Once found only at the bottom of a sales funnel, the ecommerce product detail page is evolving to address the entire buyer journey, from awareness to sale.

Consider a free, basic theme on Shopify called “Simple,” Its product pages are sales-focused, with eight sections:

- Product name,

- Price,

- Description

- Product options,

- Images,

- Two call-to-action buttons,

- Social media buttons,

- Product recommendations.

These sections are fundamental to conversions except, perhaps, the social media buttons and product recommendations. The rest — product name, price, description, images, and add-to-cart buttons — are more or less essential to completing the action.

The product detail page on Simple, a Shopify theme, provides bottom-of-funnel content to prompt a purchase.

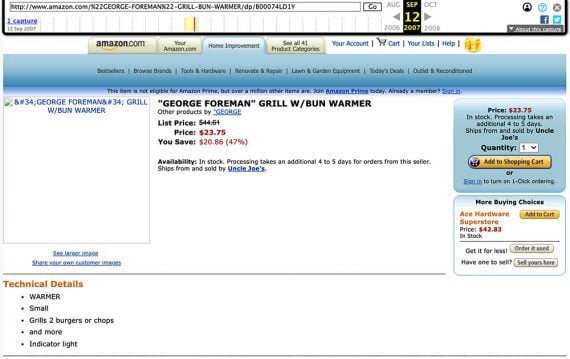

Interestingly, this list of product content sections is similar to a typical Amazon product detail page years ago. A screen capture from the Internet Archive shows that the product page in 2007 for the “George Forman Grill with Bun Warmer” had the basics — name, price, description, picture, and add-to-cart button — plus ratings, tags, and a customer discussion section.

The page was aimed at the bottom of the funnel — the end of the buyer’s journey.

Amazon’s product detail pages in 2007 contained content for end-of-journey actions.

Funnels and Journeys

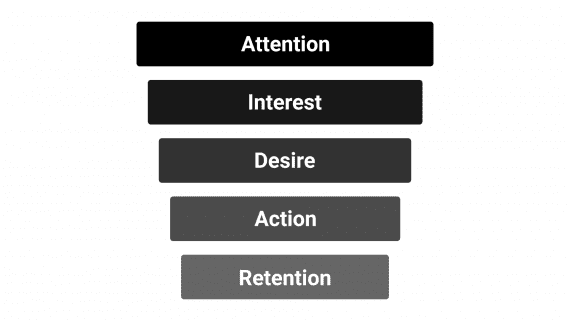

Sales funnels and buyers’ journeys are meant to describe how prospects become customers. These models help us think about the required emotional, psychological, and physical steps.

Historically, such models have focused on the action steps. As an example, consider the popular AIDAR model, a hierarchical funnel with five stages:

- Attention,

- Interest,

- Desire,

- Action,

- Retention.

A product detail page with just the basic info described above fits best near the bottom of the model in the “Action” or “Retention” step.

The AIDAR model is an example of a marketing or sales funnel.

Full-funnel

Product detail pages in 2021 have evolved from closing the sale to serving the entire journey — a full-funnel page.

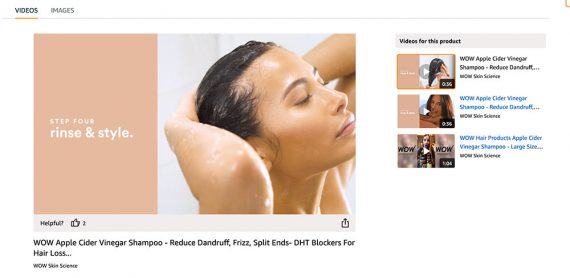

Take the product detail page on Amazon for Wow Apple Cider Vinegar Shampoo from July 22, 2021. On marketplaces such as Amazon, product pages have to attract attention in search, generate interest, and develop desire so that a shopper will make a purchase.

The Wow Apple Cider Vinegar Shampoo page on Amazon has to attract attention in search, generate interest, and develop desire so that a shopper will make a purchase.

The product name is long.

“WOW Apple Cider Vinegar Shampoo – Reduce Dandruff, Frizz, Split Ends, For Hair Loss – Clean Scalp & Boost Gloss, Shine – Paraben, Sulfate Free – All Hair Types, Adults & Children – 500 mL”

This title is not likely aimed at the bottom of the funnel but rather near the top. WOW seems to be optimizing it for search on Amazon.

Moreover, the “About this item” section adds 200 more words explaining what the shampoo does. The description here may be aimed at the middle of the funnel to create a desire for the product.

On Amazon, the Wow Apple Cider Vinegar Shampoo page contains content aimed at consumers earlier in their shopping journey.

And the list goes on. The page includes three product videos and six product-related photos. There’s a 1,097-word product description (longer than most articles on Practical Ecommerce), two charts, two bulleted lists, and 20 more photos. And there are sections for specifications, ingredients, usage, reviews, and user videos.

The WOW shampoo product page had three videos, numerous photos, and more words than most articles on Practical Ecommerce.

Evolution

Several factors are likely responsible for the differences on the Amazon product detail pages for the George Forman grill in 2007 versus the WOW shampoo in 2021.

Competition. Worldwide retail ecommerce is booming, with sales nearly tripling in the six years from 2014 to 2020 when it hit $4.28 trillion, according to Statista. And B2B ecommerce is even bigger. Global B2B ecommerce revenue reached more than $6.6 trillion in 2020, according to Grand View Research.

Thus ecommerce is competitive. Product information can provide an edge.

In a discussion about search engine optimization and link building, James Wirth, senior director of strategy and growth marketing at Citation Labs, an agency, pointed out that his firm builds links to ecommerce product pages. That process requires link-worthy content.

Nowhere is ecommerce competition as intense as on Amazon, where a product page is not the culmination of a buyer’s journey but likely the first stop. That page is the only opportunity a brand or retailer has to grab attention, peak interest, and develop desire.

Covid-19. The pandemic intensified ecommerce competition, forced more businesses to compete online, and impacted buyer behavior.

In December 2020, Salsify, a maker of product information management software, surveyed 1,800 U.S. shoppers. About 40% of respondents had relied on ecommerce in some form since the outset of the pandemic. Roughly 24% only shopped online. And another 37% limited brick-and-mortar shopping to trusted stores.

Thus shoppers who might otherwise have gone to a local store were pursuing digital aisles. Those shoppers wanted product information, including top-of-funnel content.

Culture. Finally, shopping culture is changing.

Buyers are not just interested in price. They want to know if a product is good not just in quality, but also good for the world. Consumers increasingly are interested in sustainability, social responsibility, and the well-being of workers.

This could be why shoppers might prefer a minority-owned company or why WOW’s shampoo description states that its products are vegan and cruelty-free. All of this needs to be communicated. Product pages might be the place to do it.