You are not alone if confused about the products people are apt to buy today. Even consumers aren’t always sure. Most consumers have opted to stay closer to home during a time when family vacations and festivals would have been the norm.

How we present information on the home page, landing pages, and across social media impacts sales. If you’re struggling to find what works for your target audience, consider using overall purchasing trends as a guide.

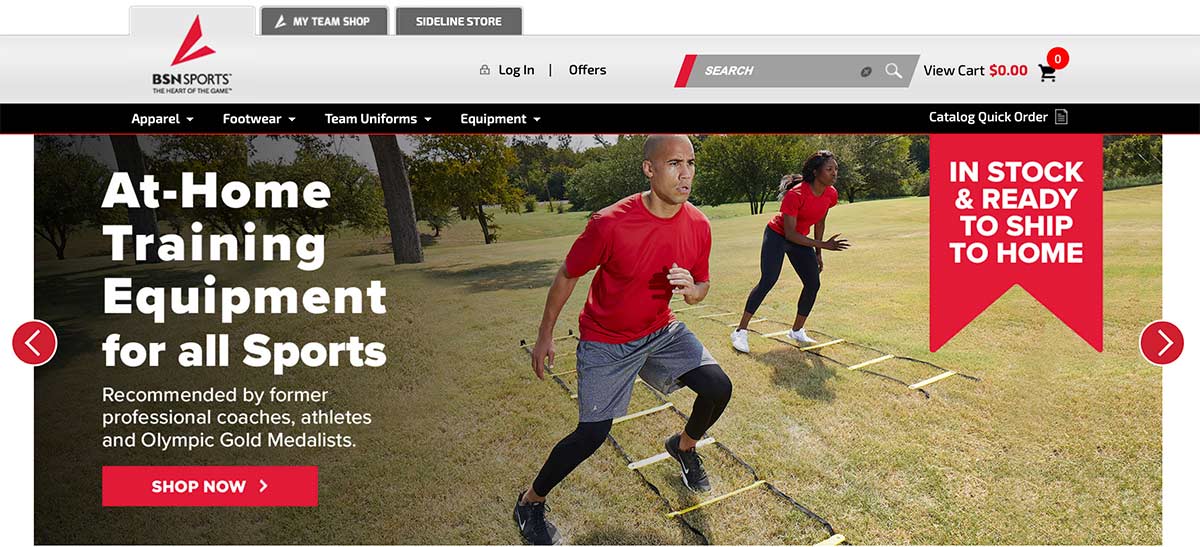

Covid-19 Commerce Insight (“CCInsights”) is a collaboration of Emarsys, the omnichannel engagement platform, and GoodData, a business-intelligence firm. Its purpose is to provide trends and analysis, based on 1 billion consumers and 2,500 brands, of the economic impact of Covid-19. According to CCInsights, U.S. consumers in mid-2020 are focused on goods that fall into four main categories:

- Physical self-improvement. Personal exercise equipment and nutrition.

- Simplified household management. Appliances, gadgets, and tools that make running the household smoother.

- Comfortable living. Home decor and related products that make the house feel more like an oasis.

- Outdoor fun. Items for the backyard and local outings.

Even when they don’t directly apply to your business model, understanding trends helps identify ways to present products online.

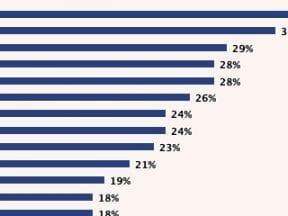

CCInsights reports that the simple jump rope gained momentum mid-March and has retained popularity ever since. It’s ranked in the top 10 trending products many times over, peaking at a year-over-year uplift of more than 62,000 percent in May and 2,841 percent for the year ended July 30.

Trending products for the twelve months ending July 30, 2020. Skipping ropes increased 2,841 percent year-over-year, followed by motorcycle helmets (459 percent), screw guns (204 percent), and rugs (283 percent) Source: CCInsights.

Product Trends

Product trends tell us what consumers are more likely to purchase.

Consider, for example, personal fitness items. Top trending goods (beyond jump ropes) include handheld weights, boxing gloves, and basketball hoops. Ranked lower are treadmills and ellipticals. This tells us consumers don’t have the room or budget for full-sized equipment. Perhaps many are waiting for gyms reopen in their area.

Motorcycle helmets and golf clubs are on the rise. Here we can deduce plenty of people want to get outdoors, but they’re more interested in doing it alone or in small groups.

The acceleration of residential power tools tells us that folks are tackling home-based do-it-yourself projects. That means they’re more focused on living comfortably.

The trend of programmable washing machines and dishwashers explains a desire to work smarter, not harder.

From all this, we can decipher that most consumers want to find ways to appreciate life at home by making things as functional, comfortable, and attractive as they can. Merchants can use these insights to select the best products to feature throughout their online store and third-party channels.

Examples

By understanding trends in your target audience, you can focus on what’s apt to appeal.

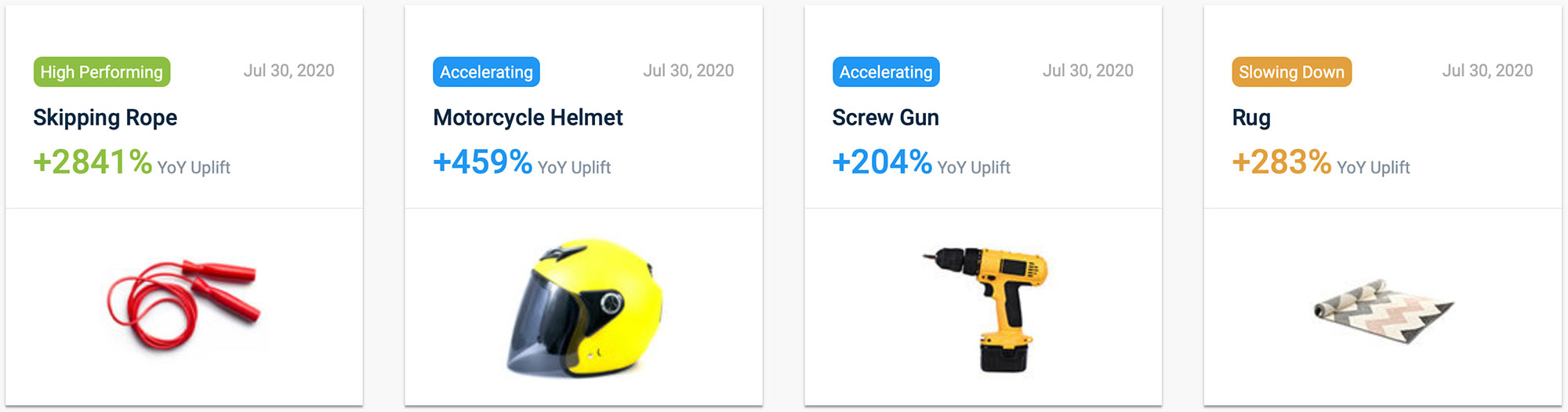

For example, Dick’s Sporting Goods combines trending activities with context-of-use images to promote bikes, golf equipment, backyard games, and portable fitness products.

Featured categories on Dick’s Sporting Goods home page include Bikes, Golf, Backyard Fun, and Fitness.

BSN Sports’ home page gives primary attention to at-home training, directly linking to relatively small and affordable products.

BSN Sports’ home page focuses on at-home training, directly linking to relatively small and affordable products.

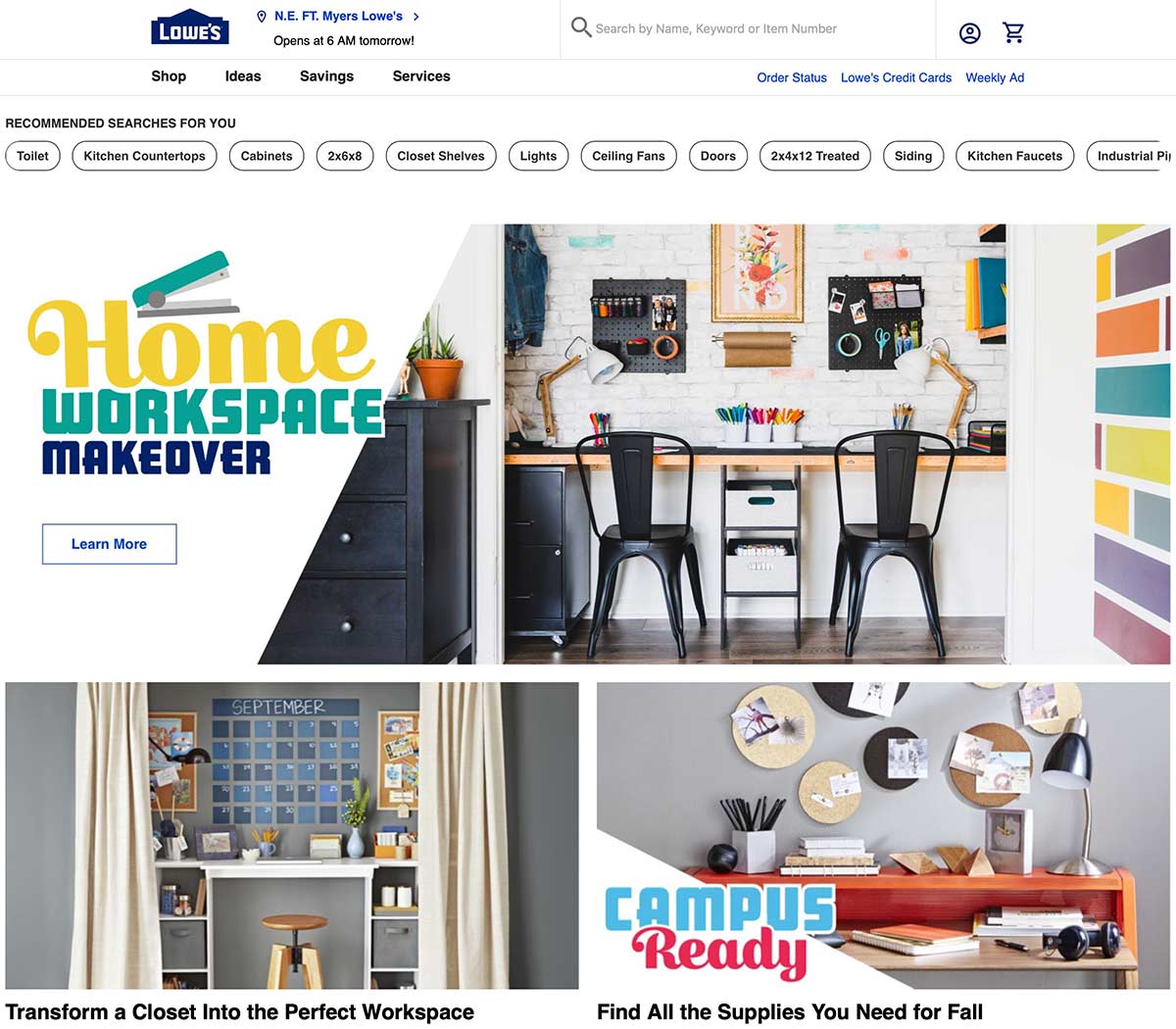

Lowe’s shifts its long term focus from home improvement, tools, and appliances to converting small spaces into workplaces. The home page links to do-it-yourself worksheets and unique products, such as headphones, office chairs, and wi-fi range extenders.

The top of Lowe’s home page focuses on home-based work and schooling.

The Container Store groups items in multiple categories to create a robust section called “Home Learning Solutions.”

The Container Store’s landing page for homeschooling, called “Home Learning Solutions.”

Not all brands can take advantage of trends. Still, even merchants that sell luxury or high-cost merchandise have options.

Take Cub Cadet, for example. It manufactures residential and commercial yard equipment. Before displaying a single product, its home page promotes free delivery or local pick-up as well as financing options — capitalizing on trends of comfortable and affordable home maintenance.

Cub Cadet home page slider promotes free delivery or pick-up and financing options before featuring a product, an Ultima Series ZTX.

If you sell higher-priced items — essential or not — financing options, free delivery, and extended warranties are an excellent way to convey value.

Ecommerce Growth

Consumer response to the pandemic isn’t changing anytime soon. With the end of summer near and continued restrictions, most people plan to stay close to home for at least the rest of the year. This translates to continued ecommerce growth across most sectors.

However, with growth comes competition. To keep and attract customers, consider using nationwide trends as part of your product spotlight strategy.