Amidst concerns that election results would dampen November holiday spending, consumers expressed confidence in the economy by spending a total of $12.8 billion online in the U.S. during the five-day period from Thanksgiving Day through Cyber Monday, according to Adobe Digital Insights. That represents a 15-percent increase over 2015. Nevertheless that figure pales compared to the $17.8 billion spent online on China’s 2016 Singles Day on November 11.

What follows are day-by-day breakdowns of the three major shopping days as well as emerging trends.

Thanksgiving Day

Many online merchants advertised and offered discounts several days before Thanksgiving. Consumers spent $1.93 billion online in the U.S., an 11.5 percent increase over last year but below Adobe Digital Insight’s $2 billion projection. The company attributed the shortfall to many consumers taking advantage of early promotions by shopping on the day before Thanksgiving as well as deep discounting on Thanksgiving Day.

… consumers expressed confidence in the economy by spending a total of $12.8 billion… from Thanksgiving Day through Cyber Monday.

Black Friday

U.S. ecommerce revenue surpassed Adobe Digital’s projected $3.05 billion by almost $300 million for a record $3.34 billion and a substantial 21.6 percent year-over-year growth rate. Most notably, Black Friday 2016 was the first day to generate more than a billion dollars in online sales from mobile devices, according to Adobe. The $1.2 billion spent via mobile devices was an increase of 33 percent from last year.

Although it was a huge day for mobile, desktop purchases represented the majority of U.S. online sales with 64 percent of revenue.

According to First Data, the payment processing firm, electronics and appliances saw the largest increase for Thanksgiving Day and Black Friday, with a 27-percent year-over-year growth rate. The online share of holiday spending on Thanksgiving and Black Friday was 24.7 percent of all sales, an increase of 6.4 percent over 2015.

Within the mobile category, smartphones accounted for 45 percent of page visits and 24 percent of sales on Black Friday, while tablets made up around the same percentage of visits and purchases as Thanksgiving Day, with 10 and 11 percent, respectively.

Cyber Monday

Adobe Digital Insights reported that Cyber Monday achieved a new record with $3.45 billion spent online, a 12.1 percent increase over 2015. This was the largest online sales day ever in the U.S. and exceeded Adobe’s original prediction.

In contrast to the other two days when mobile traffic reigned, desktops accounting for 53 percent of visits and 69 percent of sales.

Search ads drove 38.5 percent of sales on Cyber Monday.

Mobile

Thanksgiving Day had its best showing ever on mobile, with a record $449 million in U.S. revenue, according to Adobe Digital Insights. Likewise, ChannelAdvisor reported that smartphones accounted for nearly 70 percent of Thanksgiving Day traffic, with tablets contributing another eight percent. ChannelAdvisor said that for the first time, mobile ecommerce orders surpassed desktop orders, with 53 percent of all orders on Thanksgiving Day completed on a mobile device.

It appears, in other words, that most people were quite comfortable shopping from a couch or a dining room table rather than going to stores.

Black Friday became the first day ever to generate over a billion dollars in sales from mobile devices with $1.2 billion, a 33 percent increase over 2015, according to Adobe Digital Insights. Mobile devices accounted for 36 percent of total online sales for the day. Walmart reported that mobile traffic comprised more that 70 percent of its Black Friday shopping.

… most people were quite comfortable shopping from a couch or a dining room table rather than going to stores.

On Cyber Monday, mobile generated $1.07 billion in sales, representing a 34 increase over 2015, according to Adobe Digital Insights. Forty-seven percent of all website visits came from mobile devices — mostly smartphones — and contributed 31 percent of sales. In the mobile breakdown, smartphones were responsible for 38 percent of visits and 22 percent of purchases while tablets accounted for nine percent of visits and purchases.

Promotions

Mobile engagement firm Urban Airship stated that retailers promoted holiday deals earlier and at greater scale than years prior, significantly increasing mobile app messaging two weeks in advance of Thanksgiving. Retailers sent 56 percent more holiday notifications in 2016 than 2015 and this year merchants did a better job of targeting consumers based on location and previous shopping behavior.

Physical Stores

Data from the National Retail Federation shows that many consumers no longer find it necessary or appealing to shop in physical stores. The trade group’s consumer survey found that 108.5 million people shopped Black Friday deals online while 99 million went to stores.

Electronics and appliances showed the greatest growth over 2015, growing 26.5 percent year-over-year, both online and in store.

Takeaways

- Brick and mortar chains that closed on Thanksgiving did not lose any business if they had a robust online presence. Consumers were perfectly happy shopping online on Thanksgiving Day — at both online-only sites and multi-channel merchants.

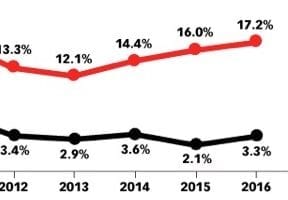

- Ecommerce will continue to take revenue share away from brick-and-mortar stores for holiday shopping.

- Mobile devices are becoming the holiday-shopping method of choice and the mobile share of sales will almost certainly grow. However, most purchases will continue to occur on desktop or laptop computers for the next few years.