All ecommerce merchants should take the time to review their processing statements this month before the holiday shopping season begins. Merchants need to check for the following items, and correct any mistakes — or it could cost them dearly.

- Rate creepage.

- Hidden, inflated, or unwarranted fees.

- Rate increase due to October 2014 interchange adjustments.

- American Express OptBlue notices and pricing.

Rate Creepage

Some merchant account providers try to pass through rate increases during the year. They may actually announce the increase on the back page of monthly statements with verbiage that blames the card companies.

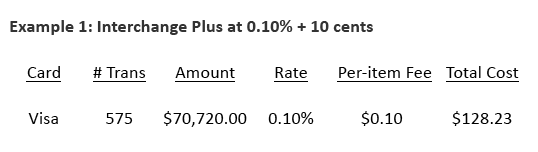

If you are on interchange-plus pricing, any changes made by the card companies should automatically be included in your pricing plan, so there is no need for your provider to change your discount rate. Therefore, if your discount rate was 0.10 percent + 10 cents last year it should still be 0.10 percent + 10 cents this year. (I’ve addressed interchange-plus credit card pricing many times here, most recently at “Merchants Using Interchange-Plus Pricing Continue to Overpay.”)

If you are on tiered pricing, there were no major interchange rate changes by the card companies over the last year to warrant a wholesale rate increase, so your rates should not have changed.

The best way to determine if your provider has increased your rates is to compare September 2013 and September 2014 statements. Depending on your pricing plan and your provider, the discount rate could be on page one of the statement or in the fee section. The discount rate can be displayed different ways. Two of the more common ways are as follows.

Example 1: Interchange Plus at 0.10% + 10 cents.

Example 2: Tiered pricing with a qualifying rate of 1.79% + 10 cents.

For tiered rate plans it is important to check all the rates — including qualified, mid-qualified, and non-qualified — and any surcharge rates, as the provider may have decreased the qualified rate but increased the more common mid-qualified, non-qualified, and surcharge rates.

Hidden, Inflated, or Unwarranted Fees

It can be more tedious to identify hidden, inflated, or unwarranted fees. I addressed these types of fees earlier this year in my 3-part series “How to Identify Dubious Credit Card Processing Fees.” These articles will help you determine if your processor has increased these fees.

Rate Increase Due to October 2014 Interchange Adjustments

The card companies generally implement any rate or fee changes in the spring and fall. Visa will implement new interchange rates for certain corporate and purchasing cards in October 2014. Some of the interchange rates have been reduced and some have been increased. The impact will be marginal for the most retail merchants, but they could result in a cost increase for some B2B merchants.

It is important for merchants to read the notices on their September 2014 statements to ensure that their provider is not taking advantage of the Visa interchange rates with unwarranted rate increases. As stated previously, merchants on interchange-plus pricing should not see a change in their discount rate as the card company interchange rate changes are automatically included in the pricing plan. The Visa interchange rate changes should not impact the discount rate for the average retail merchant on a tiered pricing plan as well. However, some providers may nonetheless implement a rate increase.

American Express OptBlue Notices and Pricing

Certain merchant account providers are sending notices to their merchant customers automatically enrolling them into the American Express OptBlue program unless the merchant contacts them within 30 days to decline. The providers probably will not use the OptBlue name, but instead may refer to it as a special pricing program with American Express. Unfortunately, some of these providers are not passing through the lower rates and fees that are part of the OptBlue program. Even worse, some providers are adding fees that on the surface look like they are American Express fees but are really hidden provider fees.

I’ve reviewed the new American Express OptBlue program recently in three separate articles. The most recent is “AmericanExpress OptBlue Negotiating Processing Rates,” where I included a checklist for providers to complete, to ensure merchants are being priced properly. Merchants who receive an OptBlue notice from their providers should have the providers complete the checklist to know they are being priced properly.

Bottom Line

Some merchant account providers will try to increase their profit through confusing rate and fee increases, or by hidden, inflated, and unwarranted fees, or by not passing through the proper cost for certain programs.

If you find that your provider has done any of these over the last year, have the provider correct it before the holiday shopping season starts. Moreover, determine in your own mind if a provider that works in this fashion is the right one for your business.