Payments

Our Payments category includes all aspects of accepting credit cards, including our 2-part “Primer on Merchant Accounts” and our 3-part “Credit Card Processing FAQs.” We also address cryptocurrencies, hosted payment apps, buy-now-pay-later, and more.

-

Payments

Payments

What Merchants Should Know about ISOs

January 10, 2021 • Mike Eckler

The pandemic-induced shift to online and contactless payments has been a boon for credit card providers and their sales agents. The industry depends on those agents, called "independent sales organizations." In this post, I will examine the role of ISOs.

-

Payments

Payments

Does Buy Now, Pay Later Threaten Credit Card Issuers?

December 14, 2020 • Mike Eckler

Capital One recently announced that it will ban the use of its credit cards to fund buy-now-pay-later transactions. According to a Capital One spokesperson, BNPL transactions “can be risky for customers and the banks that serve them.” In this article, I will examine Capital One’s claim.

-

Payments

Payments

Visa Wants to Buy Plaid. U.S. Sues

December 10, 2020 • Mike Eckler

In January 2020, Visa announced it was acquiring Plaid for $5.3 billion. Before long, the U.S. Department of Justice began scrutinizing the transaction, resulting in the filing of an antitrust lawsuit to stop it. In this article, I will describe Plaid and explain why the Department of Justice is attempting to block the deal.

-

Payments

Payments

The Long-term Effect of Buy Now, Pay Later

December 9, 2020 • Armando Roggio

Point-of-sale financing services such as Klarna and Affirm make it easy for online shoppers to buy now and pay later. These financial tech companies have the ability to reduce checkout friction and please customers, but they may affect ecommerce in other, perhaps unexpected, ways.

-

Payments

Payments

U.S. vs. Google: How the Antitrust Lawsuit Impacts Merchants

November 10, 2020 • Mike Eckler

On October 20, the U.S. Department of Justice and 11 states filed an antitrust lawsuit against Google. In this article, I’ll provide an overview of the case. Throughout, I’ll concentrate on what means for merchants.

-

Payments

Payments

Get Ready for Digital-first Credit Cards

October 25, 2020 • Mike Eckler

In September 2020, Mastercard announced the expansion of its Digital First Card Program. Introduced in 2019, the program is a series of systems and procedures that enable credit card info to be downloaded directly to a mobile wallet. The expansion aims to increase awareness and improve access to existing digital card-issuing technology.

-

Payments

Payments

The Wirecard Fiasco: Digital Payments Gone Wrong

October 14, 2020 • Mike Eckler

What would you do if your credit card processor and merchant account provider were fraudulent? That's the reality for many thousands of worldwide businesses that relied on Wirecard, the Germany-based financial technology firm that is now in bankruptcy proceedings, having committed, allegedly, sham practices for years.

-

Payments

Payments

The Potential of Real-time Payments for Ecommerce

September 29, 2020 • Mike Eckler

Real-time payments are immediate transfers of funds from a payor to a payee. The topic is trending and for good reason. The promise of immediate settlements and instant access to funds is compelling, especially for merchants frustrated by their bank's policy of holds and reserves.

-

Payments

Payments

4 Payment Methods to Integrate for the Holidays

September 14, 2020 • Pamela Hazelton

Convenience and security increasingly impact online selling. That's especially the case for the upcoming holiday season, as consumers will likely seek flexible, seamless payment options. Here are four payment methods to consider for this year's holiday selling.

-

Payments

Payments

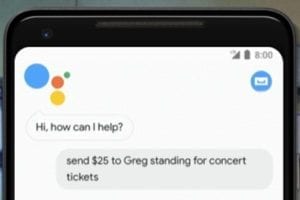

Understanding P2P Payments for Merchants

September 9, 2020 • Mike Eckler

P2P payments occur between two people. The term stands for both "peer-to-peer" and "person-to-person." Instead of using credit cards, consumers are now purchasing goods and services with P2P apps, and merchants increasingly accept P2P payments. In a sense, many merchants have become “peers” to capitalize on the trend.

-

Payments

Payments

What Merchants Should Know about ‘Buy Now, Pay Later’

August 24, 2020 • Mike Eckler

"Buy now, pay later" allows consumers to purchase goods and pay in installments, similar to a credit card. Why is BNPL gaining popularity? I’ll answer that question and more in this post.

-

Payments

Payments

‘Payment Request API’ to Streamline Ecommerce Checkouts, Improve Security

August 17, 2020 • Armando Roggio

A standard application programming interface is helping to eliminate website checkout forms and improve the ecommerce experience on desktop, laptop, and mobile devices. Ecommerce businesses that adopt the approach early could gain a competitive advantage.

-

Payments

Payments

Is Apple Entering the Payment Acceptance Business?

August 11, 2020 • Mike Eckler

In July, Apple acquired Mobeewave, a relatively unknown payments-technology startup in Montreal, Canada for, reportedly, $100 million. For nine years, Mobeewave has been developing technology to convert conventional smartphones into payment-accepting devices without requiring additional hardware components.

-

Payments

Payments

Do Contactless Payments Impact Vulnerable Consumers?

July 23, 2020 • Mike Eckler

Many brick-and-mortar merchants have implemented tap-to-pay systems during the pandemic. Customers and employees, fearing the spread of the coronavirus, are wary of handling cash and coins. But refusing cash payments has societal implications as it assumes all consumers have access to a smartphone or credit card.

-

Payments

Payments

Are QR Codes an Option for Contactless Payments?

June 29, 2020 • Mike Eckler

Before the Covid-19 pandemic, many physical-store merchants considered contactless payments to be a fad. My previous article addressed near field communication, the technology that powers most contactless payment methods in North America. In this post, I will examine an NFC alternative: QR codes.

-

Payments

Payments

Covid-19, NFC, and the Future of Contactless Payments

June 2, 2020 • Mike Eckler

Once touted as the future, contactless payments never achieved mass popularity. Shoppers preferred the familiar swipe, dip, PIN-entry, and signature. The Covid-19 pandemic will likely change that as consumers are now more conscious of what they touch.

-

Payments

Payments

Primer on Merchant Accounts, Part 2: Providers, ISOs, How to Choose

May 20, 2020 • Mike Eckler

The digital payments industry is notoriously confusing. This post is the final installment of a 2-part series on merchant accounts, which are required for all businesses that accept credit cards. "Part 1" described the purpose of such accounts.

-

Payments

Payments

Primer on Merchant Accounts, Part 1: Roles and Functions

May 12, 2020 • Mike Eckler

The payments industry is difficult to understand, even for practitioners. My 3-part series on credit card processing hopefully demystified the jargon, pricing models, and fees. This post will explain merchant accounts.

-

Payments

Payments

Credit Card Processing FAQs, Part 3: Reducing the Cost

April 9, 2020 • Mike Eckler

Credit cards are the principal method of payment for ecommerce customers. But for merchants, the backend infrastructure of processing and collecting the funds is bewildering. This is the third and final post in a series in which I’ll answer frequent payment-processing questions.

-

Payments

Payments

Credit Card Processing FAQs, Part 2: Pricing Models

April 6, 2020 • Mike Eckler

Ecommerce merchants depend on credit card payments. But the processing fees associated with those payments are notoriously confusing. This post is the second in a series in which I’ll answer frequent payment-processing questions. The first installment, "Part 1: Learning the Jargon," contained an extensive glossary of common industry terms.

-

Payments

Payments

Credit Card Processing FAQs, Part 1: Learning the Jargon

March 22, 2020 • Mike Eckler

Credit card processing fees are a longstanding pain for merchants. This post is the first in a series in which I'll answer common payment questions. The first challenge is understanding the industry jargon.

-

Payments

Payments

Why American Express Pushes for Higher Merchant Acceptance

February 21, 2020 • Mike Eckler

American Express announced last month that the number of merchants accepting its card is roughly the same as Visa and Mastercard. In this post, I'll explain how American Express’s business model differs from Visa and Mastercard’s. I’ll also examine the programs that enabled Amex to achieved parity.

-

Payments

Payments

A Guide to Payment Tokens for Ecommerce

January 27, 2020 • Mike Eckler

Innovation in electronic payments has always balanced risk and convenience. Generally, a payment method that's convenient for consumers is risky for merchants. The use of "tokens" can reduce that risk by protecting credit card details.

-

Payments

Payments

New Electronic Disbursement Methods Save Time and Money

January 12, 2020 • Mike Eckler

Businesses have expenses to pay. “Paying the bills” might not seem interesting or new. but recent innovations make disbursements faster, cheaper, safer, and more convenient.

-

Payments

Payments

Mobile Payments Streamline Brick-and-mortar Checkout

December 27, 2019 • Mike Eckler

The checkout counter at brick-and-mortar stores can have long lines. Mobile payment acceptance allows merchants to process credit and debit card transactions from anywhere and not necessarily at a counter.

-

Payments

Payments

For 2020, Multiple Payment Options Are Essential

December 23, 2019 • Pamela Hazelton

Offering multiple forms of payment, especially for mobile shoppers, will be key in 2020. The payment methods your store accepts can make or break a sale. There are five main types of payments for ecommerce sites. Merchants should offer all of them.

-

Payments

Payments

Ecommerce Strategies for a Whirlwind of ‘Pays’

November 26, 2019 • Mike Eckler

Facebook Pay is the latest entry into the world of digital payments, joining Apple Pay, Google Pay, Samsung Pay, WeChat Pay, Alipay, PayPal, Amazon Pay, Venmo, Masterpass, and Visa Checkout. It’s time to demystify all of these “pays” and to create a strategy that will advance your ecommerce business.

-

Payments

Payments

7 Apps and Readers for Mobile Credit Card Processing

July 16, 2018 • Sig Ueland

With credit card apps and readers, merchants can sell to customers at events, pop-up shops, or wherever they meet-up. Here is a list of apps and readers for mobile credit card ...

-

Payments

Payments

12 Innovative Mobile Payment Apps

May 14, 2018 • Sig Ueland

Paying with a smartphone is easier than ever. Innovative mobile payment apps are providing consumers with new ways to exchange money with peers, purchase products, use alternative currencies, manage expenditures,

-

Payments

Payments

4 Ways to Reduce Credit Card Chargebacks

July 12, 2017 • Patricia Carlin

Credit card chargebacks — wherein shoppers purchase products with a credit card and then contest the charge from the credit card issuer — are an always-present threat to ecommerce merchants. In ...