Business-to-business marketplaces are among ecommerce’s leading growth trends, yet many industries remain under-served, especially for raw materials.

The trend is evident in the level of venture capital investment and in the number of enterprise businesses developing marketplaces alongside their core products. That’s according to Paul do Forno, managing director of content and commerce at Deloitte, the international consulting firm.

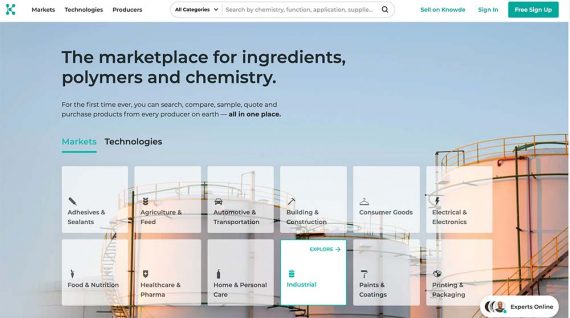

“Everyone thinks of Amazon, but there are hundreds of marketplaces popping up,” do Forno said, giving, as an example, Knowde, a chemical, polymer, and ingredient marketplace connecting B2B buyers and sellers.

Knowde raised $72 million in Series B funding in August 2021.

Purchasing chemicals, polymers, and ingredients is “a very complicated buy, and what Knowde is trying to do is make it super simple,” do Forno said.

Knowde is a B2B ecommerce marketplace for raw materials and an example of what could be an emerging growth trend.

Not New

B2B marketplaces are not new.

“Business-to-business commerce on the Internet is generating a lot of interest,” wrote Steven N. Kaplan and Mohanbir Sawhney in a Harvard Business Review article from 2000.

“The appeal of doing business on the web is clear. By bringing together huge numbers of buyers and sellers and by automating transactions, web markets expand the choices available to buyers, give sellers access to new customers, and reduce transaction costs for all the players. By extracting fees for the transactions occurring within the B2B marketplaces, market makers can earn vast revenues. And because the marketplaces are made from software — not bricks and mortar — they can scale with minimal additional investment, promising even more attractive margins as the markets grow,” Kaplan and Sawhney wrote.

Some 21 years later, the time for many of these marketplaces may have finally come.

Raw Materials

“When I think about B2B marketplaces, I break them up into three segments,” said Ali Amin-Javaheri, the co-founder and CEO of Knowde.

“The first segment is everything related to services — payment marketplaces, labor marketplaces, logistics marketplaces, freight marketplaces, all sorts of them.

“The second is finished goods marketplaces, like Amazon Business, Alibaba, McMaster-Carr. It’s all B2B. They are selling to companies, but it’s all finished goods,” Amin-Javaheri continued.

“The third segment is all things raw materials — all the stuff that companies buy to create their own products,” said Amin-Javaheri, describing the segment in which his own company fits.

Many examples exist in the first two categories described by Amin-Javaheri, but relatively few are in the third.

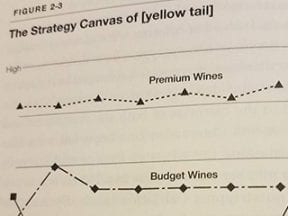

That could change. Raw material marketplaces such as Knowde could be a Blue Ocean of opportunity for businesses to combine deep industry knowledge with commerce software.

The business fundamentals are the same as those that Kaplan and Sawhney described in Harvard Business Review nearly a quarter-century ago, “Web markets expand the choices available to buyers, give sellers access to new customers, and reduce transaction costs for all the players.”

Those fundamentals could apply to raw materials in circa 2021.

“It’s greenfield, it’s massive, and it is ripe for change,” said Knowde’s Amin-Javaheri of the market for chemicals, polymers, and similar raw materials, adding that there could be $5 trillion in annual transactions for these materials worldwide.

Chemical suppliers, according to Amin-Javaheri, have traditional sales forces and methods that require a lot of personal interaction. While this approach can be lucrative for the professional buyers representing huge companies, it creates a gap for small and mid-sized organizations.

Those buyers are relatively expensive for some middle-market chemical suppliers to transact with. So they don’t. That leaves businesses — some of which are willing to spend hundreds of thousands or even millions of dollars on raw materials — feeling underserved.

A marketplace solves the problem for both buyers and sellers. The latter can connect with many more potential customers at a lower cost, while the former gets more support on a complex buying decision that might include understanding how various compounds could interact at a molecular level.

Software, Knowledge

This level of detail and complexity is why a simple web catalog won’t necessarily work. Buyers and sellers of the sorts of raw materials Knowde, for example, is trying to serve cannot simply visit a web page with a list of chemicals and casually add them to a shopping cart.

Thus, those B2B marketplaces create “workflows” that enable buyers and sellers to research products, ask questions, and negotiate prices.

These customer “workflows” could be similar in concept across industries. For example, a search that identifies chemical interactions might use similar logic and code to a search that matches semiconductor chips to motherboards.

But the parameters of, say, chemicals and semiconductor chips are vastly different. Thus raw material marketplaces will require both software and industry know-how.

That is a challenge. But it is one many companies could take on. Don’t be surprised if new B2B raw material marketplaces emerge in the next few years. And don’t be surprised when marketplaces such as Knowde gain significant market share.