The downgrading of U.S. creditworthiness from AAA to AA+ by Standard and Poor’s has dominated the news over the past two weeks. Since 1941, the U.S. credit rating has been AAA — the highest rating — denoting a safe investment.

While S&P’s action will doubtless have repercussions, the effect on small businesses may be minimal because they have never recovered from the recession that began in early December 2007 and never really ended despite the declarations of economists. Small businesses have already taken actions to maintain cash flow and stay afloat.

Small Businesses Adapt

Many small businesses have been unable to get credit for the past four years and have had to curtail expansion plans, lay off employees, and cut costs. For them, not much has changed. In its August study, “Small Business Economic Trends,” the National Federation of Independent Business (NFIB) reported that ninety two percent of small businesses surveyed stated that all their credit needs were met or that they were not interested in borrowing. They also reduced their inventories.

Small businesses that have survived the recession have already become more efficient in managing cash flow. They are not hiring new employees and are extremely reluctant to increase expenditures. The NFIB survey indicates other steps planned by small businesses include ordering smaller quantities of supplies, reducing travel expenses, and delaying equipment purchases. These tactics may not benefit the overall economy but they can help small businesses survive.

Is There an Upside?

There may actually be an upside to the credit downgrade. The dollar will be weaker than other currencies so small businesses that export goods or sell online to foreign customers will have a greater price advantage.

Although a credit downgrade usually leads to an increase in interest rates, the Federal Reserve has pledged to keep its interest rates at historic lows of 0 to 0.25 percent at least through mid-2013. These rates are what the Federal Reserve charges banks that borrow money. In turn, banks lend the money to businesses. The low rate may benefit small businesses that already have loans or lines of credit. For instance, when asked by the New York Times, what effect the downgrade would have on his business, Gus Mancy, co-owner of Mancy’s Restaurant Group in Toledo, Ohio said, “I’m being real proactive with our financial management. We’ve continued to accelerate debt payments through the recession, but I just hung up with my banker, and we’re meeting tomorrow morning to look at reducing these interest rates now that we’re seeing a dip in interest rates.”

The Future

Others see deeper problems for small businesses as a result of the downgrade. “Given the current political climate, the protracted debate over how to handle the nation’s debt and spending, and now this latest development of the debt downgrade, expectations for growth are low and uncertainty is great,” said NFIB Chief Economist Bill Dunkelberg.

Elizabeth Charnock, founder of Cataphora, a California-based software developer that analyzes Internet activity, told The New York Times, “As economic news worsens, a small business tends to get paid later and later, if at all. I’ve learned that when the going gets tough, you’ve got to stand up for yourself and show that you’re the least likely person to be bullied — not the most.”

Jennifer Hill, startup advisor and venture lawyer at Silicon Valley-based Gunderson Dettmer LLP told The Huffington Post, “One of the many challenges facing small businesses is the shrinking customer base. Consumers are still quite conservative with their pocketbooks, and as a result, organic growth from current and new customers is not growing as quickly as small businesses would like. Business owners are spending more time figuring out how to go above and beyond to keep existing customers, while at the same time figuring out how to cost-effectively reach new customers — without competing solely on price, which is a race to the bottom.”

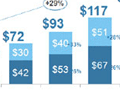

Most publicly traded ecommerce companies saw their stocks drop precipitously on July 26 as the deadline for raising the debt ceiling approached. Stocks dropped drastically on August 8 after the Friday, August 5 downgrade by S&P. Most have recovered somewhat but not to the levels of July 25. However, according to the U.S. Commerce Department, U.S. ecommerce sales reached a seasonally adjusted $47.51 billion during the second quarter of 2011, an increase of 17.5 percent from a year ago. And ecommerce contributed 4.6 percent of total retail sales during the second quarter of 2011, the highest level on record. Also, the MasterCard SpendingPulse report for July 2011 shows that ecommerce expenditures were up 14 percent over July 2010, with nine consecutive months of double-digit growth, with improvement in every subcategory except for electronics.

While it is likely that small businesses will be operating in an environment of very low growth over the next three years, Internet sellers may weather the economic malaise better than other small businesses.