It used to be that if you wanted capital for your business, whether a loan or equity investment, you had to prepare lots of Excel spreadsheets, put on a suit and tie or a dress, and spend an uncomfortable amount of time being grilled by potential funders. Today all that is unnecessary thanks to several online funding sites. You can sit in front of your computer wearing shorts, fuzzy slippers, or nothing at all and make your funding pitch.

The following websites link companies looking for funding — both debt and equity — with lenders and high-worth individuals looking for promising investments.

ACCION USA

ACCION USA

This non-profit organization makes loans to small businesses with a minimum credit score of 575. If you meet that criterion, you can fill out an application form online for pre-qualification. The rules are:

- All start up businesses must be able to provide a cosigner (a guarantor of the loan) who is not involved in the business and who has a steady source of income;

- The business must be in operation for a minimum of six months and have revenue;

- The owner has to provide a business plan or market study and 12 months of projected financials.

ACCION USA offers fixed interest rates that range from 8.99 percent to 15.99 percent. The average loan term is between two and three years.

FundingPost

FundingPost

Unlike most other online equity-funding websites, FundingPost does not list either the potential investors or the funding requests online. A company looking for funding fills out an application/profile and FundingPost sends it to potential investors privately and reports back to the person requesting funding on how many venture capital and angel investors are interested. The company can then activate and showcase the profile for a fee of $100 for an initial three-month listing. After that the fee is $30 a month to remain in the investor network.

FundingPost also hosts face-to-face networking events in 20 cities across the United States.

Go 4 Funding

Go 4 Funding

Go4Funding.com is an online platform that connects both existing businesses and start-ups with potential investors and business experts worldwide. In the “Funding Needed” section of the website, new entrepreneurs and existing business owners can post their capital requirements. Most requests are under $250,000 and business descriptions are generally brief, ranging from a few sentences to several hundred words. Go4Funding also allows businesses to upload images and videos for their pitch. In the “Looking To Invest” section, investors post their investing interests and amount of money available. The offers are heavily weighted towards loans rather than equity. The site also provides a “Need An Expert” section where entrepreneurs can solicit specific business expertise.

A basic listing is free. But Go4Funding charges a fee for each featured listing/post and for communications between users. For $25, a listing can be featured on the Go4Funding home page for seven days. The company also offers a premium membership costing $25 for 30 days. With this feature, users have access to an investor directory and can initiate up to five contacts per day. Go 4 Funding also receives revenues from advertisers.

GoBigNetwork

GoBigNetwork

A free business profile on GoBigNetwork entitles a user to receive unlimited requests and messages, as well as contact members in a personal network. Businesses can also choose from several premium subscription options that enable companies to directly contact members outside of the network. Someone seeking funding can either advertise to investors with a posting or browse through the member pages and “subscribe” to directly contact the relevant potential investors. Both the request and subscription services are available at either a monthly recurring or one-time annual fee.

Investors include angels, VCs, private equity bankers, and investment banks. Lenders include capital brokers and banks. Funding amounts range from less than $10,000 to several million dollars.

Grow VC

Grow VC

Grow VC is a global crowdfunding company with headquarters in Hong Kong and offices in the United States, Finland, and United Kingdom. The headquarters location is significant because crowdfunding is illegal when the company arranging the funding has headquarters in the United States. (The SEC considers crowdfunding as a sale of securities, which must be registered.) The company organizes seed funding for start-ups and accommodates investments of up to one million dollars. Only active funders can view funding opportunities.

The initial posting is free. But when the funding closes, 2.5 percent is deducted from the capital raised for management costs. The fee is sustained at the closing stage and only if the startup has successfully raised capital. Grow VC also helps start-ups find experts to help them launch and operate their businesses.

Funders can sign up for a premium micro investment plan and start funding startups with as little as $20 per month. Micro investments are aggregated by Grow VC and sent to the start-up company.

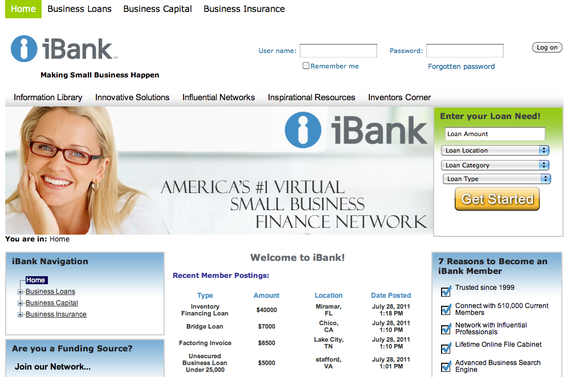

iBank

iBank

iBank.com provides those looking for loans a secure listing of offers from a network of up to 250 lenders. The person requesting a loan provides the necessary application information once and iBank.com creates a secure online vault and provides a “key” to the lenders the business selects. Other supporting documentation can also be stored in the vault.

Rather than filling out a new application every time a loan application is submitted, the user clicks on the specific loan form, and the application is automatically populated.

RaiseCapital.com

RaiseCapital.com

Raise Capital charges a one-time membership fee of $99 to post a funding request that can include text, pictures, and video. Business descriptions are usually a few hundred words. Transactions range from a few thousand dollars to several million. The firm operates only in the United States. Investors are not listed on the website, so entrepreneurs cannot contact them directly. The investors can view requests for funding online.