The U.S. Securities and Exchange Commission recently implemented regulations that allow companies to solicit non-accredited investors in the U.S. for equity investments. This stems from the JOBS Act, which was enacted in 2012. Wefunder, shown above, is one of several online equity crowdfunding platforms.

It took four years after President Obama signed the JOBS Act, but the U.S. Securities and Exchange Commission finally allows businesses to solicit people who are not considered wealthy to invest in new companies via online equity crowdfunding. Effective May 15, businesses can advertise investment opportunities to non-accredited investors via online portals.

How It Works

Individual investors must register on each portal and certify that they meet the requirements and understand the risks. They can browse the list of companies that are soliciting investors and read the business plan and financials. If they decide to invest, they can do so online. Those with an income of less than $100,000 per year are allowed to invest the greater of $2,000 or five percent of their income annually. Individuals with an income of more than $100,000 can invest up to 10 percent of income, with a maximum investment of $100,000. Investments can be spread over several companies.

Many of the portals also offer accredited investor opportunities on the same site. Non-accredited individuals who want to invest should therefore look for the letters “CF” (“Regulation Crowdfunding”) or “Title III” next to description and avoid “Reg A” and “Reg D” labels, which apply to accredited investors.

Portals

Crowdfunding portals must submit an application to the Securities and Exchange Commission and become a member of the Financial Industry Regulatory Authority. Thus far, the FINRA has approved 12 portals, but not all have starting taking investments. Portals that are accepting investments include the following.

Some portals require that an individual register either as an entrepreneur or an investor to see investment opportunities. Others allow for public browsing.

A few portals intend to target niche markets only. For instance, Indie Crowd Funder will be raising funds for the entertainment industry. Niche market, rewards-based crowdfunding platforms found it hard to compete with the larger sites such as Kickstarter and Indiegogo and eventually went away. That could happen in the equity crowdfunding arena as well.

Was It Worth the Wait?

With only a two-month track record, it’s hard to say whether the new CF rules are working. There are few companies using the rules right now. Wefunder estimates that since equity crowdfunding began two months ago, about 36 companies are trying to raise about $3 million via this alternative.

One impediment is that only $1 million can be raised in a year via non-accredited investors. So companies that need more are seeking funding from accredited investors via portals, a system that has been in place for several years. Also, administrative costs related to the raise can be high — up to 20 percent.

Some companies may be waiting to see if the CF model can be successful. Also nobody is advertising this option to the general public and the education process may take some time.

What’s Working?

Companies, not the portals, decide how to structure their offerings. While some campaigns are not gaining much traction, companies on one portal, Wefunder, are having successful raises. The way they are succeeding is quite interesting and may turn out to be a model for other portals.

For example, consumer goods companies on Wefunder are running campaigns that mirror rewards-based crowdfunding. The campaigns include videos, updates, social media sharing, and rewards for investments. The minimum buy-in is quite low, usually $100.

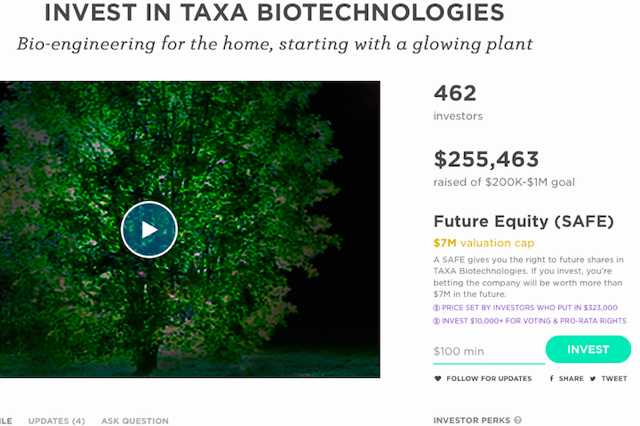

A few companies raising funds on Wefunder are offering a SAFE (simple agreement for future equity) option, which gives the companies flexibility over when crowdfunding investors become shareholders or owners of record. This approach eliminates maturity dates and accrued interest associated with convertible notes but provides a fixed conversion price to investors. While the minimum investment is $100, those who invest a greater amount get more input into how the business is run.

A SAFE option on Wefunder — such as this one from TAXA Biotechnologies — gives companies flexibility over when crowdfunding investors become shareholders or owners of record.

One of the main problems with equity crowdfunding is the lack of liquidity of the investments because there is no reliable secondary market for selling shares, to cash-out of investments. Two companies raising funds on Wefunder are getting around this by providing a revenue sharing model. One of these companies, Hops and Grains. intends to pay investors 10 percent of gross revenues until 100 percent of the principal is returned, plus an additional 100 percent. The assets of the business secure the promissory note. This option, while costly to the company, is more appealing to potential investors

Hops and Grains utilizes Wefunder to raise equity capital. Hops and Grains intends to pay investors 10 percent of gross revenues until 100 percent of the principal is returned, plus an additional 100 percent.

Conclusions

As with rewards-based crowdfunding, initial models for CF investments may not work out. But the portals will likely find an approach that works for both investors and businesses. Rewards-based crowdfunding giant Indiegogo has indicated its interest in entering the equity market by the end of this year and is exploring how it might do that. Indiegogo’s visibility will probably attract more entrepreneurs than new portals that don’t have an established reputation. CF equity raises will therefore not achieve real traction until 2017, likely.