and Discover. The final rate you pay your provider for American Express is negotiable, as is the case with the other card companies.

As I stated in my articles, American Express has done a good job with this program. It should also cost the average ecommerce and brick-and-mortar retail merchant less to process American Express transactions with this program. In fact, I provided an example in my September article of a merchant who was processing American Express transactions for less than it cost him to process Visa and MasterCard reward cards.

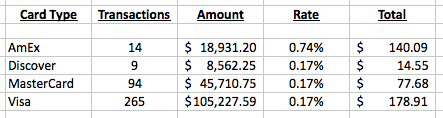

Just like with Visa, MasterCard, and Discover, what merchants ultimately pay for American Express processing is up to their awareness and negotiation skills. Unfortunately, too many merchants still think in terms of Visa and MasterCard when negotiating their rates and fees. Here is an actual, recent example. The rates/fees below are from a merchant’s February 2015 statement.

AmEx OptBlue Example

First, this merchant is paying far too much for processing in general. However, what is most important is how the merchant is being overcharged for American Express. Note the Discover, MasterCard, and Visa rates at 0.17 percent over interchange and pass-through fees. However, note the American Express rate at 0.74 percent over American Express wholesale rates and pass-through fees.

There is no reason why this merchant should pay a higher mark-up for American Express than the other cards — except the merchant wasn’t paying attention to the American Express rate. Moreover, this merchant is paying more for American Express processing under the OptBlue program than he would under the previous American Express program.

Did you receive a notice from your processor over the last few months stating it was automatically enrolling you in a new American Express program? Did you check to see if you were being charged correctly and receiving any cost savings under the OptBlue program? If you did not, don’t be surprised if your processor is keeping the savings. Even worst, some providers may now be charging merchants even more for American Express processing.

Again, I like what American Express has done with the OptBlue program, which should save the average ecommerce merchant money. Unfortunately, fair implementation of the program is up to your salesperson-provider.

My September article on OptBlue included a PDF form for your salesperson-provider to complete, to ensure you are being priced correctly. If you were automatically enrolled in this program, you may want to find out how you have been priced.