By segmenting customer lifetime value and identifying the top 20 percent, an ecommerce company can develop a focused marketing effort to increase revenues with limited additional spend.

As online merchants we consistently evaluate our marketing activities. The ability to track and attribute value makes online marketing seem like a perfect world. We have a new ad or a new keyword for our cost-per-click campaign and we can, today more then ever, see if it’s profitable or not by tracking and measuring our conversions.

The above paragraph is presented by many tech vendors promising lots of sales and eternal bliss. But reality is quite different. The measurements are not perfect, and it’s not clear what is the value of conversion assists, long-tail words in many cases don’t have enough traffic, and there are many other factors that in the messy real world do not pan out quite as nicely as in the presentation.

Our world is not linear, and when we deal with sales and the performance of marketing campaigns we must contend with the reactions we get from customers and how they perceive our brand.

The Long-term View

In this article, I’ll propose a new way of looking at the performance of your brand by concentrating on a broader view of your business. The method I am proposing is not perfect and does not answer all of the questions. However, it is grounded in reality and focuses on the long-term view of your business and it’s most important asset, your customers.

In ecommerce it is customary to look at the return on investment (ROI) of a marketing campaign. However, I suggest considering the customer acquisition cost and compare it to customer lifetime value (LTV). Furthermore, segment customers based on their actual purchasing behavior. Not all customers are equal and we do not necessarily have to look at them that way.

Where to start? The natural approach is to take an in-depth look at your customer file and look at some specific customer behaviors. Use that data to segment your customers into groups. The actual groups to use are going to differ from business to business. For overstockArt.com, our average purchase is somewhat high and our product does not lend itself to many purchases per year — i.e. we do not deal in a consumable or a subscription type purchase.

Segment into 4 Groups

We segmented customers into four groups based on purchase volume and repeat purchases.

We discovered the following statistics about our customer behavior.

- We have about 54 percent repeat purchases overall.

- The top 20 percent of our customers are responsible for 60 percent of our revenue — not to mention profits, which we did not calculate, but could only estimate to be much higher than 60 percent.

- The average customer purchases from us 1.6 times

- Only 15 percent of customers from one year make a purchase the following year.

- The lifetime customer value is $227.59

The above are overall generalization of the data. These statistics may have some value for a retailer. However, they are much too general. The next step we took is dividing our customer file into multiple groups in order to see how customer behaviors deviate from the average and what can it mean to our company. The four groups we looked at are:

- Top 20 percent of customers

- Top 10 percent of customers

- Top 2 percent of customers

- Top 1 percent of customers

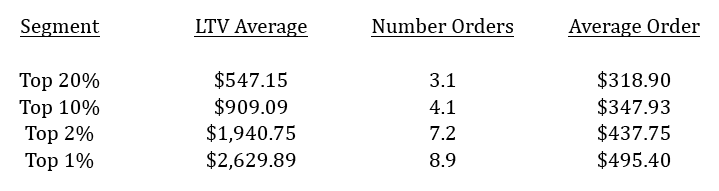

After analyzing these groups we came up with the table below regarding the value they represent:

As you can see from the above matrix, there is a lot more value in the top customers then there is overall. The buying patterns are different and the amount we can invest in acquisition is greater. But what can we do with this information?

Contacting Top Customers

Our first action was simple. We looked at the top customers and went down the list. We reviewed their orders. We looked them up online, on Facebook, LinkedIn, and Google+. Finally we selectively called them. Don’t misunderstand, we did not do this for the entire list, we randomly picked customers. We asked each customer five questions. The questions changed slightly but all were applicable to the customers and were all very revealing.

- Why did you buy art for us? Was it for your home, your office, gift, or other?

- Why did you buy it from us and not someone else? Was it price, service, or something else?

- Where did you first discover us?

- Is it easy for you to find the art and frame that you like at our online gallery?

- What would help you buy art from us? Have we provided an amazing experience for you?

(Note: Every business is different and therefore these questions may not help you.)

Now that we were armed with the knowledge of lifetime value of our customers and a segmented approach to lifetime value, we were able to predict performance of our marketing activities to a greater degree. It allowed us to invest in lead generation activities knowing how our customers will behave and what to expect as lifetime ROI from the customers we just acquired.

Last but not least, we started focusing on the top 20 percent of customers. We created a new project called “Top 20,” which is not a very creative name, I know. The project has two goals.

- Increase purchases from the top 20 club.

- Find new members for top 20.

What Motivates Top Customers?

How do we accomplish these goals? After gathering more information from this group we identified what they are looking for. For example, they are not price motivated. Instead, they are motivated by the following three aspects.

- Remarkable art. Uncommon art that takes over a room and creates an environment around it that is unique.

- New and exciting. These are volume buyers. So for them it is critical to see new art that they can choose from. It’s not enough that this is something they’ve never seen before; it needs to also look and feel special.

- Personal attention. They want to feel the experience with a variety of senses. They want a person who is in charge of taking care of them and helping them choose and consistently shares with them good opportunities to buy art.

So now we started building programs around what helps our best customers make more frequent purchases to try and increase their lifetime value. We also found a number of verticals that will allow us to attract customers that are similar to our top 20 list. In addition, we can now identify marketing channels where we can justify the costs from a long-term perspective.

Many companies just try to appeal to one type of general customer and we have done the same for many years. Now, with this new data, we are finally able to focus on specific segments and not just approach all customers as one segment.

Pricing Lead Generation

Looking at our customer lifetime value and segmenting the list allows us to confidently price our lead generation activities since we now know how much we can invest in capturing a customer. More importantly from our prospective we no longer have to look at our marketing efforts as just blasting a large segment of the population. We are now able to hone our limited funds towards the type of people and businesses who can become part of our top 20 club.

This method is only the tip of what can be done by focusing on your top 20 percent of customers. As online retailers, we are young pups in the retail world — we’ve been in business for twelve years — compared to Sears. But we can start looking back into our past and assign lifetime values for our customers.

What would any of you, as online marketers, do with your top 20 list? What would you like to know? What are the frequency patterns and could these buying patterns be shortened?